The BoE get’s ready to crank up the printing presses in mirroring Japan’s policies

It’s fair to say that the UK economy remains sluggish, and the government’s austerity measures are unsurprisingly choking off a significant amount of GDP growth. Meanwhile, even balancing the budget in the UK seems an almost insurmountable task for this or any other government thanks to the mess the twin numpties of Balls & Brown left…

Mark Carney, our new incoming Governor, has now given his first indication of what is in store for the UK. In his final speech as governor of the Bank of Canada on the 21st of May, he said the following:

“Europe can draw lessons from Japan on the dangers of half measures. It is now more than two decades since the Japanese financial crisis erupted. To end its debilitating legacy, Japan has just embarked on a bold policy experiment. Its success or failure will have a major impact on the outlook over the coming years.”

It seems evident that Mr. Carney sees the Japanese Quantitative Easing (QE) experiment as a blueprint for central banks. The BoE may indeed already be dusting off the printing presses in anticipation of Mr. Carney’s arrival later this year.

What is interesting about this is that it very much appears that Mr. Carney thinks about the UK (and the rest of Europe) in the context of what has happened in Japan. It follows logically that he quite possibly considers the ‘remedy’ that is being administered in Japan as similarly appropriate for the UK and the rest of Europe.

This is of course a significant departure from the soon-to-be former BoE governor Mervyn King, who seemed to prefer a much more balanced approach and certainly a much less aggressive and less interventionist policy. The emphasis of King seemed very much to be on inflation targeting and not growth and public sector balance sheet management.

It is likely however that the UK will not react well to any further QE that might be instigated by the incoming Bank of England governor. There are a couple of reasons for this:

1. As is the case in the US, Europe and most likely in Japan (if the last decade and a bit is anything to go by), the monetary transmission mechanism is broken. QE has demonstrably falling marginal utility as the amount of liquidity is increased beyond a certain point. Add to that the misallocation of capital that it causes (also known as ‘Bubbles’), and the perceived solution of administering more QE becomes questionable.

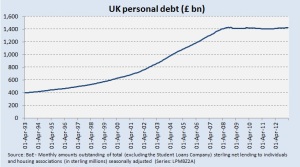

2. The persistently high levels of personal debt in the UK will likely prevent QE from having the desired consumption effect, simply because consumer balance sheets are already full of debt. Unlike in the US where consumers seem to have reduced their personal debt levels, they remain almost unchanged from 2008 in the UK. Trying to ‘stimulate’ the economy with more QE in a situation where consumer balance sheets are already stretched seems obviously futile if one is seeking a long term solution.

A new QE program in the UK will almost certainly have the singular goal of devaluing the GBP and creating high levels of inflation. This will theoretically increase UK competitiveness (unless of course other countries are doing the same – and they are), and also help the government inflate away its debt. This ‘debt reduction’ will indirectly be paid for by the saving classes of the country, just as will most likely be the case before too long in the US and in Japan. The Great Zero Sum Game continues.

If this is to be Carney’s policy, we should all be scared. Very scared.

Comments (0)