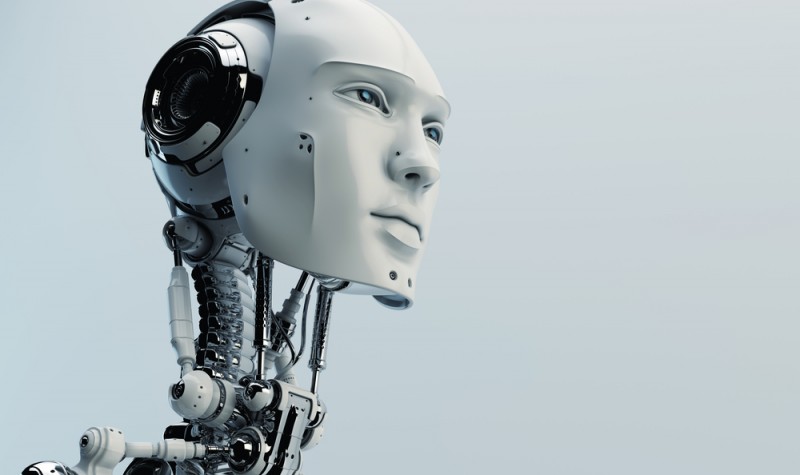

Global Markets: Is the robot in control?

There are multiple red lights flashing on the global investment flight deck console. But the flight controls aren’t working anymore. Victor Hill is having a recurring nightmare.

Eurozone blues

I’ve been having nightmares about being on the flight deck of a Boeing 737 Max-8 as the anti-stall robot takes control and points the nose down in steep descent as the manic crew struggles to regain control…Then I wake up in a cold sweat and think about European bourses…

The magi of the European central banking confraternity assembled this week for the Ambrosetti Forum at the Villa d’ Este on the shores of the beautiful Lago di Como. They dined sumptuously – despite the harrowing screams emanating from certain eurozone government bond markets. (The Italian debt-to-GDP ratio is set to rise from 132.1 percent in 2018 to 134.4 percent next year and spreads are widening again.) Over late-night drinks they shared their deepest fears…Italy is very close to default – with potentially dire consequences for Europe’s flagging banking system…

| Master Investor Magazine

Never miss an issue of Master Investor Magazine – sign-up now for free! |

Some fear that the eurozone is slipping back into a Japan-style deflationary trap in which economic growth will go backwards. Even die-hard supporters of the European currency union fear that the single currency may not survive another prolonged recession in Europe.

If the UK has a productivity problem – though I have argued that GDP-per-hour worked (the OECD metric) is misleading – the eurozone, particularly its southern belt, has a growth problem. The ECB’s programme of QE over 2012-18 did nothing to address this. What it did was to inflate asset prices – property, stocks and bonds. Who owns such assets? The well-off and the rich: precisely those who do not use their increased paper wealth to boost consumption.

Further, European manufacturing has experienced a precipitous decline over the last six months. New orders in Germany slumped by 8.4 percent in February, year-on-year. This was mainly for three reasons. Firstly, China’s economy is slowing (growth is at around 6 percent rather than the historically typical 8 percent) and is therefore pulling in fewer European (principally German) manufactures. Second, the automotive industry – which is the backbone of manufacturing, not just in Germany but in France and Italy too – is being fundamentally disrupted by the animus against diesel and the now inevitable triumph of electrification. Third, European corporate managers, especially in Germany, are becoming more pessimistic – and Brexit does not help.

The ECB, with catechistic dogmatism, shut down its programme of quantitative easing (QE) in January, having committed the purgatorial sin of greed, though not the infernal one of lust. And now there are no fiscal tools available to (amongst others) the Italian government, thanks to the Stability Pact. The rumpus the European Commission made over the Italian populist government’s budget over the winter means that, fiscally and monetarily, Italy has nowhere to go.

People can vote for what they like – populists or not. (I shall be following the European elections closely this May – in which the UK will now almost certainly participate – what a laugh!) But in states in which politicians have been deprived of all control of economic policy, the real question is: What is the point of voting at all? (That is the main theme of a book I am writing.)

The splendid Ambrose Evans Pritchard reported in The Daily Telegraph on Tuesday (09 April) that Germany’s former European Commissioner, Günter Verheugen had “lashed out” against the EU for putting Britain into an impossible position over Brexit[i]. Herr Verheugen told a German TV interviewer that the EU’s negotiating team had made a strategic misjudgement and had misunderstood the larger issues at stake. He said the British should be offered some input into EU decision-making (Mitsprache) on trade policy, as any policy to try to subordinate the UK without voting rights is likely, medium-term, to collapse acrimoniously.

