December Mining Round Up And A New Streamer

Recent performance of my mining recommendations hasn’t been 100% brilliant. But, then, neither has the sector. Hummingbird is still on track, but too slowly for some: Xtract Resources’ Bushranger project and its CEO’s reputation has sunk even lower now that the ore sorting technology he hyped as rescuing its economics, won’t now do so. So its 1.3 million tonnes of copper will remain in the ground until its price gets considerably higher: Pan African Resources however is recovering from what I thought a much too cheap level with “expected production performance for the half year to December 2023 positioning the Group to deliver excellent results for the full financial year”. And ASX listed Barton Gold is also holding up well, on encouraging drilling results and a promised – possibly significant – resource update before the year end.

The gloom has been more brightly pieced by Empire Metals’ sharp rise following a drill result showing even better grades at its Pitfield titanium prospect in Western Australia. It should obviously be held, while Wishbone Resources, a gold target in the same State, remains as a speculation for a similar performance once its own drilling results are announced early next year.

But Greatland Gold’s recent almost doubling from its 6p lows is, I think, an enormous bear trap – set off by the spike in gold, in turn stimulated by the Palestine war and interest rate speculation and which might not continue, and by chartist mumbo-jumbo. Either way nothing has changed (yet) to make Greatland a less risky investment at current levels. There are still big traps ahead. The updated Havieron resource statement due soon won’t, I think, boost the shares as much as the hopefuls think. That is because most informed opinion doesn’t believe the mineable gold there will double and, more important but not appreciated by the hopefuls, is that even a larger resource, if it won’t be mined for a long time ahead as will be the case for what Havieron has been drilling, won’t be accorded nearly as much value as nearer term production. The reason is obvious. Who knows what costs and commodity prices will be that far ahead ?. And whatever is definitely monetised in the far future will have a heavily discounted present value today.

The second reason of course is the continuing uncertainty what Havieron’s new 70% owner, Newmont, will do with it. Opinion seems to be swinging towards its retention, rather than a ‘sale’ back to Greatland Gold. If so, Newmont’s plans for it won’t necessarily be in GGP’s favour, especially in regard to the timing of the necessary additional investment that an expanded mining plan and much higher costs looks certain to call for and which GGP at the moment can ill afford. Whatever outcome, it isn’t clear that GGP shareholders won’t avoid substantial dilution, at least in the medium term

But – Now for something completely different

Trident royalties – another streamer?

AIM:TRR 307m f/d shares @35p = £108m market cap.

Back in Jan 2016 I first put forward streamers as an answer for investing in mining and commodities without all their risks (read there as a more thorough description than I have space here. But to simplify the two methods – a ‘royalty’ buys a % of a miner’s revenue, and an ‘offtake’ buys an amount of its product which the streamer then resells). I have updated from time to time on the grand-daddy of them all – then Silver Wheaton, now Wheaton Precious Metals having switched emphasis to gold meanwhile.

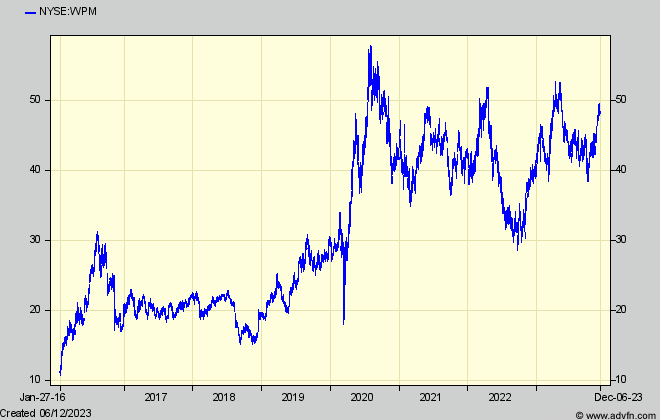

Since then WPM’s shares have almost quadrupled from $12, and reached a $53 peak in 2020 before turning erratic and their current $49 on NYSE, or £41 on LSE (where listed only since 2020). Its current $22bn market cap reflects its position as a major provider of development funding for all the world’s miners.

Wheaton Precious Metals

Partly reflecting their defensive qualities, while exposed (and geared to) commodity prices, streamers attract high ratings, now around 40x, but by the same token that makes their shares volatile at their tops. And also, in the last few years while benefiting from filling the gap in funding that developing miners were encountering, so as to buy at keen prices the royalties and offtakes they sell instead to raise those funds, streamers couldn’t avoid the one risk they still bear which is when its producing miners slow production due, for instance, to covid.

That is why WPM and similar have seen flat earnings recently, although WPM is now recovering, not just because gold is strong.

Because these major streamers had been doing well up to 2020, I decided not to feature a newcomer, Trident Royalties, run, uniquely in the UK, which floated on AIM in mid 2020 at 20p. That was because it would be very small to start with (raising only $20m – it reports in US$ to align with the sector) and so would not have a spread of deals, which in any case were only for iron ore and copper which I felt investors would not be interested in.

