How to build a passive retirement portfolio

Filipe R. Costa demonstrates how to create a simple and low-cost strategy using ETFs, to fund your retirement.

“If you want a thing done well, do it yourself.”

– Napoleon Bonaparte

Investing for retirement is usually seen as a difficult task because it requires disciplined saving and a skilled investing approach. Living standards for retirees depend on their accumulated savings, which can make them averse to the idea of self-managing such an important asset. Long-term investing does require a sound strategy to be successful, but it can still be effectively self-implemented with a limited amount of effort and expertise. Investment is now, more than ever, less about picking skill and more about mechanical implementation.

Not that skill doesn’t matter, but it comes with risks. Achieving market returns while keeping risk at bay is often what matters the most. The growth of the passive investment industry over the last 20 years means we now have all the tools to implement a good retirement plan on our own. Anyone can put a sound retirement strategy in place by allocating their monthly savings to just two different assets.

Investing by yourself

Investing for the very long term is all about maximising total return while preserving capital. We need a balance between potential return and risk incurred. As the theory goes, we should build a sufficiently large portfolio of assets in order to avoid the idiosyncratic risk that comes with each asset. For example, Purdue Pharma has just filed for bankruptcy despite pharmaceuticals doing well as a sector. Such an event represents an idiosyncratic risk that could have been neutralised by an investor holding a sufficiently large portfolio of pharmaceutical companies. Diversification across companies, sectors and asset classes is key to get the most out of investment. When we’re investing for something as important as retirement, eliminating unnecessary risk becomes central. Unfortunately, achieving the necessary degree of diversification requires buying at least a few hundred assets. Such a task cannot be implemented by an individual investor due to the time and costs incurred.

| First seen in Master Investor Magazine

|

The rise of the passive investment industry, in particular the expansion of exchange-traded funds (ETFs), has been a game-changer for individual investors. One single ETF can often be acquired with less than £100 and usually represents a share in hundreds, if not thousands of assets. AnETF is a portfolio of assets, thus offering diversification within its investment theme. Investors don’t need to buy 100 different stocks to get exposure to the FTSE 100. These ETFs do it for a tiny fee. Some have ongoing fees of less than 0.1% per year.

With just two ETFs, an investor can gain diversified exposure to equities and fixed income, and build a classic 60/40 portfolio. More sophisticated investors can spread the funds over several layers: domestic and international equities; small stocks; short-term and long-term bonds; and commodities. This approach would require buying six or seven different assets but would still be attainable while diversification would remain at an optimal level. The ETF world goes even deeper, offering specific investment factors and styles. Investors can buy a conservative or aggressive ETF directly with no need to adjust the proportion of equities and bonds. In this case, an investor just needs to add funds every month to the same ETF and rebalance every year or so.

The simplest portfolio

The simplest retirement portfolio should have an equity component and a fixed income component. The first step before creating a portfolio is to decide on the proper allocation of funds between these components, or asset classes. While there is no perfect threshold, we know a few facts that may help us to decide. Stocks are usually seen as being riskier than bonds. They provide a higher total return than bonds, in the longer term at least. Bonds are safer and in particular better suited for shorter investment horizons. If we start saving early in life, we may wish to pursue an aggressive strategy – that is, to allocate a significant part of the portfolio to stocks. While stocks aren’t free from large capital drawdowns like those experienced during the financial crisis of 2007-2009, these events are less significant for horizons of 20 to 30 years. As we have seen in the past, stock markets tend to recover quickly from their losses.

The odds of losing money on a well-diversified portfolio of stocks in a five-year interval are small. If we increase the interval to 10 years, the odds are very low indeed. If we stretch the interval a little further, stocks just look like safe havens.Thus, stocks aren’t exactly risky over the longer term. But they are risky over the shorter term. The corollary of this is that, as retirement nears, investors should reduce exposure to stocks and increase exposure to bonds.

