Outperform the market with long/short strategies

If you believe current market prices are unsustainable and you fear the US Presidential election shenanigans may drag the market down, but still don’t want to convert your shareholdings into cash, then you may wish to consider building a long/short portfolio to hedge your bets.

If high valuations and the US election don’t scare you, then maybe the growth in coronavirus infections or the European lockdowns do. One way or the other we live in times of trouble and the stock market seems to completely disregard them. But it pays to be safe rather than sorry. The market may well continue to rally but there will be a time when prices will face reality and corrections will occur. Not even central banks with their massive liquidity injections and negative interest rates can keep the market afloat forever.

However, I understand there aren’t many options available for those seeking out safety in asset classes. The yield on a 10-year US Treasury is currently 0.87%, which hardly pays for inflation. Its German counterpart is even worse as it yields a minus 0.63%, which means you need to pay for the privilege of lending money. Increasing duration doesn’t solve this problem, as the negative yield plague even extends to 30-year bonds. These bonds are probably the worst investment ever. