Diversifying through sports betting

While an investor tries to maximise the expected returns of his portfolio, he always faces a formidable enemy – risk. In theory, if leverage has no limits, any level of expected return can be achieved. But risk is also expected to rise with it and make the burden of failure too great for an investor to bear. Finding a balance between desired return and tolerable risk is always the most difficult part of investing.

The Modern Portfolio Theory of the 1950s conveys some good lessons about risk minimisation. Instead of purchasing just a few stocks and incurring the idiosyncratic risk related to those particular stocks, an investor can pick up a larger portfolio of securities, completely eliminating the idiosyncratic risk. In the end, only market risk would remain, theory says. If the expected returns that derive from such diversification are not as high as desired, there is always leverage, which would enable the investor to boost expected returns to the desired level without pushing risk to the same high levels as the initial smaller portfolio.

But what about market risk? Can we diversify it away?

Theoretically, we can’t pick any more securities in order to reduce market risk. After eliminating idiosyncratic risk, we cannot diversify away the risk that comes from economic conditions, political cycles, and so on. But the notion of the market is broad and difficult to delineate. Under the theoretical foundations of the Capital Asset Pricing Model, the market is composed of every asset one can think of, whether traded or not. To some extent then, when we buy just the traded bonds and stocks, we are not exactly buying the market, and therefore some risk may still remain diversifiable.

Today, I’m looking at something that may at first appear strange as an investment strategy but that in fact may provide additional diversification for an investor holding a portfolio of stocks and bonds—sports betting. While different from investing in financial markets, sports betting can still be regarded as an investment, provided that the placed bets follow a sound strategy that takes into account both return and risk. By a similar token, financial investment would turn into gambling when trading doesn’t follow any sound strategy. So what matters is the attitude of the investor, not the subject of the investment.

Unlike regular investors, most sports bettors are amateurs. They place bets on their favourite teams or for the thrill of watching a game with an additional outcome. Most of them end up losing money. Unlike financial markets, where trading occurs through a market where bid and ask orders match each other to settle a trade, most sports betting occurs through bookmakers, who make a living opposing bettors.

These bookmakers have several layers of protection, which start with a high overround (their raw profit margin) and go on to grade clients in a scale that starts from “amateurs” and ends in “potentially dangerous”. Those bettors with the most reliable strategies usually end up with their betting limits cut to a minimum or being kicked off by the bookmaker. In financial markets, traders still have to face commissions imposed by a broker and the hidden fees behind bid-ask spreads, but can remain for as long as they want to (or as long as their money allows), no matter what their performance is.

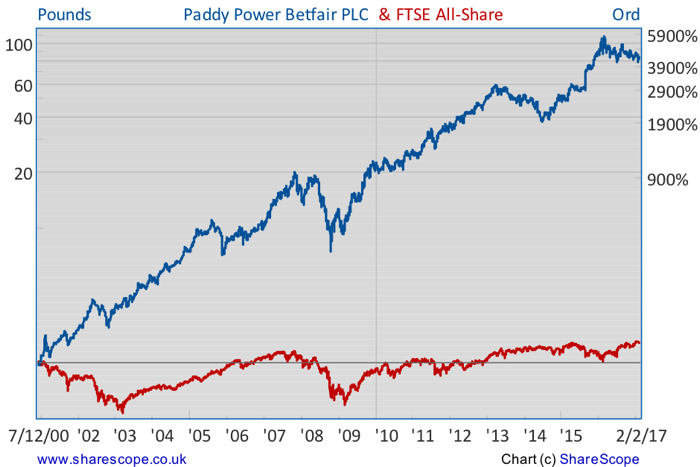

But the sports betting industry has been growing fast and investors can today avoid bookmakers and place bets in a similar fashion to what happens in the stock market. Companies like Paddy Power Betfair Plc (LON:PPB) offer betting exchanges, where traders oppose other traders instead of all playing against a single bookmaker.

While the rise of a betting exchange is certainly a plus for investors willing to jump into new diversification instruments, there are still empty fields. To be successful, an investor needs not to pick shares of Amazon, buy gold, sell brent crude or buy the pound against the Turkish lira. He may opt for passive investment strategies or to delegate investment management to a third party.

