Choose your own level of risk and return with the new IF-ISA

While the Cash ISA has been a popular product for savers who want to shelter their money away from the taxman, it’s no secret that its returns over the past few years have been derisory.

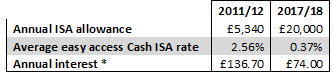

According to data from personal finance website Moneyfacts, the average easy access Cash ISA rate fell from 2.56% in January 2012 to just 0.37% in May this year. That means, despite the annual Cash ISA allowance having almost quadrupled from £5,340 to £20,000 over that time, savers are actually earning less tax free income than they were 5 years ago – see table.

Not only do savers have to contend with falling interest rates, they now have to face the challenge of rising inflation. Having been at or near 0% for all of 2015, and below 1% for much of 2016, it has just been announced that the UK CPI measure of inflation moved to 2.9% in April this year. This pushes the rate further above the Bank of England’s 2% target, to its highest level since June 2013 and even above the 0.48% inflation rate being seen in Zimbabwe!

That means Cash ISA savers are now receiving a substantial negative real return on their money – around minus 2.46% if they save at the average easy access rate. So as well as being tax free, the Cash ISA is well and truly a return free product. Ex-pensions minister Baroness Altmann recently echoed this view by commenting, “Cash Isas are now redundant for most people.”

But all is not lost for ISA investors who are willing to take on extra risk in order to boost their returns.

Launched by the government in April 2016 in reaction to the increasing popularity of alternative finance, such as peer-to-peer (P2P) lending and crowdfunding, the Innovative Finance ISA (or IF-ISA) is a new product to add to the ISA stable. It enables investors to earn a tax-free return on loans issued by P2P lenders and so called “crowd bonds” issued by crowdfunding companies, by putting them within the IF-ISA wrapper.

These financial assets typically take the form of business loans, whereby investors lend their money to companies looking for growth capital. Interest rates on these financial assets currently on the market begin at around the 7% level but can be as high as 12%. That’s an attractive rate of return in the context of the Cash ISA and is even within the range of historic expected returns on equities.

Of course, as with any investment, the increased returns are possible because investors are taking on additional risk.

Lending money to businesses in the form of loans or bonds puts investors at risk of the company not paying back the capital or interest which it owes. So in other words, some or all of investors’ capital is at risk by investing in IF-ISA eligible bonds. Tax law can also change and is dependent on individual circumstances. And unlike with the Cash ISA, there is no Financial Services Compensation Scheme to fall back on should the product provider (P2P/crowdfunding platform) go into default. However, some crowd bonds, such as those issued by Crowd for Angels, are secured against assets of the lending company, thus reducing the risk of lending.

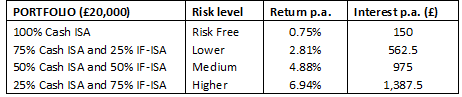

But crucially, the annual ISA allowance can be split between the Cash and IF-ISAs (and Stocks & Shares ISA if so desired) in any proportion – for the current tax year the allowance has risen to a generous £20,000. That means investors can effectively set their own level of risk and return with their total ISA allowance by allocating different amounts of money to different products. Here are a few examples.

Risk free – 100% Cash ISA

If an investor puts all of their annual ISA allowance in the 0.75%, no notice Cash ISA currently offered by National Savings & Investments (NSI), by the end of the year they will have earned interest of £150. This approach effectively has zero risk attached to it but the lowest rate of return and also a negative real rate of return.

Lower risk – 75% Cash ISA and 25% IF-ISA

Investors who are willing to take on a little more risk in order to boost their returns could invest just a quarter of their annual allowance into IF-ISA eligible crowd bonds. In this scenario 75% of the allowance is invested in the NSI Cash ISA with the other 25% put into a 9% IF-ISA eligible crowd bond. This boosts annual returns up to a more attractive 2.81%.

Medium risk – 50% Cash ISA and 50% IF-ISA

Increasing risk further we now put half of the annual allowance in the IF-ISA bond. This takes annual returns up to 4.88%. With this being ahead of inflation, investors who are taking on incremental risk are starting to earn a real return on their money.

Higher risk – 25% Cash ISA and 75% IF-ISA

Investors with a higher tolerance for risk could put three-quarters of their allowance in the IF-ISA eligible bond and the rest in the Cash ISA. The effective interest rate now rises to 6.94%, a level approaching that of expected returns from equities, with the 25% Cash ISA allocation providing a risk free buffer.

The table below shows a brief overview of each case and how, depending on risk tolerance, investors can get a higher return by investing in a portfolio of Cash ISAs and crowd bonds.

Andrew Adcock is Chief Marketing Officer at Crowd for Angels, an FCA regulated crowdfunding platform which is approved by HMRC to operate the Innovative Finance ISA and offers a range of crowd bonds to investors. For more information visit http://www.crowdforangels.com.

Comments (0)