Global monetary tightening may help European stocks

Omicron? Whatever. Investors don’t believe that pandemics will be the dominant issue in 2022. They believe that the global economy has learned to adapt, and that any Covid-19 variants will have little economic impact due to massive vaccination programmes and low government appetite for lockdowns. This year will be all about the outlook for rates instead, as central banks around the world move together into a new rate cycle, after more than a decade of ultra-low interest rates and trillions spent in asset purchases to provide liquidity to the market. The risk is shifting from pandemics to inflation.

Inflation is rising but yields are still low

Inflation is rising everywhere, and in some instances to concerning levels. In the US, inflation rose from 1.4% in 2020 to 6.8% in 2021, a number last seen several decades ago. In the UK, the headline numbers point to 4.2%, which is the highest figure in a decade. At the same time, Eurozone inflation is now at 4.1% and is showing signs of revival across almost all of its countries. Even in Switzerland, where bond yields across the full spectrum, up to a maturity of 50 years are negative, inflation is currently running at an annual pace of 1.3%. Only in Japan is inflation staying stubbornly low.

While inflation is rising and already at multiyear highs in many regions, bond yields remain at near record-low levels. Negative yields are still the norm across Europe. They’re seen on government bonds of up to nine, 25 and 50 years in France, Germany and Switzerland, respectively. Even in Spain, where inflation is now at 5.4%, yields are negative on bonds of up to six years. In the US, yields have always been positive, but they’re below 2% across the full spectrum. In the UK, where inflation has been rising for some time due to a mix of Brexit and pandemic issues, they are even lower, with the highest value on record being 1.2% for a 25-year gilt.

These numbers are a bit on the low side if we take the central banks’ pledge to push inflation to 2% seriously. The current inflation numbers at double and triple that goal make things even worse. It’s hard to foresee a positive real return from investing in government bonds. Someone investing in a French 10-year government bond would need inflation to average zero over the next 10 years just to keep up with living costs. However, with inflation currently above 4%, there would need to be some deflation for that to be possible, but the European Central Bank (ECB) does not want this to happen. In such a scenario, I would avoid bonds across the full spectrum and prefer to keep my money under the mattress.

While inflation is already high, central banks are still keeping their rates at low levels. The Federal Reserve (Fed) is promising three hikes for 2022, but its current target rate is 0.25%. The ECB didn’t touch its repo rate and is still rolling out its asset-purchase programmes.

Therefore, monetary conditions are still loose, which explains why Treasury yields are so low. Investors seem to expect inflation to be transitory as the low rates are well entrenched in the yield curve. The expected future spot rates reflected in the current spot rates are too low for any inflationary scenario. For example, the one-year rates expected to prevail in five years are around 0% for France and Germany, 1.1% for the UK and 1.6% for the US. These numbers highlight very well the transitory dynamics foreseen for inflation. However, I find it very difficult to justify such a quick normalisation in the inflation numbers to support the figures mentioned above. To sum it all up, the case to invest in bonds is weak − very weak.

Investing in equities is the only option

This is where equities come in. Price multiples are well stretched in the US, even after last month’s correction. But investors are expected to lose money in real terms if investing in bonds. No matter how we look at bonds, they seem a bad investment at this point. Thus, investing in equities is the only option left, as investors seek a positive real return.

While inflation has a direct negative impact on bonds, that’s not the case for equities. Stocks may well rise with inflation, as companies can sell their products at higher prices to get higher profits and pay higher dividends, even if only to make the same money in real terms. What investors must do is to choose carefully where they put their money, eventually shifting from a growth style to a value style.

Emerging markets

A number of central banks in eastern Europe and Latin America have already raised their key interest rates, but their counterparts in south-east Asia are still keeping rates on hold, as they wait for changes in the developed world, in particular in the US. If the Fed hikes rates in 2022, as promised, south-east Asia and other emerging markets will most certainly follow suit, as central banks that leave their policy rates unchanged when the Fed is tightening run the risk of big falls in their currencies, which could lead to currency crises and inflation. Turkey is an excellent example of what happens when a central bank from a fragile economy stubbornly contradicts this observation. Thus, rate hikes in the developed world are expected to force higher rates in emerging markets. But many of these countries are not experiencing inflation, as supply chains in these countries have not been disrupted. A rate rise may kill the moment and derail equities. In addition, companies from emerging markets frequently tap USD-denominated debt markets. Rate hikes and/or a potential dollar strengthening may erode corporate finances. For this reason, I prefer to avoid emerging markets for now.