After deciding on the proportion of stocks and bonds to hold, investors may then opt for the simplest portfolio, purchasing just two ETFs and adding funds to them each month. Some good options are:

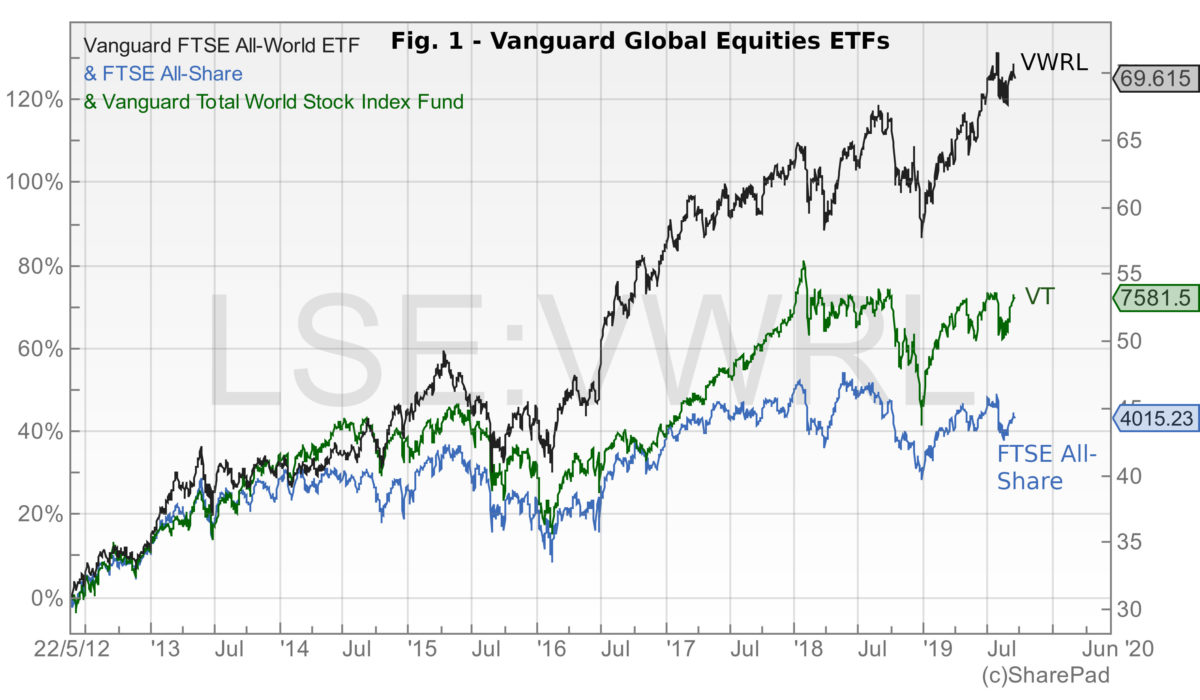

- Vanguard Total World Stock ETF (NYSEARCA:VT) – This ETF holds positions in more than 850 stocks from around the world. The largest complement is US stocks (58.7%), but it also holds stocks in Europe (18.3%), Asia (13%) and emerging markets (9.8%). Most holdings are large capitalisations. This is a broad equity fund, offering the widest international diversification possible. Vanguard also offers an option for those looking to separate US equities from foreign equities, in the form of the Vanguard Total Stock Market ETF (NYSEARCA:VTI)and the Vanguard Total International Stock ETF (NASDAQ:VXUS). VT has an expense ratio of 0.09% while VTI and VXUS have expense ratios of 0.03% and 0.09% respectively.

- Vanguard Total World Bond ETF (NASDAQ:BNDW) – This ETF offers broad, diversified exposure to the global investment-grade bond market. It provides income above what is attainable from a Treasury bond portfolio but still with relatively low risk, as the holdings are high credit-quality issues. Again, there is an alternative approach which is to buy two ETFs: the Vanguard Total Bond Market ETF (NASDAQ:BND)covering the US market and the Vanguard Total International Bond Market (NASDAQ:BNDX)covering the rest of the world. The expense ratios for BNDW, BND, and BNDX are 0.09%, 0.035% and 0.09% respectively.

