The Pound, the Brexit, and the Current Account

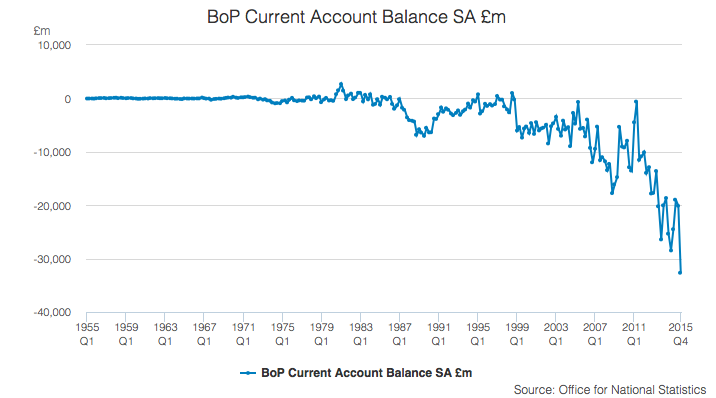

The ONS has just announced the highest current account deficit on record for the British economy, at 5.2% of annual GDP. While nothing new, this trend may become hazardous now that Brexit plans are under discussion. In fact, some of the effects are already in play and can currently be seen in the stunning deterioration of sterling in the year to date. If the British decide to leave the EU, the economy could enter a period of higher inflation, higher borrowing costs, decreasing foreign investment and weaker sterling. Given the risks, the only place to be on the pound is on the short side. As for gilts, they have been stable so far, mostly due to the ECB intervention that led to hot money outflows from the Continent towards Britain’s borders, but those flows may reverse direction very quickly, particularly if the prospect of leaving turns into a reality.

First, the good news: the British economy grew at a pace of 0.6% (2.4% annualised) during Q4 of 2015, which is an improvement over previous reported figures. That certainly came as a breath of fresh air and relieved the Bank of England from following the ECB in its latest reflation attempt. Second, the bad news: the current account gap widened from £92.9 billion in 2014 to £97.3 billion in 2015, currently representing 5.2% of GDP. In Q4 the current account deficit hit £32.7 billion, up from £20.1 billion in Q3 and hitting a massive 7.0% of GDP.

Many have dismissed the figures, arguing that the main driver for the widening gap has been the outcome of investments. The argument is that as the British economy recovers faster than its neighbours´ economies, Britain’s income from overseas investments declined while foreigners’ income taken from the UK improved. This weighs negatively on GNP and widens the current account gap. Some further explanations go as far as to attribute 80% of the deterioration since 2011 to: (1) falling receipts from UK investments abroad, mainly due to many of the UK’s largest 25 multinationals investing in the heavily depressed commodities sector; and (2) sluggish growth among neighbours. That argument seems fair enough to me, but it falls short of explaining the huge trade gap, the huge primary income gap and the huge secondary income gap. The British economy has been increasingly financed by external investment, but I wonder what could happen in a scenario in which the UK leaves the EU!

As the balance of payments is by definition balanced, to finance the gap in the current account foreigners must invest in the country and/or the central bank must allow the pound to depreciate and/or the central bank must buy excess sterling in the market with its reserves. Fortunately, so far, it has been possible for the BoE to stay away from any significant intervention, as the country has been attractive enough for foreigners to pour their money in. That explains why it is possible for the country to keep the pound more or less balanced without much intervention and why the government can still issue 10-year Gilts at 1.44%. But the increasing foreign investment in the country will also contribute to a widening primary income gap in the future, as foreigners own a growing share of the British factors of production.

