The One Asset Class That Looks Cheap Right Now

Global gyrations

During the last decade we have played witness to massive capital movements around the world. Money has flowed from developed countries towards emerging markets, just to flow back in the opposite direction at a later date. While lifting barriers to capital movement has helped intensify global trade and accelerate the development process of the emerging world, it has also helped to favour speculative money flows that today move from country to country in a permanent global gyration seeking out the best yields money can buy. The truth is that money flows help to boost growth, but the speculative money flows are short term by nature and can also help to destabilise these economies.

Nevertheless, it would be naïve to blame free capital movements for the final result, as global instability seems to have much more to do with the fierce competition among central banks rather than anything else.

The FED is the major player in this game. Looking at what the FED is doing is sometimes all an investor needs to do to determine where to put his money. Commodities and emerging markets are two asset classes that are heavily demanded as a function of the FED’s policy. At a point when the FED is delaying its tightening, these asset classes have become bullish again. With equities becoming overvalued in most of the developed world, the best opportunities now lie in the emerging world.

It’s all about monetary policy

While the gold standard lasted, there was relative stability in terms of capital movements because exchange rates between countries were stable. A participating country could not increase the money supply at its discretion, because people would start selling the home currency in exchange for foreign currency. In the end the central bank would be forced to buy back the currency. When that was the case, international capital movements were more related to fundamentals and international investments generally had a longer-term significance. But when Nixon announced the death of the gold standard in 1971, central banks got a licence to do whatever it takes to accomplish their goals – a licence to print money, in fact. The money supply regained life and was expanded at much faster rates than before, leading to volatile hot money flows around the world.

Forty-five years without the gold standard have shown us that the world is currently much more exposed to currency crisis than before, as a result of massive capital gyrations that are the main output of central bank action.

After the Lehman collapse, the FED engaged in a massive purchase of assets while it also cut interest rates to near zero. Such policies reduced the yields on lower risk assets. The main idea was to force money to flow from savings to consumption and investment, at a time when the economy was in a recession. The policy adopted by the FED was so bold that investors started looking elsewhere to get a yield on their money. Capital flowed out of the US in the direction of emerging markets, thus enabling these countries to secure cheap financing and to expand the production of commodities. But after igniting a recovery in the US, the FED started threatening an inversion in policy, which led to a sudden, massive outflow of money from emerging markets towards the developed world again. That moment became known as the “taper tantrum” in 2013. The effect was so nefarious to emerging markets and commodities that Bernanke was forced to retreat for a while. Later, in 2015, Janet Yellen prepared the world for an inversion in the FED’s interest rate policy. That moment became known as the “super taper tantrum”. Due to massive shifts in FED policy, emerging markets have been accumulating large losses for the last few years.

The year of 2015 was a tough one for emerging economies. The main reason for this was the expectation, created by the FED, that rate hikes would occur very soon. In fact, the first rate hike was done in December, when the FED decided to hike its target rate from 0-0.25% to 0.25-0.50%. While the increase in rates was small, investors felt the FED would hike them a few more – perhaps four more – times in 2016. As a result, equities reversed their bullish trend and the S&P 500 closed the year flat. Emerging markets (as measured by the MSCI EM index) lost 15%.

The expectation of increasing yields in the US accelerated emerging market outflows, boosting the value of the US dollar, depressing the value of emerging markets currencies and trashing commodities.

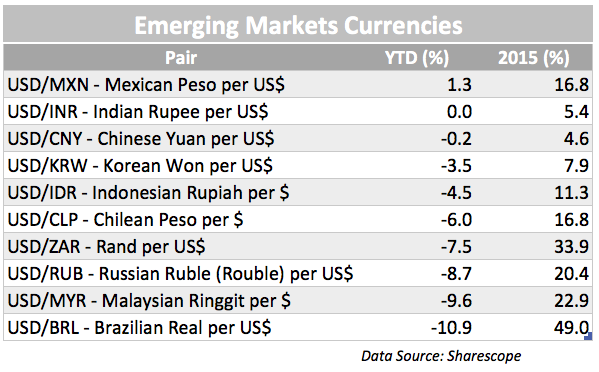

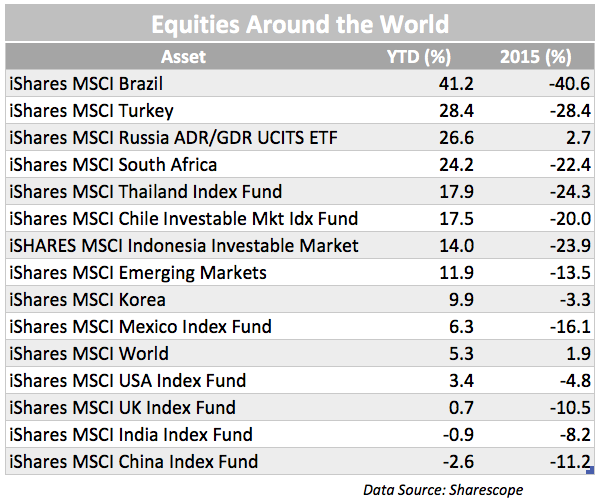

While there was no currency crisis, in some cases the losses experienced were extreme. Brazilian equities lost 40%, Turkish equities 28% and many others experienced double-digit losses. In terms of currencies, the US dollar gains were expressive: 49% against the Brazilian real, 34% against the South African rand, 20% against the Russian rouble, and 17% against the Mexican peso, just to name a few.

