Gearing Up Gold

I’m glad to see Hummingbird up over 50% in the month. I did say it was a little risky and dependent on the new mine, Kouroussa, going to plan to open this year, but a recent iupdate confirmed all seems on track. The shares’ recovery is, of course, being geared up by gold’s rise, and if both those factors continue unchanged, HUM’s shares have a long way to go still.

Investors of course know that, rather that gold itself, it is gold miners whose profits will benefit more from the gearing effect of gold’s price rising over existing costs – the higher those costs initially, the faster the profit margin will rise, or recover.

But there is always the risk of production problems, and no matter how reliable a miner might have seemed, they can ‘strike’ without warning, as they did for Pan African Resources which betrayed my reason for buying its shares last year. (Although they have recovered nicely since I urged keeping them last month. But maybe they’ve reached a plateau for the time being). On top, there is the damage to be inflicted by the high cost increases being reported (or rumoured) by miners worldwide.

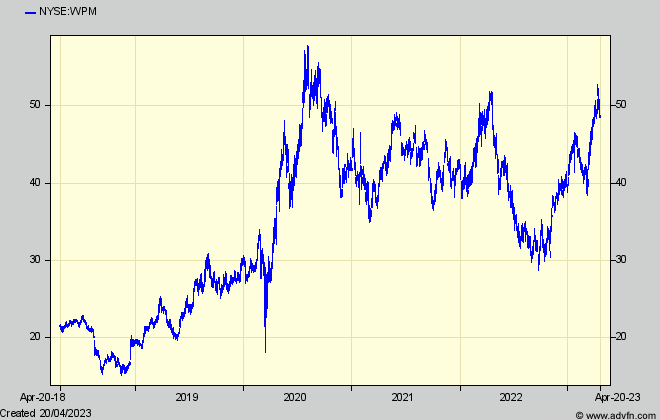

Luckily there is a way to avoid both these risks. You can buy a gold ETF. But back in Jan 2016 I put forward, and in April 2020 explained more fully, gold streamers (owning a share of production) and gold royalty holders (owning a share of revenue) – the biggest of whom is Wheaton Precious Metals. (NYSE:WPM) with a current market cap of $22.6 billion.

WPM’s portfolio of gold (and silver) deliveries, and of production royalties, currently stands at over 33.4 Million ‘proven and probable’ gold equivalent ounces, lasting for 30 years into the future (with another 24Moz ‘inferred’). These are payable to it by the miners to whom it has advanced some of their development capital.

Having effectively ‘paid in advance’ for that gold, WPM’s further costs to resell it at current prices is only $452/oz, which means a profit margin of over $1,500/ounce currently. While that margin might not grow (with a rising gold price) as fast as for some individual miners with much higher starting costs, WPM’s advantage is that it is not at risk from any one miner experiencing production problems, and neither will it suffer from the exceptional production cost rises being experienced by actual miners.

It is those advantages that have enabled WPM to expand so fast and to command a premium rating over individual miners with its current PE of over 30 times (although only a measly 1.2% yield). But for investors believing in a strong future for gold, it won’t be the yield they’ll go for, but the long term share price rise WPM has been consistently delivering.

Almost all these streamers and royalty owners are listed in Canada, other key ones exposed to gold being Franco Nevada, Royal Gold, and Sandstorm Gold, with others, newer, including Nomad (TSX:NSR); and Empress Royalty (TSXV:EMPR). The only UK such is Trident Royalties (AIM:TRR) but which is exposed to lithium, copper, rare earths, and iron ore as much as to gold and so has not performed particularly well

Signs of life?

Mining projects can take years to develop and often seem to have died, but can suddenly spark into life, as it has with Condor Gold when its underlying merits are suddenly recognised or when regulators and bankers finally get their acts together.