Nevertheless, its streaming concept quickly caught on and – able to raise a much larger $69m in the next year and $6m in 2022, bolstered by another $50m in bank loans – Trident was able to go on an acquisition spree, adding royalties and offtake deals in copper and for the first time in gold and lithium, so that by mid 2023 its portfolio contains $152m of assets, of which half is gold and potentially over 40% lithium – not all of which however are earning yet.

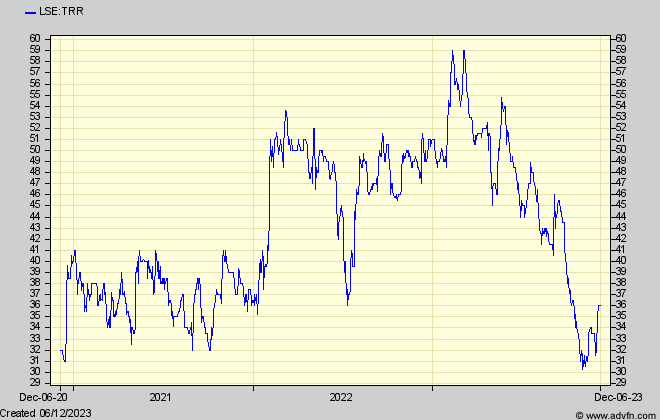

That is why the shares got to nearly 60p in January – only to nearly halve since then, for a mixture of reasons.

Trident Royalties since listing

As for buying the shares, my reason for taking an interest now is the chart, showing they might have fallen to a point where recovery looks likely.

However, those reasons must be taken into account and is why I think any recovery might be somewhat slow to start with. Firstly, revenue from streaming is low at the moment. The deals are typically for projects not yet in production and their revenues are not slated to start to arrive in quantity until 2026 so that, meanwhile, overheads and interest on the loans Trident takes to buy its streams is producing negative earnings. Secondly is the ‘valuation’ method used by brokers (my old bugbear!)

Three brokers follow Trident, all with suspiciously close current ‘targets’ around 80p. But they use the same old ‘NPV’ basis which I have shown many times on here is illogical and leads to share price ‘targets’ (whatever they are anyway) always, always, much higher than is ever reached in practice. (the reasons are slightly abstruse, so although true are ignored by analysts wanting to ‘sell’ the shares for their company broker employers)

But during 2023 that NPV basis has come back to bite in the rear. Using as they do a ‘discount rate’ in their calculation, with rocketing interest rates the analysts’ assumed discount has had to follow suit, considerably reducing their valuations.

(Those ‘targets’ were in September, and I don’t know the earlier ones which I assume were higher. Even so, the slide in all ‘future project companies’ shares is for similar reasons to those affecting the energy investment trusts which I described in January)

So, instead of those ‘elastic’ broker targets (in reality PR puffs) the market (especially for the larger, more established and diverse streamers whose income can be steady and more predictable) uses a PER measure which is what, eventually, will determine Trident’s share price.

But that won’t be for another few years, so meanwhile RR’s share price might hover between the two approaches. But Ruffer investment management added 5% in September, so maybe I’ll be proved wrong.

That was in early September however, before a long-standing problem blew up concerning the validity of a royalty Trident thought it was buying over the Sonora lithium project in Mexico which made it questionable whether it would go ahead. Although the deal wasn’t valued very much, the news nevertheless badly affected the shares, from which they are only just starting to recover. Ruffer maybe wasn’t pleased.

All that came on top of the significant fall in lithium prices throughout 2023 just when Trident had committed to substantially increasing its exposure to the metal.

But there is better news to look forward to. Trident has been steadily making more, relatively small, deals in silver and copper helped by the continuing funding drought its clients are experiencing, and still has useful cash in its balance sheet for more. Its profits are highly geared with a high gross margin that currently merely covers overheads and interest but should soon grow faster than those two drags on profit. And significant news could arrive in the next few years concerning Trident’s potentially most valuable asset, which is a 1.05% gross revenue royalty over N America’s biggest (and almost only) lithium project, at Thacker Pass in Nevada.

That has just received significant $650m backing from General Motors, some time after Trident paid $28m to buy the royalty in 2021 in a deal which originally was for a much larger one but will reduce when, as expected, the mine’s operator pays Trident $13m to buy most of it back in 2026. That will boost Trident’s income, which brokers estimate will rise from around $11m this year, through maybe $13m and $15m in 2024 and 2025, to a maybe a 50% jump in 2026 (excluding that buy-back) when Thacker Pass starts producing. At full production later, and current lithium prices, Trident reckons Thacker Pass could earn it an annual $21m thereafter. When lithium was higher earlier this year, the company was talking of $30m pa.

There are too many other projects in Trident’s pipeline for space to describe here, or to estimate their contribution, but much is happening that should translate into revenue and geared up profit growth which, before too long, will produce positive earnings per share for the market to value more precisely than the vague NPV or ‘asset value’ basis. So that is why the chart looks like signalling a good entry point, although a possible cash raise to further bolster its balance sheet might slow recovery a little. TRR is attracting a bit of publicity as I write (not why I alighted on it) which might skew a buy decision. As readers know, I don’t ever advise on timing. I merely give the background for readers to time themselves. And I have never gone along with the daft idea of ‘New Year’ tips.

Comments (0)