Three Celtic Goldies

Scotgold (SGZ), Galantas Gold (GAL), and Conroy Gold & Natural Resources (CGNR); I’ve covered them all in recent years for their potential. Now they are all much closer to realising it. But in what order will the market recognise them ?

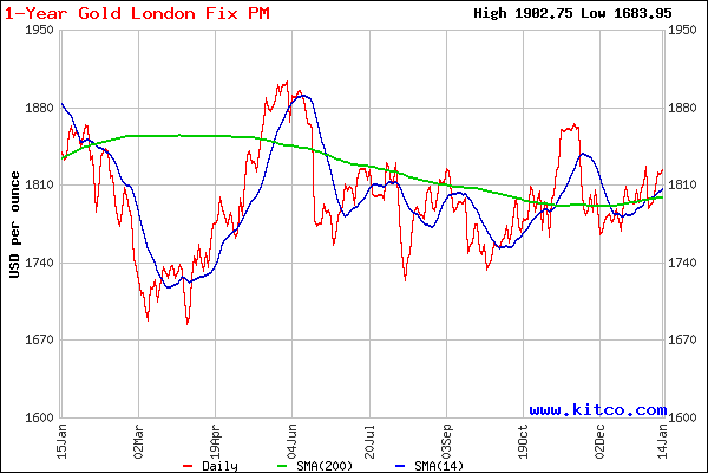

Meanwhile the prospect of inflation – if not spurring gold – is at least holding it up. So expect more interest in these three, so far quite small, producers-in-the-wings, once the market recovers from its current malaise.

One year gold in $US

In no particular order, first up is Scotgold, – market cap £48m @ 80p – which I wrote about in some detail in May 2020 while the shares at 57p were on one of their regular upswings – eventually doubling before, as was usual up to then, sinking back. Now, they are on an upswing again after the excellent news that, at last, and after many delays from one reason or another including Covid and Scottish weather, Scotgold has been achieving first volume gold production from its Cononish mine in the Scottish Grampians. So will the shares hold this time?

Scotgold last two years

The problem before was that developing the mine from when planning permission was granted four years ago, but ten years after coming to market, and in particular building the processing plant, to first trial pour of gold, took longer than expected. Even so, with access to high grade gold much easier than for most gold mines, only four years from start to production is pretty quick.

At the moment, the amount of gold (and equivalent silver) that SGZ’s drilling has led it to believe it can recover is about 180,000 oz over a nine year mine life (worth £240m at the current gold price). Costs to plan and develop the mine so far have left the company with nearly 60m shares in issue (over 60% held by directors and connected parties who have mostly financed the mine up to now) to whom some £8.5m debt stands to be repaid over the next five years.

Against that is the company’s recent report of its first production of 700 oz of gold in December, after ramping up during the quarter which as a whole produced 1,508 oz after some covid related delays.

For the current year Scotgold is predicting a fast expansion, but with a very wide range for the current 1st quarter of between 1,400 and 2,200 oz. That is because, still early into a revised new mining plan instituted by a new CEO, it is still unsure of the gold grades to expect as it continues to ramp up. Later in the year however it expects to open a new stope, and after more plant upgrades, hopes to achieve an annual output rate of 16,000-17,500 oz.

That remains to be seen, but on top of that SGZ is planning to bring in a ‘phase 2’ plan which it expects will increase total annual production to 23,500 oz by mid 2023.

Obviously that prospect – of £32m pa of revenues – will look attractive to investors against the current £48m market capitalisation (despite the limited mine life) but at present the company is being cautious about costs beyond saying it is achieving a cash profit right now – so investors have little idea of the immediate profit potential.

In the past SGZ has predicted all-in costs around £544/oz which, at the current gold price would deliver a gross profit of £800 per ounce (note that I am using the dollar price adjusted to sterling). But that was before the latest mining plan and the cost of new plant that has been added over the past year.

Even so, I have made a crude estimate of the NPV now based on that original margin, allowing for the debt repayment and company overheads, and cautiously assuming that the full 23,500 oz per annum won’t be achieved before 2024. That NPV at 8% turns out at £68m which some will find disappointing compared with estimates in the past (at lower gold prices), and comes about entirely due to the delays and extra costs.

However, Scotgold believes there is considerable potential to find more gold in its other licences nearby and so to increase the mine life. But that will take a long time to establish, so, because many observers have been disillusioned by Scotgold’s record of past delays (unwarranted though they may be from now on) I wouldn’t expect the shares to continue their strength for long. I, personally, would only buy if they sink back to the 60p levels – pending more clarification how things are going.

I have mentioned Conroy Gold and Natural Resources before (in MI last March 3rd describing its full background) and again in my December round-up, on its joint venture to develop its gold finds with experienced Turkish mining group Demir Export whose signing last week produced the usual share spike which hasn’t held.

CGNR has three main groups of Northern and Southern Irish licences which it considers host up to 8Moz of gold, of which it has so far defined 517,000 oz at Clontibret where it found a 900 oz gold ‘nugget – worth £1.2million today. The jv will see Demir invest Euros 10m in two initial phases to develop Clontibret ‘up to construction ready status’, with a third phase to bring its other licences into operation, in return for which it will earn a 57.5% interest in them all. Thereafter, it will participate equally with Conroy in the necessary construction spending unless Conroy elects to be partly bought out.