UK investors without access to these ETFs may trade the Vanguard FTSE All-World ETF (LON:VWRL)and the Vanguard Global Aggregate Bond ETF (LON:VAGP). VWRL invests in more than 3,250 stocks around the world and comes with an expense ratio of 0.25%. VAGP invests in more than 1,700 different bond issues, including investment-grade and government bonds from around the world. Its expense ratio is 0.10%.

With just two assets, it’s relatively easy to add more shares to the portfolio and to rebalance it, from time to time.

All-in-one allocation

For the investor who wants a diversified allocation across asset classes, iShares offers a group of multi-asset ETFs that are even simpler to allocate funds to than the above two-asset portfolio. One asset is all that it takes.

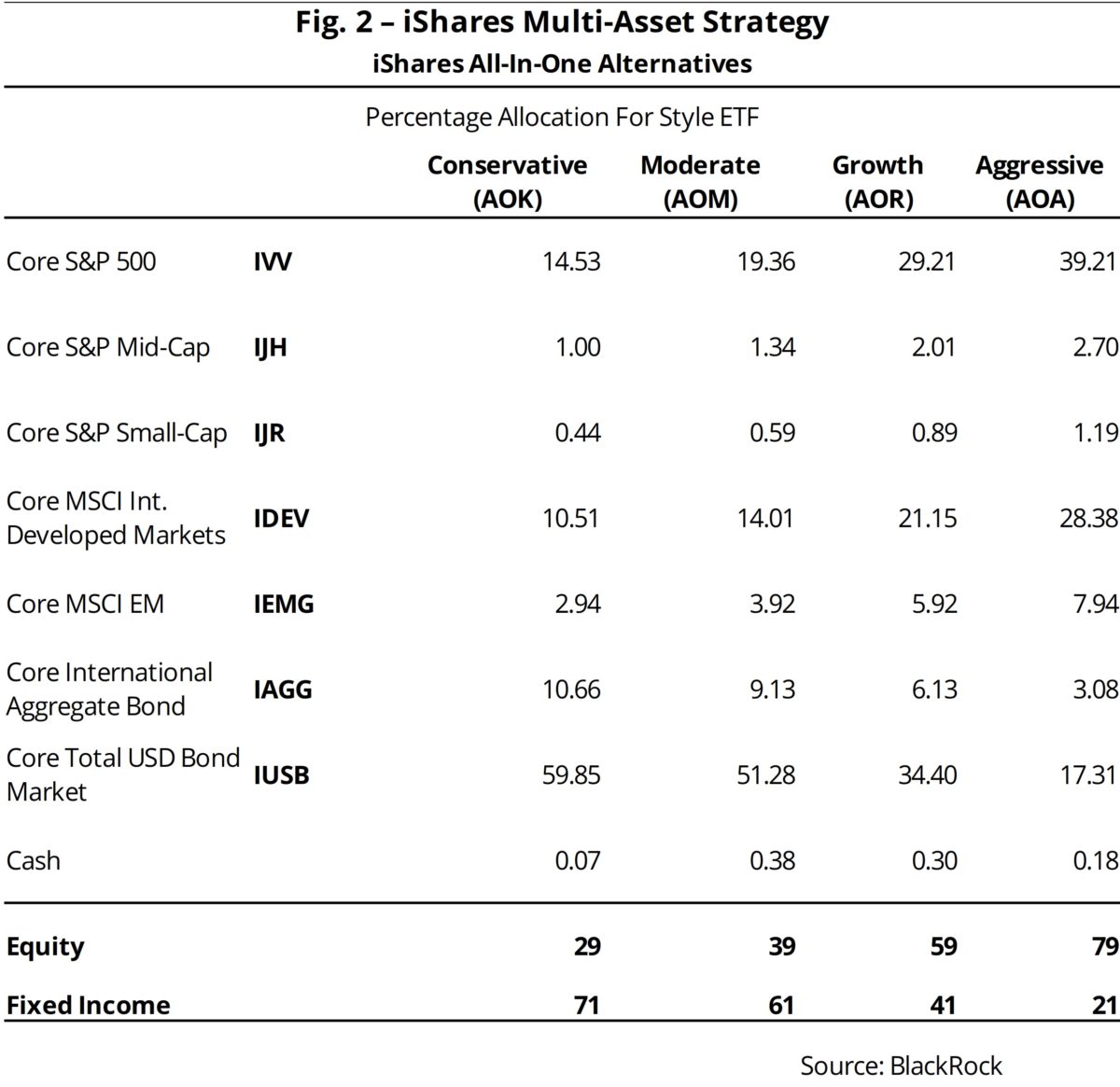

