Caledonia Mining: Is the Optimism Justified?

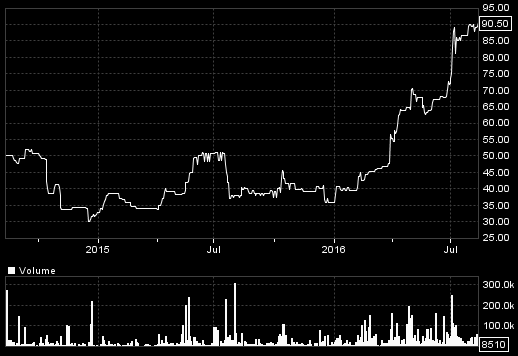

Writing in the Magazine this month, Richard Gill has re-iterated his bullish view for Caledonia Mining (AIM:CNCL) after its substantial bull run. I have to disagree.

While the company was an obvious beneficiary back in January of any improvement in gold – it is in the middle of a well-flagged expansion project at its Zimbabwe Blanket Mine to double gold output over the next few years, which it is paying for from its existing resources and revenue – I think its shares and £45m market cap are now well into over-valued territory.

But because it is a private investor company, which for reasons I explain will never be invested in by institutions (except by one small private investor fund which has already bought, and afterwards puffed the shares) it might for a time retain the ‘upward momentum’ which is cited as a bull factor. I explained in the blog that this can happen when investors lose sight of real value, but the point of Master Investor is to help investors understand what they are doing when they put their heads above the parapet.

What Richard’s article – and that small fund, in a recent web presentation – overlooked is that the earnings per share forecast by Edison (paid by the company and therefore with an incentive not to highlight it) and which Richard’s article quotes, is almost double what shareholders are really likely to be earning in the future. That is because in 2012 Caledonia sold 51% of the Blanket Mine (but not 51% of the company – in other words, current shareholders have sold off 51% of their asset) to an indigenous group under Zimbabwe’s equivalent of S. Africa’s Black Empowerment laws, for $30m which is already being used towards the mine expansion. But the said group has paid for its 51% by way of a loan and partly by forgoing dividends and, so far, little has been paid back. Consequently, in its accounts the company does not yet fully deduct the 51% minority profit share that the empowerment group is entitled to, but deducts only 15%.

So, although the company’s accounting treatment which still takes in 85% might be ‘correct’ just at the moment, to base a valuation of the company on the resulting ‘cheap’ PER is likely to be misleading. (The dividend yield – which is only just covered by the ‘correct’ earnings – is of course real. The question is how long it might continue – especially in the light of Zimbabwe’s chronic shortage of cash to pay off its IMF loans. The country can’t be too happy that Caledonia remits scarce cash to pay dividends to its Canadian and UK shareholders, whom it doesn’t need to butter up any more to raise any new funds.)

Also overlooked, is that a PER measure is not appropriate for a limited life mine. (Blanket has expansion potential, but it has not been fully confirmed so investors should not be counting on it.) In such a situation it is the NPV that is the most appropriate measure, and while consultant Minxcon’s 2015 technical report showing a $66m (£51m) NPV at $1,250/oz gold (for 100% of Blanket – i.e. Caledonia’s share is only 55% of its present market cap) has been updated by Edison to reflect a revised mining plan, some of the expansion potential, and being one year closer to the increasing cash flow, it assumes a $1,400/oz gold price from 2018 onwards. This takes CMCL’s attributable 49% to $110m (or £85m, but at $1,400/oz gold which we haven’t seen yet in the current bull run).

At $1,200/oz, Edison’s shareholder 49% value becomes only $73m (or £56m compared with CMCL’s £45m market cap) and readers will know my reservations about according to a miner’s shareholders more than about half the theoretical NPV. In fact, even fully funded miners in current markets are only being accorded about 1/3rd their theoretical NPVs.

Another reason why Caledonia’s shares have been strong is a perception that political risks in Zimbabwe have been diminishing. Have they? There still seems to be unrest, and only two days ago The Daily Telegraph commented, “In the streets outside Zimbabwe’s finance ministry, Robert Mugabe’s despairing subjects hold regular strikes and protests against the crisis overwhelming their country’s economy.”

In the medium term, if the Blanket Mine is left alone by the Government to achieve its expansion plan, and gold continues to look healthy, its earnings will certainly rise significantly and, according to Edison, the mine (not Caledonian’s shareholders who have no control of it) will have amassed nearly $50m cash by 2018, which will enable further expansion and perhaps acquisitions.

But while we don’t know the timing of when the indigenous investors will have finally paid for their 51% of Blanket, investors should remember that eventually their attributed share of its earnings will contract to only 58% of what it is now. (And one might even take issue with the company’s accounting treatment which does not yet fully deduct the indigenous share despite the fact that Blanket is spending the $30m they ‘paid’.)

At present, of course, the average private investor probably won’t notice, and will go by that ‘headline’ performance over the next few years, keep running after the shares and ignoring, as private investors tend to do, the snags I’ve highlighted. But those snags will keep away the institutional investors who might otherwise keep the shares healthy.

On balance I would be inclined to bank my substantial profit since January and look elsewhere for some of the more dependable goldies I’ve been highlighting.

Comments (0)