Europe and Japan

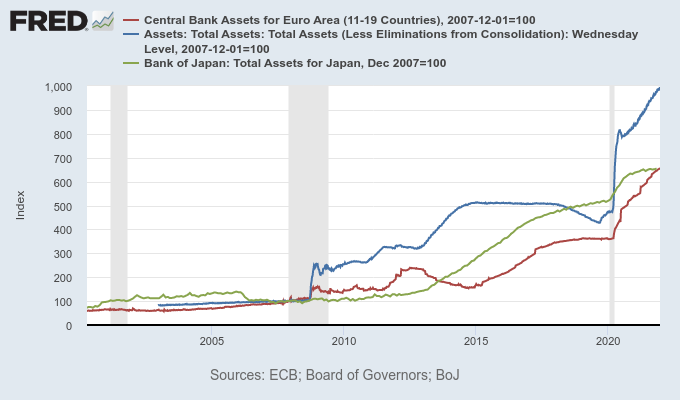

In contrast with the Fed, the ECB isn’t in a hurry. Its president, Christine Lagarde, doesn’t seem worried about inflation. The central bank confirmed it would end its emergency quantitative-easing programme by March 2022 (as previously announced) but promised to increase its regular asset-purchase programme to smooth the taper in the second and third quarters of next year. Additionally, the ECB extended the period in which it plans to fully reinvest its asset holdings. The announced measures will lead to an expansion of the ECB balance sheet.

After failing to drive inflation towards the 2% target for years, the ECB is closer to the Bank of Japan (BoJ) in policy stance than to the Fed. Policy officials still believe inflation to be transitory and mainly related to pandemic and supply-chain factors. They believe it will abate in the second half of 2022 and thus prefer to wait and see before tightening policy. With the pandemic denting growth, the ECB is more concerned about the impact of acting too soon rather than too late.

For these reasons, I believe the ECB will move behind the curve and eventually keep its repo rate unchanged for most of the next year, even if in contrast with the Fed and other major central banks. With European stocks having underperformed US stocks during the last 10 years and currently trading at more conservative fundamentals, the pointed differences in monetary policy favour an investment in European equities in 2022. In Japan, inflation isn’t rising and the BoJ wouldn’t dare touching interest rates. Equities in the country don’t look expensive and are a good alternative to Europe.

Three ETFs to invest in this year

Taking into consideration the comments above, I suggest three ETFs for 2022, to capture the returns from stocks from regions where they seem more conservatively valued.

Vanguard FTSE Europe ETF (NYSEARCA:VGK)

VGK offers exposure to large caps located in major markets of Europe, including Austria, Belgium, Denmark, Finland, France, Germany, Greece, Ireland, Italy, the Netherlands, Norway, Portugal, Spain, Sweden, Switzerland and the UK. Not all of these markets are under the umbrella of the ECB. However, given the strong trade connections between all of them, monetary policy is highly correlated. At the same time, all of the above markets look undervalued when compared with the US. VGK is well diversified over more than 1,300 stocks. The fund manages $27bn in assets and its ongoing charges are just 0.08%. For a broad European exposure to top companies in the area and for a cheap buy, this is the best ETF.

iShares MSCI Eurozone ETF (BATS:EZU)

For investors seeking a more targeted exposure to the Eurozone, iShares offers EZU. The fund invests in mid-to-large-cap stocks issued in the countries that use the euro. It is currently invested in around 240 stocks for a total of $7.3bn. In comparison with VGK, this ETF is much less diversified, smaller and riskier. With ongoing charges of 0.51%, it’s also more expensive. However, it provides a more targeted and concentrated exposure.

iShares MSCI Japan ETF (NYSEARCA:EWJ)

EWJ gives investors exposure to Japanese equities, by investing in mid-to-large-sized stocks totalling 250 holdings. Ongoing charges are 0.51%, similar to what BlackRock charges for EZU. Top holdings include Toyota Motor, Sony Group, Keyence, Tokyo Electron and Recruit Holdings.

A few final words

I believe we’re observing cost-push inflation that is related to the pandemic and supply-chain factors. The revival economic packages approved by developed countries to fight the pandemics and the existing loose monetary conditions helped create asset-price inflation that came in the form of very high valuations, in particular for growth and meme stocks. A lack of yield and an excess of liquidity led to this situation.

But consumer demand is not rising to the point of pressing prices too much. It’s all about the supply side, which is expected to normalise as the pandemic slows. The expected monetary tightening will bring some stock valuations back to earth. In that sense, US stock picker and founder of ARK Invest, Cathie Wood, has reasons to be concerned about her disruptive, high-growth funds, which hold many ‘stratospheric-priced’ stocks. However, there are still opportunities. Rotating from growth to value, from emerging markets to developed markets and from the US to Europe may prove to be a good option.

Comments (0)