iShares offers four different ETFs: conservative, moderate, growth and aggressive versions, according to the exposure to equities and bonds. These ETFs are no more than funds of funds because they are composed of other iShares ETFs. Each ETF invests in seven other ETFs, but in varying proportions. They cover US equities, mid-and- small capitalisations, international developed-world equities, emerging markets, US bonds and international bonds.

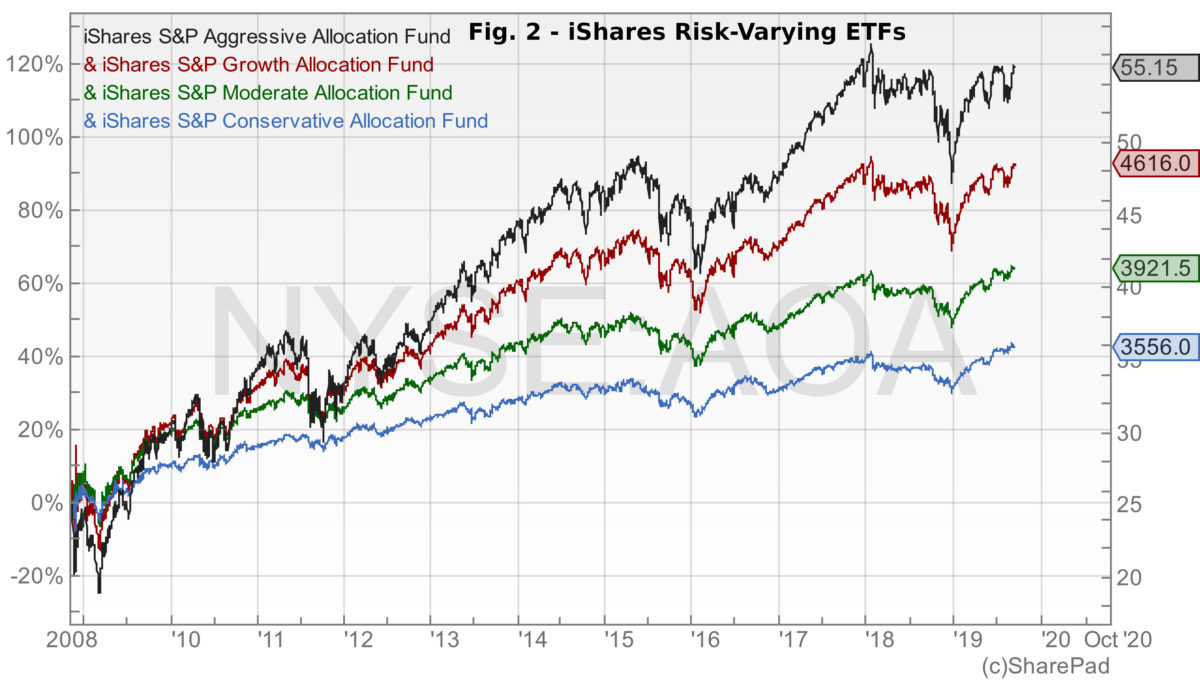

- iShares Core Conservative Allocation ETF (NYSEARCA:AOK) – Consisting of a diversified core portfolio based on conservative risk considerations, this ETF allocates a large share of bonds to the portfolio and a small portion to equities. Its equity beta is just 0.25, which means this portfolio is a lot less exposed to market risk than the broad market is. This ETF might be best suited for someone looking for an equity-bond exposure around 30/70.