When the FED sneezes, the emerging world catches a cold. The influence the main central banks can have in emerging markets is so great that investors may be better off at looking at central bank policy than at the market fundamentals. At this point, it seems that central banks are retreating again and money is flowing in the direction of emerging markets once more. Commodities are recovering, and equities and emerging markets currencies are improving. While this flow may very well revert again when central banks re-focus on rate hikes, it may still be some time until that happens.

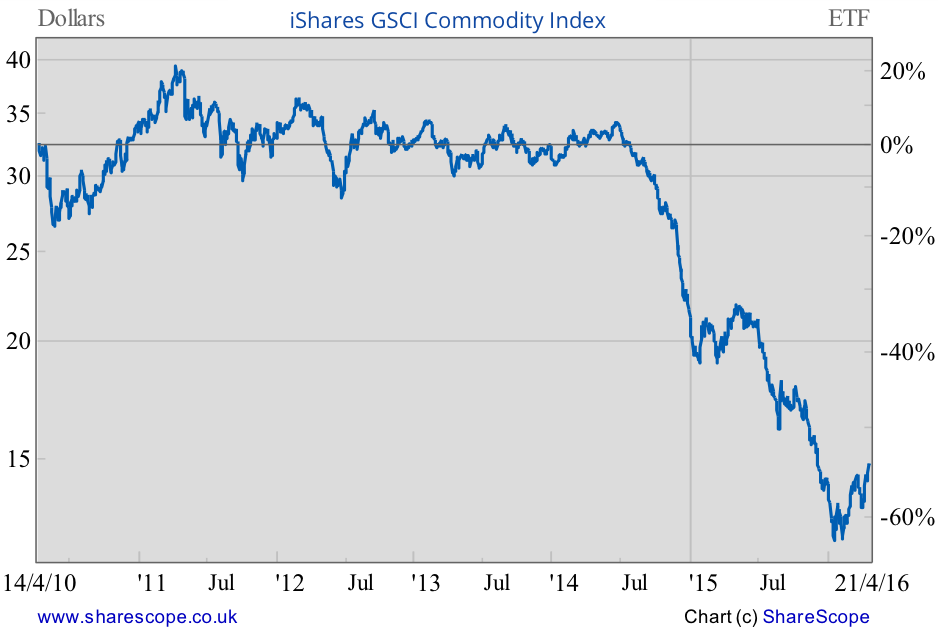

To hike or not to hike

In December the FED hiked its target rate to 0.25-0.50%, at a time when the ECB decided to do nothing. These hawkish decisions led to a bearish Christmas and a lousy New Year for investors. But since mid-January things have changed, as the FED has retreated from its initial hawkish tone and the ECB has been delivering negative rates packed with large asset purchases to keep the system oiled with lots of liquidity. With 10-year Swiss government bonds now negative and many of the shorter maturities inside the Eurozone also negative, the yields offered in Europe are no longer decent, which has been favouring emerging markets once again. The new inversion in money flows led by renovated central bank dovishness is depressing the dollar and helping commodities recover from record losses. The crude oil composite hit an intraday low at $7.11 on January 20, but since then has gained 65% to $44.77. Gold, which had been on a five-year-long bearish trend, has also recovered well, gaining 18% this year on expectations of further easing. Almost every commodity is now edging higher year-to-date.

All emerging markets have benefited from the dollar weakness, but the commodity producers were those that benefited the most. The Brazilian market is now up 41% year-to-date, followed by Turkey, Russia and South Africa, which have all recovered by more than 20%. These countries have seen their prospects impaired by a commodity slump and are now rallying on the price inversion.

Low rates for a long time

The near future for emerging markets will continue to depend heavily on the path followed by the FED and the ECB. Central banks have so far failed to invert their policy, as world GDP growth is still weak. From an expectation that the FED would hike its target rate four times in 2016, investors now believe it will hike rates just once. The US is growing faster than the rest of the developed world but not enough to be able to accommodate a significant tightening, as the argument goes. Europe is closer to a helicopter drop than to a rate hike, and looks set to remain that way for some time, unless consumer prices start showing signs of life, which seems unlikely for now. In the meantime, this will favour commodity prices and emerging markets. While the uptrend this year has been strong, many of these markets are still deep in the red for the last three years. Brazil is still down 43%, Indonesia is down 32%, Turkey is down 30%, Mexico 27% and Russia 21%. Taken as a whole, emerging markets are down 11% for the last three years, which still leaves room for recovery.

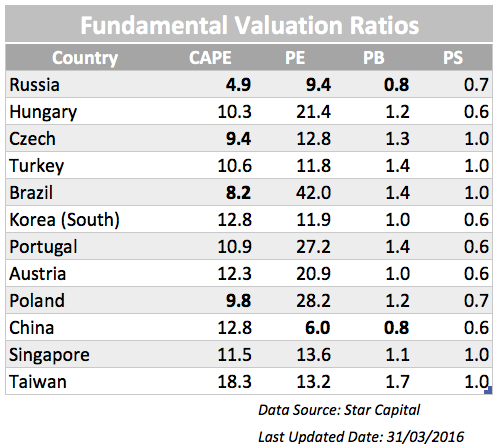

In terms of fundamental value, many of these economies present investors with low CAPE ratios, which provide an extra margin of safety in terms of valuation risk.

The Russian equity market trades on a CAPE of 4.9x and on a price-to-book of 0.8x. Even China trades on low valuations, despite revising GDP down. The best opportunities are in emerging economies and a few peripheral European economies. They have been battered in the past but are now recovering fast, as the financial system stabilises.

Comments (0)