Rumours of War? Miners on the Move?

Its good to see that, at last, some of my miners have been waking from their slumbers.

And its not all due to the rumbles of guns but to other noises off. War’s stimulous to gold has helped of course, but Solgold (SOLG) has almost met my 40p target albeit four months later than I thought – as the market awaits the revised feasibility study for Alpala next week, which rumours suggest will be on a less ambitious scale than was the first plan.

Rumours also are that the NPV might be less (reflecting a smaller scale and not a worry unless the irr isn’t good) but what the market hopes for is a markedly less initial capital cost, which is what investors felt last time was too much to handle. Adding to the rumour mill is that an easier development route will, at last, attract a bid – whether for Alpala alone or for Solgold as a whole – probably from a joint venture between current major shareholders BHP and Newcrest.

But Solgold investors should remember that it makes no sense for an acquirer to pay the NPV to buy a project, but much less. While if someone takes away Alpala, what will be left is an exploration company with a big requirement for more cash before any other project (of which of course there are plenty that look promising) comes to fruition. So I don’t expect Solgold’s shares to get to very much higher than today.

Kefi Gold and Copper (KEFI) is, also, at last awaking from its long doldrums – as its Tulu Kapi gold mine approaches (for the umpteenth time) financial close, and construction start – hopefully some time in the summer. If it does, then its profitability once in production in two years time will be substantial and justify a share price (according to analysts’ latest expectations) some multiples of the current 1p – promising a return much better than from Solgold. How quickly that will be anticipated in the market is of course a moot point, and don’t be surprised if the current flurry fades away at times beforehand.

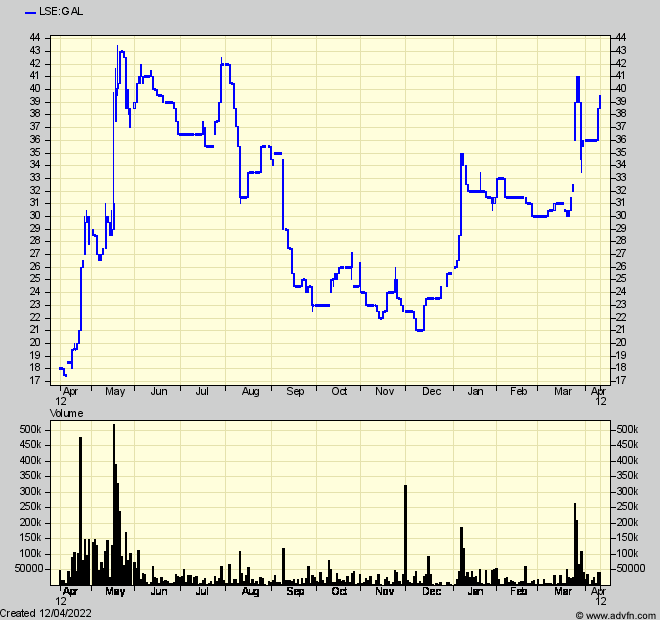

Galantas Gold (GAL) the Northern Ireland goldie I’ve been flagging for some time, has been very erratic but, then its shares (quoted here and in Canada) are not very liquid, and production to a revised plan has only just restarted. While profits won’t ramp up quite as quickly as I estimated a few years ago, making the shares look extremely cheap at current levels, that is only because the ultimate scale of production is planned to be considerably higher. Adding to the attraction is that recent exploration to expand the gold resource has been proving highly successful, and the company is to discuss the results and the broader scope in a webcast on April 21st. The shares are relatively illiquid only because some well-known gold investors have snapped some up already. I think GAL will reward investors rather better over the next few years than will SOLG.

Emmerson (EML) has been strong also after Putin’s war has threatened to cut off world supplies of potash fertiliser from Ukraine and Belarus, two major producers – so improving – perhaps markedly and permanently – EML’s potential market for its planned Moroccan Khemisset potash mine. But as the share chart shows, there may be a block to progress above 8p because complete financing for the mine, not to mention some key environmental permits, still hasn’t been arranged, even though engineering consultants have been appointed. Even so, a key component was put in place in November from an Asian investor consortium, while the company reports that financing discussions with other banks and credit agencies are going well.

If they are concluded and a financial close comes into view, I would expect that 8p ceiling will be broken.

As for Xtract Resources (XTR), my strong pick a year ago, it hasn’t needed to be stimulated by rumours of war, but only by speculation about the drilling programme at its Bushranger prospect in New South Wales. I haven’t commented recently because there is little point until it becomes clearer how much bigger is the deposit than was known when a feasibility study was produced a few years ago It looks as though that drilling programme is now almost complete, so that a revised study can show investors the real value of what is there. XTR had promised such a reveal about now.

It has to be said, though, that the copper grades have not been particularly startling, so that I, personally, have revised downwards my (admittedly back of fag-packet) estimated of the value which former owner Anglo American might pay to buy back the Racecourse deposit within Bushranger and which some more excitable investors had been hoping for. It is still possibly twice XTR’s current market value however, but the situation has been complicated (in a good way) by the discovery meanwhile of another porphyry (named Ascot) a few hundred metres away, plus hints of even more within the same licence.

XTR is currently examining these through an aerial IP survey whose results – if, as hoped, show that the whole Bushranger licence (with Ascot and others) has much more promise than just Racecourse alone – could help the shares’ current gentle upwards momentum to accelerate.

In other commodities, Atlantic Lithium (ALL) has rocketed to over 60p, whereas I had been cautious at 40p, Sorry about that, but short-medium term timing is not my strong point. It is all very well thinking you have a better handle on a share’s value than other investors and being right in the longer term – when those others ‘lacking your judgement’ continue to pile in or sell off as the case may be. ‘Prophets in their own Land’ — and all that!

But ALL’s strength has been due to ‘news’. With the price of lithium carbonate in China almost doubled again since January, and ALL reporting (unofficially) that it has been receiving unsolicited approaches to buy the company, the shares couldn’t resist. I wouldn’t deter anyone from hanging on.

But a profit is a profit (in this case treble since January) and it might be worth pondering what effect will a world recession – and consequent slow down in EV production, already being reported in China – have on the lithium price?

Comments (0)