I read a few positive comments in the FT this morning claiming that, in the sense that “the UK economy has outperformed its main partners”, a large current account deficit “is a nice problem to have”. But this ignores the fact that the UK is financing an increasing deficit via hot money flows derived from ECB action. In Q4 the net inflow under the portfolio investment account (part of the financial account) hit a level of £72.6 billion (up from £23.0 billion in Q3). The ONS recognises that this may be the consequence of “non-residents increasing their net investment in UK long-term debt. Additionally, UK residents switched to net desinvestment in foreign long-term debt”. But the most recent numbers for Jan-Feb already point to an inversion of this trend, as this balance was reduced by £9.5 billion. I’m not sure what “long term” really means, but I guess that it refers more to the maturity of the debt rather than to the nature of the investment itself. This money enters the UK because the country is solid and provides a better return than the yield-depressed EU provides. If the UK status changes, this money could easily reverse course.

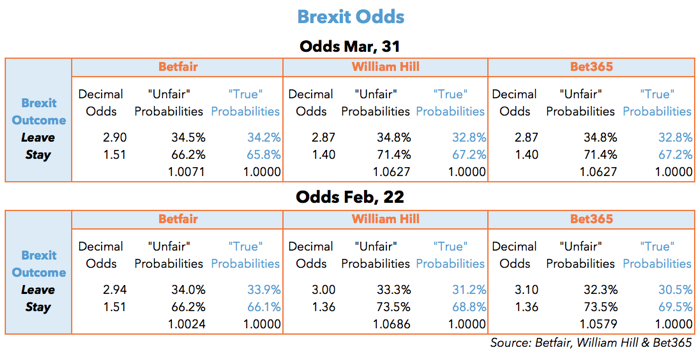

At a time when the ECB is increasing its quantitative easing programme and the British economy is in much better shape than the whole Eurozone economy, I would expect the pound to appreciate relative to the euro. But that has not been the case, mostly because of the risks perceived by the market stemming from a Brexit scenario. This is worrying because the odds of that happening are relatively low (see next table with bookmakers’ odds for that event).

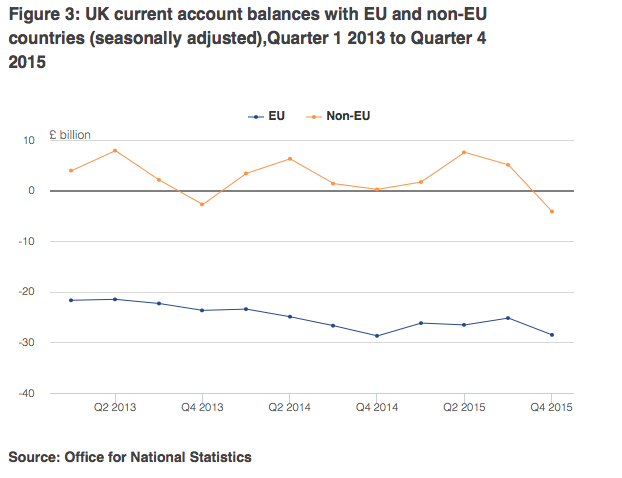

If the odds on Brexit start changing in the direction of the Leave option, the pound will see its decline accelerate. While many arguments may be made in favour of both the “Leave” option and the “Stay” option, one cannot ignore the risks of an exit. There is no reason to believe Britain will improve its trade balance while turning its back on its most important market. There’s no reason to believe that it can rely in non-EU members either. If anything is clear from reading the reported current account figures it is that the British position is deteriorating more rapidly against non-EU countries than against the EU. The trade deficit with the EU increased from £25.2 billion in Q3 to 28.5 billion in Q4, but the country turned what was a surplus of £5.1 billion in Q3 into a deficit of £4.1 billion in Q4 with non-EU countries.

If there is a future for UK trade it certainly relies on having access to the EU market. In leaving, future trade success will heavily depend on the ability to negotiate with the EU, from the outside. I wonder what message would be sent to the market by the bloc if it allowed the UK to leave while keeping the same rights as before… A tough stance has been adopted before to avoid the Eurozone from collapsing, and I expect the same to happen in any future negotiations with the UK. This would press Britain’s current account gap, as money would flow away from the country. The pound would accelerate its downfall on the back of capital flight from the country, which would end with a surge in inflation and with an increase in borrowing costs. I’m not sure if such an outcome is what the Out campaigners would want.

Comments (0)