Herr Verheugen voiced the fear in Germany that a bad Brexit will only accelerate a European recession and could drive Britain into the arms of those (the USA?) who do not hold German interests dear. Indeed, it was the fear of a no-deal Brexit which would impose 10 percent tariffs on German cars exported to the UK that had the Germans twisting arms at the Brussels summit in the wee hours of 11 April – resulting in the Halloween flextension.

Gabriel Felbermeyr, head of the Kiel Institute for the World Economy, told the Ambrosetti Forum that the EU’s Brexit strategy should be stopped before it does any more harm to the long-term relationship with Britain. He said that a new form of relationship should be found with nations which reject the principle of ever-closer union.

Alas, this pragmatic vein of thinking does not impress the French, who regard Brexit as an opportunity to grab a slice of Britain’s massive financial service sector and to say au revoir to a stroppy neighbour who always pooh-poohed their grandiose plans. Even though the French statistical agency INSEE has come up for air saying a no-deal Brexit would cost the French 1.7 percent of their GDP. Stick that up your yellow vest, Monsieur Macron!

I did not want to get into an analysis of the current Brexit imbroglio today but I will just observe that even if the May-Barnier Withdrawal Agreement were, by some miracle, to pass through the House of Commons between now and Halloween, the Brexiteers would regard it as German nationalists regarded the Treaty of Versailles (1919) – a hated imposition that must be torn up, page by page – at almost any price. Even Yanis Varoufakis has described it as the kind of treaty signed by nations conclusively defeated in war. In short, it can never be a viable blueprint for Britain’s future relationship with Europe…

American bottle

The Federal Reserve under Chairman Jerome (Jay) Powell was supposed to put the fear of God into the markets this year with a prolonged spell of Quantitative Tightening (QT). Those of you who were at the Master Investor Show last Saturday (06 April) will know that I asked our Chairman, Jim Mellon – What happened?Jim’s reply was crisp, as ever: They bottled.

US interest rates have now (probably) peaked at 2.5 percent while the European Central Bank (ECB) is still lending overnight money to eurozone banks at minus0.4 percent. Meanwhile the yield on 10-year German Bunds has plunged into negative territory as conservative European investors – mainly pension funds – shift out of corporate bonds in a flight to quality.

| Master Investor Magazine

Never miss an issue of Master Investor Magazine – sign-up now for free! |

While the US economy has been purring along in the second half of Mr Trump’s first term, there are two major concerns. One is that the fiscal stimulus driven through in January last year may prove as evanescent as plum blossom. The other is that the US-China trade war might yet end badly for the global economy.

A recession in Europe driven by the inherent deflationary character of the single currency would be one thing. But a recession in the USA at the same time would be quite another. If there were to be a recession in Europe and the US at the same time the central banks would have nowhere to go as there is little scope to cut rates further. It might be possible to carry out additional QE – where central banks buy government and corporate bonds – but most analysts think that there are diminishing marginal returns to QE. That means that the more you do it the less stimulus it generates. As Jim said at the Show, the central banks have behaved like druggies who need a bigger and bigger fix to get the same high.

Moreover, the Dodd-Frank Act (2009) has restricted the ability of the Fed to lend to whomsoever it likes. The new regulatory framework reduces the ability of the Fed to lend directly to individual banks. That could prove a restriction too far in any future financial crisis.

My friend John Stepek of MoneyWeek thinks that investors shouldn’t worry too much about a recession in the US[ii]. He thinks that if the American consumer is still spending, then that’s good news for the global economy. Good jobs data out on Monday suggested that the US economy is still sound with 200,000 new jobs being created in March and wages rising at 3 percent. The US Treasury yield curve has actually steepened slightly – a negative slope being ominous. John spoke at the MI Show last Saturday and I recommend his thoughtful case for contrarian investing in his new book, The Sceptical Investor.

On the other hand, one of my favourite reclusive billionaire gurus, the acerbic Doug Casey, has been issuing grave warnings from his palatial bunker in deepest Uruguay. He thinks the recent rise in the Yen is an omen of forthcoming financial turbulence. Household debt in the USA is reaching unprecedented levels. The latest estimate is $13.5 trillion – a new record. The US debt-to-GDP ratio is predicted to rise to 110 percent over the next four years. The US Treasury yield curve is still modestly negative. And some commodities (such as palladium) are spiking – something which often happens at the end of the business cycle.