One such whose shares have suffered badly from delay is Emmerson (AIM:EML) whose Moroccan Khemisset potash project I discussed fully in Dec 2021 and again in April’22 as potentially a strong share performer once under way. Its delay has been partly down to waiting for financing, which seems now to be much closer with the appointment of lead loan arrangers, but more especially for the local authorities to grant an environmental permit. EML’s 2022 Report just published is optimistic for an approval soon, and even says it hopes construction will start this year, which is why the shares are up 30% from their end March lows.

They are still only half the 9 odd pence of a year ago, but as in all such cases. investors should best wait for the current spike to settle down before making a speculative purchase. ‘Speculative’ because, although a go-ahead would spark a sharp recovery in the shares, the medium term prospects for them will depend very much on the terms of the necessary financing, and as was the case for Horizonte Minerals after its very long gestation and go-ahead last year, this could be less attractive for shareholders than they, usually optimistically, assume.

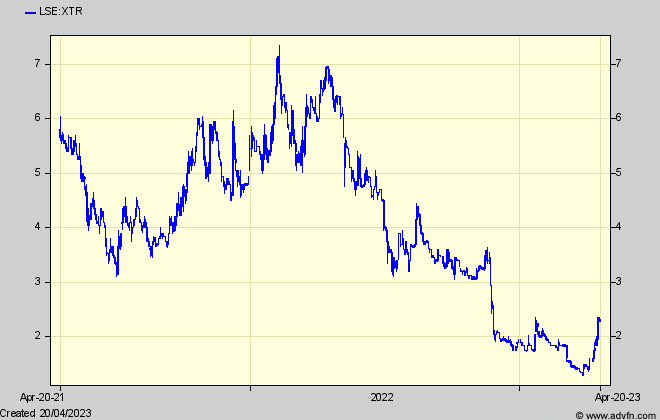

So how about Xtract Resources (AIM:XTR) where I and many others were truly misled by CEO Colin Bird’s over-optimism about the size of its Bushranger copper deposit in New South Wales.

After a long period of wailings and gnashings of teeth (mine included) which took the shares down to 1.75p after touching 7p a year ago, they have suddenly sparked up to 2.35p (as I write). That appears to be due to speculation about Xtract’s other, producing, gold assets in Africa, where it has a 23% share of net profits of the Manica Gold project in Mozambique which Xtract has been keeping somewhat in the shadows until fairly recently.

Its majority partner has spent almost everything needed to switch fairly limited production up to now from an alluvial operation to a more productive open pit, whose output in the first quarter of 2023 had reached 3,976 ounces – an increase of 56% over the quarter. And, while the published financial results for Xtract’s 23% share of Manica are rather hard to follow and to separate from its partner’s results and costs, Colin Bird says it is now in a ramp-up phase which will see its overall income from Manica ‘well in excess’ of that up to now.

A feasibility study (when gold was only $1,262/oz) showed this new phase of Manica to be low cost and to deliver some 30,000 gold ounces pa over the next 7 years. Assuming, say, 20,000 ounces for its first full year, Extract’s revenue share would be $8.5m at a margin the feasibility study predicted (in 2016) would be over 50%. Even if costs have risen substantially (except that they appear to have been only 32% of revenue so far in 2023) the net cash income to Xtract (even though only for 7 years) would be very useful in the context of Xtract’s current market cap of only £20m, and would help allay fears that it will come to shareholders for funds to undertake more drilling at Bushranger.

Bushranger of course, which although disappointing so far, still has 1.3 million tonnes of copper (resource – not reserves) able to be mined via an open pit, for which the company is still working on an up-to-date feasibility study. (the previous one when 1/3rd the size showed the Racecourse deposit would be uneconomic at current copper prices)

However, I did point out that Harmony Gold’s acquisition last October of the Eva project in Queenland with a 1.7million tonnes copper equivalent reserve (ie about twice the size of Bushrangerat a better grade) in order to commence its exposure to copper, (like many other mining conglomerates) gave hope that Bushranger might attract a bid eventually. Its value has to be speculative at the moment pending the results of the feasibility study. Meanwhile, the current share recovery looks like being limited.

Comments (0)