The SPDR S&P500 ETF Trust Units (NYSEARCA:SPY) is a way of achieving market returns without requiring any active management from the investor. The iShares Russell 2000 ETF (NYSEARCA:IWM) is another way of getting exposure to the market in a passive way, but with a focus on small caps. Those looking for active management can choose from thousands of investment funds, which will manage risk and return on investors’ behalf. But in this field, sports betting fails. For an investor not willing to hand pick a Borussia Dortmund win and some Premiership over 2.5 goals outcome, it is a lot more difficult than it is in financial markets.

One way to overcome the above problem is by subscribing to a tipster’s services. But unfortunately, this doesn’t work very well most of the time. Most tips services, either paid or free, rely on the knowledge of those connected to the sport themselves – sports journalists, ex-players, and others directly connected with the game. But unlike what may seem to be the case at first glance, playing a game and betting on a game isn’t the same. Most of these people don’t know anything about risk.

To make sustainable profits out of sports betting, one doesn’t need good guessing on whether Manchester United will win its next game or whether Chelsea is going to score more than one goal. It is a matter of evaluating whether the assigned odds are in accordance with the estimated probabilities. If you offer me evens on Rotherham beating Arsenal you wouldn’t grab my attention; but if you offer 200/1 on the same, you would. That is because what is at stake is not whether I think Arsenal would win, but the chances I assign to it. Most tips you can read on newspapers just fail the risk check and will make you poorer over time.

Enter the Cloney fund

Still, there is hope for those without any sports betting knowledge and who don’t want to rely on tipsters. The hedge fund business came to sports betting a few years ago. Unfortunately at first it was a fund named Centaur Galileo, which was very poorly managed and is now out of business. But there is an Australian company – The Priomha Group – which has been offering an investment fund based on sports betting for seven years now. To reinforce its commitment to European rules, they opened a subsidiary fund based in Gibraltar.

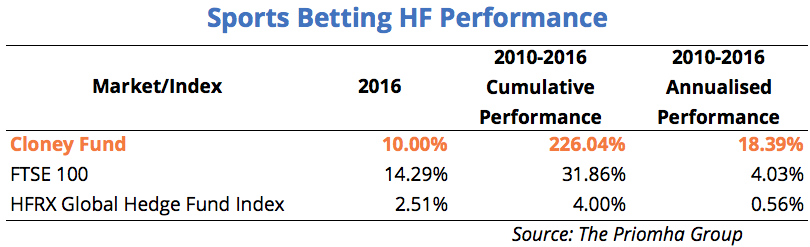

The Cloney fund from Priomha has an enviable performance track record. For the period 2010-2017 the fund gained 226.04%, which translates to an annualised return of 18.4%.

Sports betting funds like this from the Priomha Group mostly base their betting picks on objective criteria. They have watchers who gather some subjective game play details, but these data are usually translated into objective constructions like number of corners, number of chances, and degrees of crowd mood, pitch conditions, weather conditions, and even degrees of manager’s mood. In the end, they use algorithms that fit all the data and place bets according to objective criteria balancing return and risk, as opposed to the tipsters’ subjective evaluations mainly focused on returns. Not that there aren’t good tipsters specialised in certain markets; it’s just that the performance of the average tipster is poor.

The Cloney fund from Priomha has an enviable performance track record. For the period 2010-2017 the fund gained 226.04%, which translates to an annualised return of 18.4%. This performance compares with an annualised return of 4% for the FTSE 100. Such a performance has been achieved on a standard deviation that is close to the standard deviation experienced by the FTSE 100.

While achieving a huge return is certainly a great attraction, my main aim here is to achieve portfolio diversification. The Cloney fund is not exposed to boom-bust economic cycles, to monetary policy, to political cycles, nor to any other events that make for market risk. At the limit, the correlation of sports betting returns (and therefore of the Cloney Fund’s returns) with the market are close to zero, which means investors can reduce risk in their portfolios by allocating some money to an investment vehicle like this one.

Comments (0)