- iShares Core Moderate Allocation ETF (NYSEARCA:AOM) – This ETF is a diversified portfolio composed of bonds and equities to target a moderate level of risk. Its equity beta is 0.35, higher than AOK, as this ETF has a larger proportion of equities. Still, risk is moderate, if not conservative. The equity-bond exposure of this ETF is around 40/60.

- iShares Core Growth Allocation ETF (NYSEARCA:AOR) – The iShares Core Growth Allocation ETF consists of a diversified portfolio of bonds and equities similar to AOK and AOM, but with a higher proportion of equities. The equity beta of this ETF is 0.53. Its equity-bond proportion is around 60/40.

- iShares Core Aggressive Allocation ETF (NYSEARCA:AOA) – This ETF is the one with the highest risk. Its equity beta is 0.71. The equity-bond proportion is around 80/20.

Figure 2 shows the exact allocations of the above four ETFs.

A factor portfolio

The latest financial crises have shown that equities, as a whole, do badly under stress. It doesn’t matter whether you’re exposed to the US market, other developed countries or emerging markets. The correlation between these asset classes is huge, such that the diversification achieved by a portfolio spreading its assets across these markets is limited.

Factor investing allows the investor to separate equities by core components that are uncorrelated with each other. This way, when a factor declines, others may still rise, which is often not the case with asset classes like US equities, developed countries and emerging markets. Just suppose that you go to your local supermarket and instead of buying meat, fish, rice, fruit and vegetables, you buy protein, carbohydrates, vitamin C and saturated fat. You’re still buying the same products but you’re looking at them from a different perspective.

