Are Monetary Conditions Really Tight?

A few days ago, the meme stock frenzy seems to have been reignited, pushing the price of Game Stop (NYSE:GME) and AMC (NYSE:AMC) significantly higher. Between 10 and 14 May, Game Stop rose from $17.46 to $48.75 and AMC from $2.91 to $6.85. Despite its spectacularity, the momentum quickly faded and both were hammered down to $21.90 and $4.70. However the money is still lying around waiting for the next frenzy…

While the dumb money waits for the next social media opportunity, the smart money is pushing stock prices higher on the back of better than expected earnings and renewed interest rate cut optimism. The Dow itself posted an 8-session winning streak. Interest rate cut optimism is regaining momentum as investors bet on a September rate cut in the US as inflation approaches target. Since the beginning of the year, the Nasdaq index is up 13%, which is more than respectable given the current level of interest rates.

Not so good inflation figures…

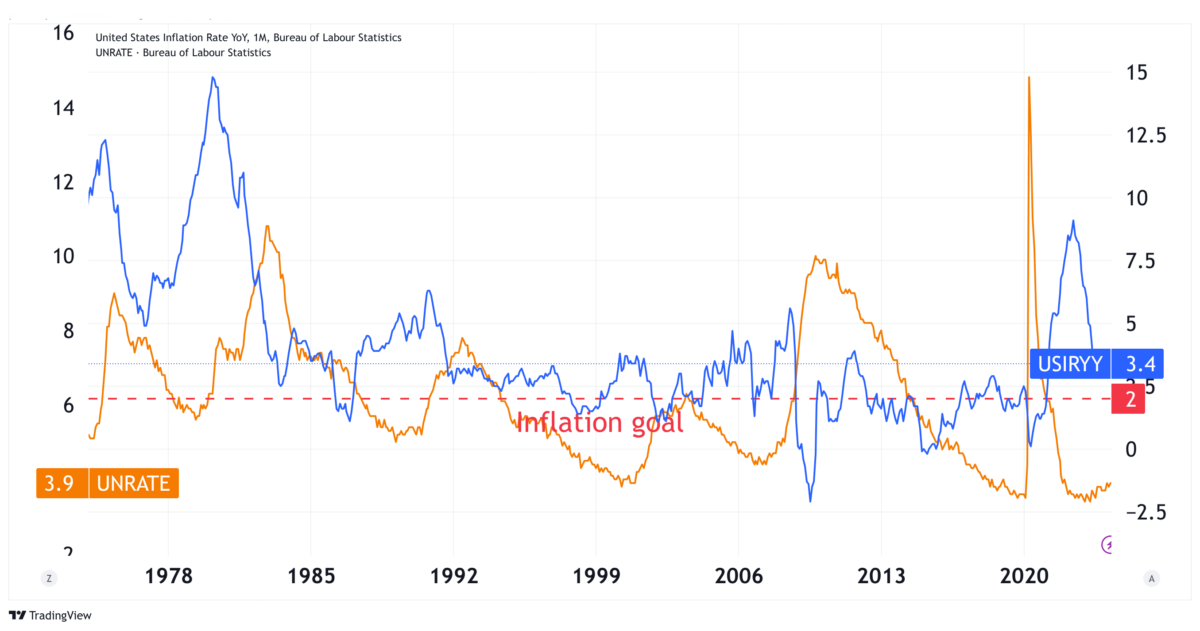

All of the above makes me wonder whether this optimism is justified. It seems that the latest CPI reading has motivated investors to buy stocks again. The month-on-month figure rose 0.3%, slightly below the consensus of 0.4%, while the year-on-year figure still stands at 3.4%. While this is an improvement on the near double-digit inflation numbers seen in 2022, it is still far from the central bank’s 2% target. This reality has been largely shrugged off, as have other data points. For example, the latest PPI figures for April showed an increase of 0.5% against a consensus of just 0.3%. Another example is the Michigan 5-year inflation expectations reading of 3.1%, which is not only well above the 2% target, but also close to the highest levels seen in recent years. Indeed, the highest levels seen above were 3.2% in November last year and 3.3% at the peak of inflation.

Although the inflation figures appear to be improving, they are not reassuring. As a consequence of an interest rate increase from zero to 5.50%, I would by now expect an economic slowdown while inflation cools. If on the one hand the lack of any kind of economic landing is good news overall, on the other hand it could be a sign that something is missing in monetary policy. The US unemployment rate stands at 3.9%, a figure that is close to a record low when taking into consideration the last four decades. At the same time, GDP grew in the first quarter at a moderate but still significant rate of 1.6%. To use the exact words of the US Bureau of Economic Analysis (BEA), “the increase in the first quarter primarily reflected increases in consumer spending and residential investment”. In my view, this is an odd development given that interest rates are significantly higher than they were two years ago. ***How is it possible that consumer spending and residential investment continue to drive the economy?

Not so tight monetary policy…

The other day I read an interesting article by James Mackintosh in the WSJ, about market froth getting extreme, where he tries to discern the reasons behind the recent stock market bubbles such as meme stocks, SPACs, cannabis stocks, loss-making tech and the solar and wind stocks. In the end, he claims that “too much money in the economy had to go somewhere, and it went into stocks”. James Mackintosh blames easy money for creating these little bubbles. He presents an interesting chart of the Chicago FED Adjusted National Financial Conditions Index which supports the easy money theory. I reproduce a version of the chart below.

It should be noted that numbers above zero represent tight conditions while numbers below zero depict loose conditions. This way, it becomes clear that despite higher interest rates, monetary conditions are still loose. Mackintosh is more than right on the easy money thing. We’re not living behind tight monetary conditions.

For an interest rate to be effective, whatever its level, there must be some shortage of money. If no one is seeking for money, it doesn’t make much difference whether interest rates are at 2%, 5% or 50%. The financial conditions index shows that current monetary conditions are not tight. There is excess liquidity in the US economy, which puts pricing power on the supply side. Unfortunately, as long as consumer spending remains this strong, we will have to live with higher inflation. For inflation to come down systematically, the FED will most likely have to tighten financial conditions to the point where consumer spending suffers. Most people would disagree with me, as there’s a rush to return to near-zero interest rates and continue to fuel the current stock market rally. However, the central bank is missing its inflation target and I suspect that now is not the time to talk about rate cuts. It’s highly likely that interest rates will remain high for longer than currently expected, and that any cut by the FED this year will be a one-off rather than a reversal of the interest rate cycle. Still, the US economy is strong enough and corporate America is showing decent profits so far. However, if the FED doesn’t cut rates and those profits don’t continue to grow, the market will have to come down for current price multiples to catch up with their historical record.

Speaking of bubbles, can Nvidia really deliver on all the promises it made at its earnings presentation? Or is AI the new tech bubble?

Comments (0)