Gold is doing great – but against which currency will it do best?

Gold is undoubtedly the shining star of the commodity space this year, but investors should think carefully about which currency they benchmark against.

While the S&P 500 is at a sweaty break-even point, gold has skyrocketed 25% year-to-date, having breached the psychological $2,000 level. With central banks and governments still battling one of the most severe hits to the global economy in living memory, the prospects for the rest of the year look even more promising for gold. But there are many different ways of buying gold and thus investors need to know the alternatives to pick the best.

Trading is a two-sided bet

The correlation between gold and stocks has never been very clear, as gold is not exactly the safe haven many believe it to be. More than anything, gold is a hedge against inflation. When stocks are hit hard, as happened between February and March, gold doesn’t hold up so well. Many factors contribute to this, but the fact that gold is most commonly traded against the US dollar, which tends to rise when volatility rises, is one key reason. Investors usually buy currencies like the US dollar and the Japanese yen during times of turmoil and thus everything that is at the other side of the trade, be it a stock, a bond, a commodity or another currency, tends to depreciate against the dollar.

When we trade in the FX market, we’re effectively trading one currency against another, which is the same as saying we are going long one currency and short the other. Thus, buying the euro against the dollar is the same as holding a long position in the euro and short position in the dollar. The performance of our position is favoured by both euro upside and dollar downside. The same applies to anything else. If the demand for the dollar is too high like it was in February and March, the dollar tends to rise against everything else. Thus, the dollar price of stocks and the dollar price of gold tend to decrease.

However, we’re getting used to the fact that, when markets go down by more than one digit, the FED and the US government come to the rescue, promising aid packages that are expected to boost the economy and thus stocks. That being the case, investors are again happy to exchange their safe dollars for stocks, bonds, commodities and other currencies. This helps the price of gold in dollar terms. But gold is also boosted by low interest rates and the prospects for massive intervention by central banks around the world, as both reduce the opportunity cost of holding gold.

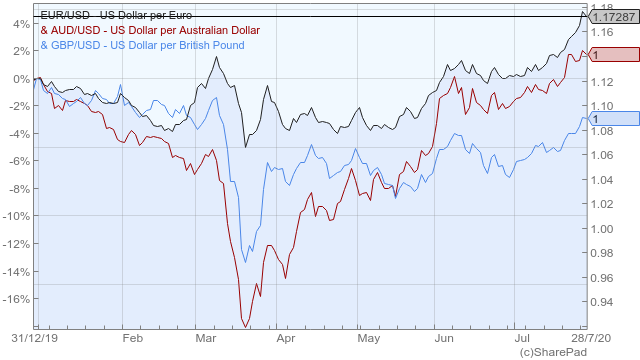

With all of this in mind, I believe the prospects for gold are good for the rest of the year. The pandemic is not over yet and a new wave of infections may well arrive later in the year. At the same time, unemployment has risen quickly, and the numbers are always resilient and tough to turn around in a V-shaped recovery. US stocks skyrocketed after the February-March decline as if the pandemic never happened, but it’s very likely that the market could go down again and central banks may need to come to the rescue with even more stimulus. Interest rates are near zero and will likely remain at those levels helping the case for gold bullishness. Still, we need to decide which is the best currency to sell against a long gold position. In my view, the euro is no longer the best bet, particularly after the EU could agree on joint debt issues. This was a major positive event for the union, one that strengthens the euro. At a time when there’s a lot of uncertainty surrounding the future of the US economy, I’d prefer to buy gold against the dollar than against the euro.

In order to buy gold against the dollar, there are many ETF options. I particularly like the SPDR Gold MiniShares Trust (NYSEARCA:GLDM). While the SPDR Gold Trust (NYSEARCA:GLD) is the oldest and most popular gold ETF, it has been losing business to a few cheapest alternatives. Smaller investors cannot deal well with price fractions of $150 and are sensitive to the fees. In order to fight losing market share, StateStreet decided to launch GLDM, with a gold-per-share ratio of one hundredth instead of one tenth and reduced fees of just 0.18%. You can check my article in the February 2020 Magazine for a more detailed view on gold ETFs.

Still a big problem to solve

If you buy a gold ETF that’s quoted in US dollars and you live in the EU or in the UK, you would probably have a big problem to solve. If the dollar goes down against the euro, at the time of selling the ETF you will get less euros than before, which will erode part of the profit. To avoid this erosion, you need to look for a currency hedged fund. Examples of these are the WisdomTree Physical Gold – GBP Daily Hedged and the WisdomTree Physical Gold – EUR Daily Hedged. Roughly explaining, these funds are expected to attain the performance of gold against the US dollar after eliminating currency risk.

An alternative and very simple way of getting the most out of the Gold/USD pair without any need to take into account currency risk is through spread betting. In general spread betting companies allow you to fix the gain/loss amount per point change in your own currency. Let’s say your stake is £10 per unit change in the XAUUSD instrument (gold against the US dollar). If gold rises from $1,900 to $2,000, your profit is £1,000 (£10 times 100 points), disregarding the currency of the instrument you’re trading.

In the end what’s really important is to know what you’re trading before doing anything. If you live in the US, when you buy gold with US dollars, you’re betting gold will appreciate against the dollar. But when you live in the UK and buy gold with sterling, you’re betting not only that gold will appreciate against the dollar but that the dollar will appreciate against sterling. If you don’t like this second part, you need to hedge your bet.

what a difference a day makes its breached the $2000 dollars mark twice – once on the way up and then on its way down falling fast

I’ll try the Venezuelan Bolivar.