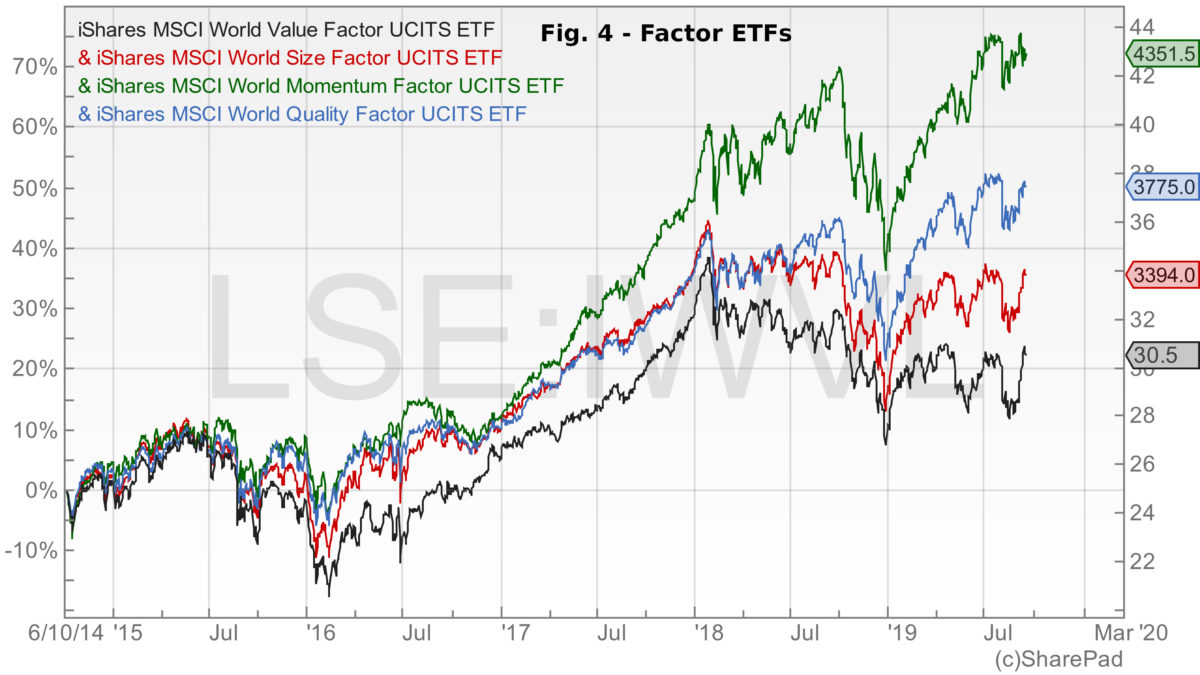

Past research identifies five equity factors that are key drivers of returns: market beta, size, value, momentum and quality. Building these factors isn’t an easy task for an individual investor but there are ETFs offering exposure to them. Investing in these ETFs is an alternative way of building the equity part of a retirement portfolio. An investor looking to build a 60/40 equity-bond portfolio, may split the 60% equity part across the five factors mentioned above. This portfolio may be built in the following way:

- iShares Edge MSCI World Value Factor ETF (LON:IWVL) – This ETF is for investors who want to focus on stocks that have relatively lower share prices relative to their fundamental values. It aims to track the value factor. An alternative is the Vanguard Global Value Factor (LON:VVAL).

- iShares Edge MSCI World Size Factor ETF (LON:IWSZ) – The iShares Edge MSCI World Size Factor ETF is for investors who want to focus on stocks with smaller market capitalisations.

- iShares Edge MSCI World Momentum Factor ETF (LON:IWMO) – This one is for investors who want to focus on stocks with strong recent performance. Another option is the Vanguard Global Momentum Factor ETF (LON:VMOM).

- iShares Edge MSCI World Quality Factor ETF (LON:IWQU) – This is an ETF for investors who want to focus on stocks with strong fundamentals, which may include higher operational earnings and balance-sheet quality.

All of the above ETFs are exposed to market beta, so you don’t need an ETF with a broad market exposure. The above four groups are just enough for the equity part of your portfolio. You may then add a bond ETF for the fixed income part. The BNDW ETF mentioned in the simple portfolio is an option. IAGG and IUSB mentioned in figure 2 are another alternative.

A few words on dividend income

There is a belief among investors that dividend-paying stocks, preferred shares, coupon-paying bonds and any other income-providing assets are better than non-income providing assets. In particular, for someone approaching retirement, there is a sense that keeping the principal untouched and living off the income is the best way to go. With this in mind, it’s easy to understand why someone approaching retirement would prefer assets offering periodic disbursements. If these disbursements are enough to live on, the portfolio may be left unchanged.

Still, stocks should see their price decline when they turn ex-dividend, as the dirty price of a bond also declines when it turns ex-coupon. A stock that doesn’t pay dividends should provide higher capital gains than a dividend-paying stock which splits total return between capital gains and income. The theory says that dividends and capital gains should be perfect substitutes. Thus, an investor can ‘create’ dividends by selling a few assets. The difference is merely psychological, as selling assets is sometimes seen as a kind of loss while taking dividends doesn’t hurt.

| First seen in Master Investor Magazine

|

In recent research about the factors that explain stock returns, dividends generally appear to be irrelevant. In other words, investors gain nothing by investing in dividend-paying stocks. The key reason why dividend-paying stocks usually provide good returns is not because they pay dividends but because most dividend-paying stocks are high-quality and profitable businesses.Quality and profitability explain higher returns. Those are the factors that really matter, not dividends.

Final remarks

Managing your own retirement funds is an easier task than many individuals think, mainly because of the rapid expansion of the ETF industry of late. Twenty years ago, it was difficult for an individual investor to build their own portfolio because it would mean hand-picking hundreds of assets. For a novice investor it was a near-impossible task. But, even if the investor in question possessed the necessary knowledge and expertise, it is unlikely they would have had the time and patience to manage such a long list of assets. Transaction costs were another obstacle.

Today, we can build a diversified equity portfolio with just £100 or £200. All we need is to purchase one share on the appropriate ETF. From this foundation, investors may build out more complex strategies while staying diversified. We can all manage our retirement funds, starting with a more aggressive strategy early in life and then switching to a more conservative allocation when the time for retirement nears.

Never miss an issue of Master Investor Magazine –

Never miss an issue of Master Investor Magazine –

Comments (0)