December Mining Update

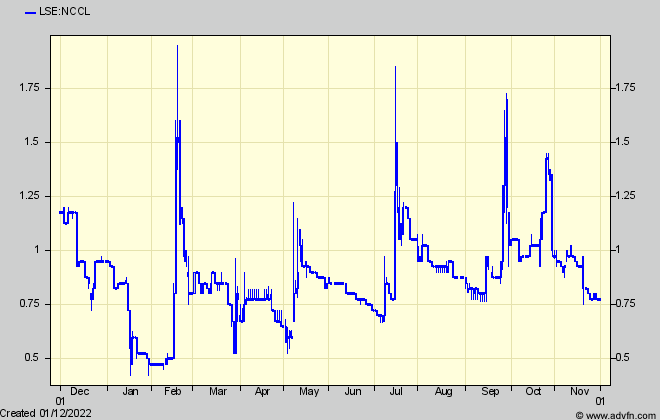

Ncondezi Energy NCCL

I’ve been airing the potential for NCCL, now that it has been forced (by the dislike for coal) to put its almost ready to build Mozambique Tete 300MW coal fired power station into cold storage, and replace it with a solar power scheme.

This scheme is already a long way into planning, ready to start earning before even the coal project could have done. But meanwhile the poor state of is owner’s balance sheet (brought about by the long drawn out 10 year and $20m wasted costs planning for coal) have made for caution among many investors.

Nevertheless the shares were beginning what looked like a slow recovery, until two weeks ago the company was forced to make a 1:5 fund raise (around £1/2million) to see it through to reaching agreement early next year on a transmission connection solution with the Mozambique authorities and confirming power demand from potential off takers.

The placing price at 0.65p – nearly half the shares price a month before – was the bad news, which was well outweighed in my view by the good, in the form of an updated valuation following a detailed feasibility study for the first 300MW stage of the solar project. While NCCL provided detailed figures, which were much more comprehensive than the equivalent usually provided by other energy hopefuls, investors still seem to need a bit more explanation of their import for the shares.

Which, in my view, are for scope to be much higher than now, once the project starts earning in 2-3 years time.

Ncondezi Energy latest year

As an intermittent producer, that 300MW peak output is not to be compared with the now parked, always-on, 300MW coal plant. The ‘effective’ total power (and revenue) generated by solar in the best sunny locations is about 20% that of a permanent generator although could be doubled when – as is planned but not yet in the figures until agreed with offtakers – battery storage (BESS) is added.

NCCL is planning only a 100MW peak output plant to start with, but has provided figures for the 300MW that it hopes it can achieve soon afterwards which will deliver substantial economies of scale, and is only the first stage of the 5,000 MW that has space for on its existing site (which could still operate a coal sation alongside).

Assuming a 300MW peak plant (before BESS but with better scale economies than 100MW) NCCL projects that a total capex of $464m would deliver a ‘project level’ NPV (at a 10% discount rate) of $73m. That, to some investors, might look small and is limited by what tariff the offtakers will think gives NCCL a reasonable return. But as a reliable figure backed up by long term off-take and government guarantees, such projects usually attract 75% loans, thereby gearing up the returns substantially for the providers of the 25% equity, so their effective return will actually be much higher.

That is apart from the fact that a 10% discount rate used by the company looks conservative, reflecting that a grid connection and offtakers are yet to be agreed, and that an NPV is not as good a guide to value as will be the annual $23m cash income (after all deductions such as tax, loan repayments, and a share to the Mozambique Government) that the equity owners are projected to receive. That is an annual 20% against the $116m they will have invested.

For NCCL shareholders the questions are 1) When will 300MW be achieved? : 2) What will be their share of the equity income for the amount NCCL can afford to invest ? : and 3) how many shares will it have to be divided among to give a value per share ?

Answers to 2) and 3) are reassuring. Firstly, NCCL will receive a useful ‘development fee’ at financial close as re-imbursement for the work it has done. While we can’t know the details, this appears from other such projects to be around 5% of the capex, so for a 300MW project NCCL should receive around $23m (ie 5 times its current market cap)

Secondly, to earn 100% of the project’s $23m net cash income, equity investors must stump up $116m cash – a sum which some NCCL investors (those pi’s on the bulletin boards at any rate) seem to fear will involve issuing a frightening number of new NCCL shares.

That looks not to be the case. In its statement NCCL says it will invest what development fee it receives into the project, and gives the share of the annual income it will thereby earn for a 100MW plant as between $6.8m and £7.8m, which is respectively 29.3% and 33.6% of the $23m total – the range dependent on what ‘return’ the other investors putting up their share of the $116m will demand.

That 33.6% share of the project implies NCCL shareholders would be stumping up a lot more than my estimate of a $23m solar development fee, and it seems the extra $10m investment is coming from additional re-imbursement for the work it has already done on the transmission infrastructure for the coal plant..

Although by financial close which could be next year NCCL will probably have had to raise more funds (as it has just done) to keep going, I can’t see it being very much. By that time the market should be recognising that – according to the company’s figures just announced – it will look forward to an annual cash income between $1.3m and $1.7m for a 100MW project, or between $6.8m and $7.8m for 300MW, neither of which requires more investment from NCCL. As a 25 year project, the market should accord at least a 5 times multiple to those cash incomes, meaning a market cap of at least $6.5m for 100MW and $34.0m for 300MW.

