A tricky problem

Those who followed me into Solomon Gold, at 3p in March and at 7p two weeks ago, have a short term dilemma. What to do now that the shares have briefly touched 14p and today have bounced off a 10p chart level (but at low volume).

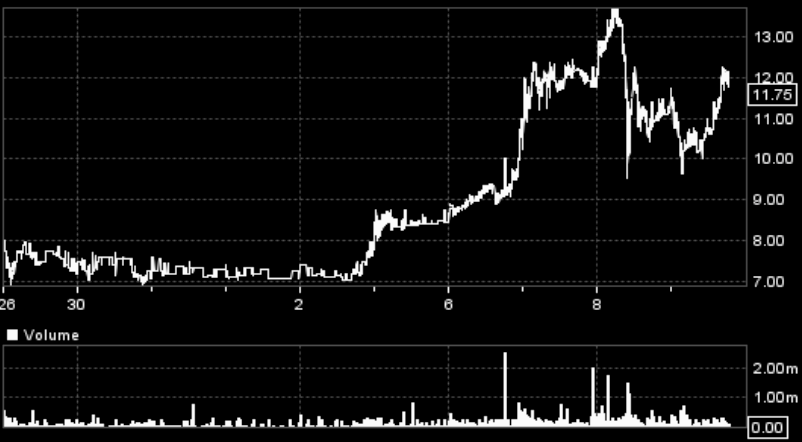

Solomon Gold – 10 days to 9th September 2016

After the boost brought about by the substantial capital raise from Maxit Capital at 6p, necessary to step up the drilling and exploration programme at Solg’s highly promising Cascabel project – which was why I re-recommended the shares – and after a further, smaller, boost from the August 25th announcement that Maxit wanted more, the shares didn’t react much to the next, game-changing announcement on August 30th, whereby Cascabel was endorsed by world major Newcrest Mining. It has ‘conditionally’ agreed to take a 10% stake in the company, again at 6p, thereby bringing expertise in the block cave mining technique that will be essential if Cascabel’s currently very deep ores are to be mined economically.

But how conditional is conditional? And might the expanded drilling programme due soon discover other ore bodies not as deep, so that block caving isn’t quite as vital to get any mine going quickly.

Newcrest’s 6p offer has to be agreed by shareholders by October 13th – three days after they also have to agree to issuing more shares to Maxit – at a price to be agreed but assumed to be also at 6p.

And Newcrest’s offer is partly conditional on no better offer being received beforehand.

So, after a few days to ponder the implications of all that, a scramble for the shares started in the new week beginning September 5th which took them up, on heavy volume, to a brief, 13.9p peak three days later.

No one has come up with a reason, but which seems to have been speculation around that tantalising phrase in the August 30th announcement – “SolGold’s Board recommends the investment by Newcrest, subject to no superior proposal being received by SolGold prior to shareholder approval.”

Investors had obviously also connected that with CEO Nick Mather’s statement (in the August 25th RNS) that “SolGold has entered into a number of Confidentiality Agreements with unassociated third party major international mining companies, and several of these have conducted detailed due diligence and project site reviews.”

So what now? Investors have to ponder whether interest from others is so strong that the shares will remain above the 6p share price before Maxit and Newcrest decide whether to pay more for the stakes they want. Or whether Newcrest, for instance, might walk away, leaving the way open for someone else. They also have to remember that a maiden gold and copper resource for only part of the whole – all promising but unexplored – Cascabel prospect should be announced by the end of the year.

They should also bear in mind that at least some of the many who took shares at 6p through Maxit will be tempted to take a quick profit at these levels.

I, personally, have taken a short term profit on a small portion of my holding. But I’ll be trying to get back in again at some point.

Comments (0)