From a cursory reading it is not clear exactly how this will work out, but it is not important yet for an evaluation of the shares because there is a long way to go before any progress will allow investors to guess the potential. But a market cap of a mere £11m at 28p compared with a theoretical £11bn worth of gold ‘in the ground’ certainly makes them worth accumulating on dull days for a bottom drawer.

Conroy Gold and Natural Resources last two years

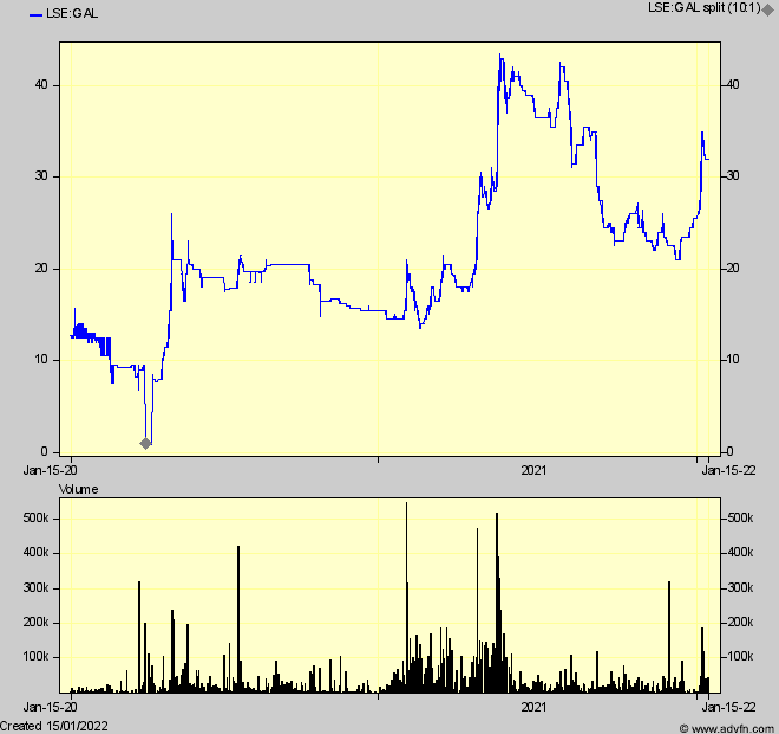

Last up is Galantas Gold Corporation (GAL) which along with Scotgold on the same Celtic gold trend is already about to produce. But deciding which is a better bet is somewhat problematic. While Galantas has just released its revised mining plan which will start soon for the Cavanacaw mine in Co Tyrone following the change in management and refinancing last April when I described it in detail and again in September, its size and profitability looks to be smaller that SGZ. However it benefits from seemingly more reliable forecasts and better potential in the medium term to extend its current 6 year mine life.

Galantas Gold last two years

GAL’s market cap, fully diluted by warrants still outstanding (SGZ doesn’t have any) is £35m compared with SGZ’s £48m, for respective gold recoveries according to their latest forecasts, of 130,000 oz over six years for GAL, and 266,000 oz over eight years for SGZ. GAL of course has been producing gold on and off for a long time, which is why restarting now with a relatively modest capital investment for the prospect of much higher production made it so attractive to the experienced miners who refinanced it last April.

Thinly traded however (with over 75% held by the board and new key investors including mining guru Ross Beaty) the company, based in Canada, is not widely followed over here, and its shares fell back during the news drought and halt to mining which followed the refinancing and while the new management bedded in to produce the improved mining plan. But investor interest is returning now that production will restart soon – indications are by the end of this quarter – at a planned higher rate than before.

That comes on top of excellent drilling results reported in December of the campaign GAL has instituted to expand its gold resource. Unlike Scotgold’s similar campaign which will be spread widely over a number of licences and will take a long while to establish any extra potential, GAL’s merely has to explore nearby veins and extensions. From the preliminary results, expanded and longer life production than the current six years already looks highly likely.

Unlike Scotgold also, Galantas seems more confident in predicting progress and costs, although these are showing rather less profitability – initially at least – than I estimated back in April. I based that estimate on GAL’s long out of date Preliminary Economic Analysis dating from 2014, adjusted for the present gold price and assuming higher costs. But the 15% extra that I assumed looks to have been quite a considerable under-estimate, explaining my reined back figure.

But figures from the company at the moment are still a bit vague. GAL hasn’t announced any more than that the existing mine is still being extended and refurbished and that it expects to restart production (it seems by April) to produce 9,000 gold ounces by this end year at a cost per saleable ounce of $1,150. That output should expand to 17,800 oz in 2023 at a higher $1,350 cost per ounce, which means that profitability initially will be rather less than I had estimated, although the costs being incurred now are expected to allow a much higher output to at least 35,000 oz/year later on.

The result is that my estimate now is of a NPV the same as my £55m last year (versus £19.2m in the 2014 PEA) but taking in only the first six years of what I think is the current mine life, and allowing nothing for any potential beyond that for a much longer life. In effect my estimate is based on a lower profit in the first two years than I initially assumed, compensated by higher profits thereafter.

I stress that without more detail from GAL this is a very crude estimate, but given that news and progress can be expected to get steadily better from now on, the resulting 55p NPV per share (assuming all warrant conversions) looks a good reason to accumulate them from now on. I rate them the shorter term opportunity of the three and better than Scotgold for their longer term potential.

Conroy meanwhile could be extremely cheap – but in the very long run.

Comments (0)