Horizonte Minerals – “Are We There Yet?”

HZM is one of the few developing miners in the world progressing to be a major supplier of one of the most in-demand metals – nickel – which is why I have been following it for 10 years and describing it on here from about 2016. It hopes eventually – from scratch in 2010 – to be counted 3rd equal with BHP among world producers.

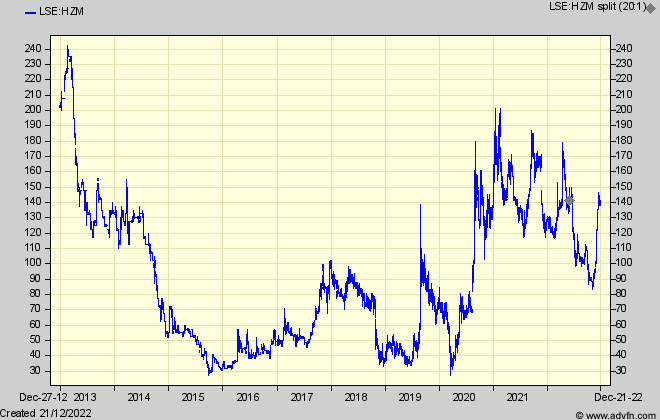

But, as usual, it has had to overcome some big challenges on the way, not least the usual roller-coaster commodity prices, and waxing and waning chances for raising the necessary funding.

At my last update a year ago (29 Nov ’21) HZM had just secured the $633m funding to start building phase one of its Araguaia project in Brazil – slated to produce 14,500 tonnes of nickel annually, which at the nickel price prevailing then would generate some $300m of annual revenues for nearly 30 years. With two more phases to follow, the long term target is over 50,000 annual tonnes.

In anticipation of that funding, the shares had staged one of those performances that investors in mining are there for – quadrupling over the previous two years to a then 8p (equivalent to 160p now after a 1:20 share consolidation in July). But I was skeptical of any further progress, arguing that because the institutions were (as I had feared) paying a much lower share price (7p) than had been hoped for, and extracting more onerous terms, the expected value per share once in production was now much lower. I thought the shares wouldn’t get above 10p then – 200p now – for the foreseeable future, and so far I’ve been right.

Part of the reason for the institutions’ caution had been a staggering 46% increase in the expected capital cost. So I said that, taking account of the repayments of the various loan packages, and the sky-high costs of a deal to pay up front for some of the output, I estimated the NPV per the now much increased number of shares when stage one started in 2025 had fallen from the c 20p which investors had been going on, to only 10.5p per share. So by my long argued principle that shares never reach more than 1/3rd to 1/2 of any theoretical NPV based value, I urged caution.

But hope always springs eternal in private investors’ hearts (if not in the Scrooge-like institutions’) and the recent surge in nickel prices has re-invigorated it. My calculations a year ago were based on the (‘long term’) $16,800/tonne HZM was itself using to project that NPV, and the price has now spurted to $25,500/tonne after a brief flirtation with $33,000/tonne in April.

So with production costs at stage one expected to be less than $7,000/tonne, the gearing effect of those higher prices will be substantial. HZM’s NPV estimates now extend to $1.5bn for stage one at $23,000/tonne and $2.4bn when stage two (with double the output) starts, possibly in 5-6 years time. Beyond that, another 24,000 tpy project at Vermelho some 30 miles away but of uncertain later timing would add another $3.4bn.

With stage one construction now well under way and first nickel hoped for in a year’s time, private investors can hardly contain themselves with the prospect of a long term $5.8bn NPV on the current 268m shares – meaning an apparent £21 per share (compared with the current 140p)

Even without those two additional stages, the medium term outlook looks interesting. What determines a share price isn’t an NPV, but the annual cash flowing towards shareholders, and HZM’s latest projection at a $23,000/tonne nickel price is for annual free cash flow at stage two of $379m (and reported profit to be $462m) While it doesn’t spell out what it will be for phase one alone (the only one being built now) it can be estimated at around $180m which equates to 67p per current shares in issue. Hence PI’s excitement at the over 300p share price, that such an income would normally command. – starting only next year !

But wait a minute, Scrooge has something to say that might delay the party. While private investors always look on the bright side, the Institutions don’t. Unlike private investors who will be thinking ‘we’re arriving’ at the end of ten long years of pain, spending, and fund raising – so it’s time to rake in the dosh – the institutions will be totting up all those obligations so merrily accepted a year ago in return for the funds to start to build.

Those project loans and streaming obligations are big. If, over the coming year as some observers fear, a recession dents the long anticipated nickel price rise, that gearing effect will operate in the opposite direction, and the loan repayments and streaming deductions will eat more heavily into the cash flow from which they are repaid.

To recap from my list of those obligations a year ago, I estimate interest, repayments, streaming and royalties on the original basic funding package will be c$75m annually for 9 years. In addition the company says the $251m cost (very out of date) of stage two will be financed by stage one’s cash flow. Stage three (Vermelho) will cost in the same region as one and two together, and as well as from early cash flow will probably need more loans and involve more share issues. Those figures compare with the $180m annual cash income I inaccurately estimate from stage one at a $23,000/tonne nickel price.

Share dilution now in the pipeline from stage one funding is a;ready quite big and will further reduce cash per share. Instead of loan repayments there could be conversion into possibly another 13% more shares in addition to 8% outstanding for options. So today’s 269m shares (compared with 190m a year ago and 85m just before that) could balloon to 325 million, much higher than the optimists ever expected.

So I see the coming year while stage one construction completes and first revenues come into view as a tussle between the nickel price, which if it continues strong will gear up HZM’s medium term value, and calculations of the cash outflows to fund stage two and repay those obligations. It means I wouldn’t chase the shares just yet unless they drift back a lot. That is, unless you are sure of that nickel price. And I’m afraid I can’t help you there.

@John Cornford,

A brilliantly factual article..

A sobering but useful read.

thank you