At a current 0.8p, NCCL’s market cap on the full 575m shares now potentially in issue including warrants, is £4.6m or $5.5m. So, while investors might, currently, be pricing in only the lower outcome for a 100MW project, the scope to expand beyond that with substantial economies of scale and proportionally much higher profitability must surely begin to look attractive at some point in the coming year.

Xtract Resources XTR

What a disaster XTR seems to have become – although on reflection not as great as a halving of the shares since September might imply.

Extract Resources latest year

Chairman and CEO Colin Bird is under fire from all sides for what seems to have been his grossly misleading ‘hints’ about the size of the Racecourse copper deposit that XTR has been spending shareholders money to drill and which has turned out – according to the update resource just announced – contains just under 1million tonnes of copper, against the 2 million that Anglo American would need to see before possibly buying it back – which prospect first excited everyone including myself. Until around mid-year CB seemed to be promising that 2 million tonnes was in sight, although his then suddenly going quiet began to sow doubts.

I also started doubting and said so here in October, because the initial very long copper intercept that started off the excitement was not being repeated in the transverse ones and neither was the grade very good. But even so CB didn’t warn, so I didn’t sell my own shares, despite a gut feeling telling me to. It isn’t easy to have the courage of one’s own gut feeling however, as must have been the case for many investors who have recently sold out in what looks like a panic.

But 1 million tonnes of copper is still not to be sneezed at, and is still one of the bigger undeveloped copper resources in Australia. What worries investors is that it might now be to s,mall with too sparse grades, to be economic to develop.

That however looks a bit pessimistic. While the initial vision of the Racecourse deposit as a long, near horizontal ‘carrot’ has turned out to be a thin one, the saving grace is that the richest part is near the surface, meaning less cost to mine. While some investors have been suggesting it would still be uneconomic unless the copper price gets considerably higher, the company is still insisting to wait for the professional update to the economics (based on the full drilling results) which is due in a month or two. Following that, speculation is that if insufficient to make a ‘decision to mine’ quite yet, further drilling of the mostly untested, newly discovered, Ascot prospect a few kilometers away might be a way to go.

Meanwhile, a market cap of £17.3m for an in-ground recoverable resource of around 650,000 tonnes at a $8,000/tonne price (vs $10,000 6 months ago) worth $5.2bn would be considered very cheap in normal circumstances.

With the market seemingly giving no benefit of any doubt to mining or commodities generally, lithium is still attracting investors, despite the market wobbles I pointed out last month that looked like damaging the high-flying price. Since then the Chinese are reported as complaining that lithium is getting too expensive for the batteries for its cars, although others are pointing out that Goldman Sachs’ opinion in June that the lithium (and all battery metals) market had peaked didn’t work out for some time.

Even so, investors will still be looking for exposure to what is looking like a reliably long term growth story, and I pointed out Atlantic Lithium’s (ALL) attractive looking economics and share price projections even if the sky-high lithium price some forecasts were relying on doesn’t happen, but provided investors waited for the funding they will have to stump up.

A newcomer promising even more riches for investors has recently arrived however, in the shape of (Alkemy Capital Investments (ALK – previously Tees Valley Lithium) which listed in Sept 2021, and re-listed in March this year at 100p, with a plan to acquire a site at the Tees-side chemical park to produce higher value lithium hydroxide used in more expensive, longer lasting vehicle batteries. The shares are now 280p after planning permission was received last week.

That contrasts with ALL who is to produce the standard lithium carbonate used for most of the car industry from concentrate ores shipped from its mine in Ghana, and illustrates perhaps the complicated nature of the whole lithium market where its different grades and uses from different types of ore and different intermediate chemical products are being set up by numbers of companies scrambling for a place in the European value chain now being built.

The differences in that value chain and implications for the individual companies and for prices is what makes for some caution in forecasting, notwithstanding which the two brokers retained by ALK are forecasting a stupendously high price for the shares once TVL is in production in perhaps 4-5 years time. Shard Capital has just come out with 1,200p per share and VSA with 1,000p but a look at the latters’ calculations makes for caution.

There are no forecasts as yet by the company except for the capital cost around £300m, so VSA has put what looks like its fingers in the air to forecast lithium prices, and production costs 10 years into the future and a resulting NPV of £400m rising to £1,400m as TVL builds up to 4 production lines,. It then ‘risks’ this by 90% to arrive at its ‘target price on the current 6m shares of some 1,000p.

Needless to say 1) a NPV always exaggerates a share price actually achieved. 2) using a ‘risk’ is a thumb-in-air guess, by-passing the need to forecast the extra shares or borrowings which will actually be needed for the capital cost and will dilute the value in the shares. Whether 90% will be enough remains to be seen.

Nevertheless, at this very early stage of ALK’s development, given the sheer size of that ‘target, no doubt some investors will overlook the crudity of the calculation and push the share price well up towards it while the company completes the remaining steps before production starts.

Alchemy Capital latest year

Comments (0)