Australian woes

Australian home prices have been falling since late 2017 – and that fall is now accelerating. I have to admit to some embarrassment here. Last April I described the Australian residential property market as a one-way bet. Yes, my judgment was undone by visiting some fabulous Australian homes while down-under and listening to the confident assertions of my hosts, their affluent owners. I got that wrong. A salutary lesson – at least for me. Sorry.

Business Insider Australia suspects the downswing will last for quite a while yet. The current downturn is now one of the largest on record, only surpassed by a handful of periods in the late 1800s and the first half of the 20th century. It has even exceeded the decline further to the financial crisis of 2008-09 (which Australia largely survived unscathed).

The family home is the largest store of wealth for most Australian families. Combined with weak household income growth, falling house prices are likely to impact household spending negatively, potentially putting a drag on economic growth. As a result, many analysts believe the Royal Bank of Australia will cut rates again.

But there is light at the end of the tunnel. Expectations about house prices rose to a four-year high in April, according to the Westpac-MI Consumer Sentiment Survey, although the majority remain pessimistic. Other housing indicators such as clearance rates, building approvals and housing finance have also improved recently.

On Wednesday (10 April) Prime Minister Scott Morrison, much as expected, formally asked the Governor General to dissolve parliament and to hold a general election on 18 May. The ruling Coalition party starts the campaign with 73 seats and Labour with 72 out of the 151-seat Parliament. The winning party will need to secure at least 76 seats. The key battlegrounds will be Victoria, Queensland and Western Australia.

Indian flair

Indians went to the polls yesterday (11 April) but, this being India, there will be seven separate polling days spread over a six-week period and concluding on 23 May (the day the European elections begin). Five years ago more than 8,000 candidates ran for a seat in the 554-member Lok Sabha (the lower chamber of India’s parliament).

| Master Investor Magazine

Never miss an issue of Master Investor Magazine – sign-up now for free! |

Tom Stevenson of Fidelity International (who also spoke at the MI Show last Saturday) knows India well. He regards this election as a referendum on Nahendra Modi’s brand of Hindu nationalist populism – one that Mr Modi, barring upsets, is likely to win, despite a number of badly executed policies such as the so-called demonetisation programme. Mr Modi banned high denomination banknotes by decree in a country where most workers are paid in cash, causing much dislocation.

Overseas investors have largely spurned India under Mr Modi. Restrictive land and labour regulations, excessive bureaucracy, a poor (though slowly improving) infrastructure, and a dismal banking system have put them off. On the other hand, India’s services sector is globally competitive, accounting for 60 percent of the economy. India is the world’s biggest outsourcer and is a technology powerhouse. It’s no coincidence that much of Silicon Valley is run by Indian nationals. Moreover, consumer spending is rising rapidly.

Nothing can detract from India’s achievement in overtaking China in the GDP growth stakes. India is growing at over seven percent per annum while the IMF thinks that China is growing at 6.3 percent. The Bombay stock market last week became the first global index to reach an all-time high this year. And yet, the pliant Reserve Bank of India cut interest rates from 6.25 percent to 6 percent on 04 April to please Mr Modi.

The primacy of the central bankers

Right up until early January we thought that rates would edge upwards this year, especially in America, and that QE would be displaced by QT. But it was not to be. If anything, global interest rates are heading south again and the central bankers are itching to switch the money pumps back on.

Where will it all end? The more they resort to monetary intervention the less effective it will be. It will be as if the pilots have lost control of the aircraft, now piloted by something digital and possibly sinister…

How my nightmare ends

The aircraft is hurtling earthwards but it’s not because the robot is trying to kill us (though the first malicious robots cannot be far off). No, it’s a glitch in the software – one that has claimed 346 lives[iii]and cost Boeing (NYSE:BA) about $40 billion in lost market cap since 01 March – not that that seems to matter much right now…

Then I remember something I skim-read deep in the training manual: that the robot can be disabled by rotating a little spindle on the top left-hand corner of the control column…And having done so, I pull back the control column and the nose lifts skywards…And the shimmering surface of the ocean, just a few hundred metres below, begins to recede…And the passengers stop screaming and start blubbing, knowing that, this time at least, everything’s going to be okay…

[i]German fears grow over EU Brexit talks strategy, Daily Telegraph, 09 Aril 2019.

[ii]See: https://moneyweek.com/504818/investors-shouldnt-worry-too-much-about-a-recession-heres-why/?utm

[iii]The Lion Air flight 610 crash in October last year claimed 189 lives and the Ethiopian Airlines flight ET302 on 10 March claimed 157.

Comments (0)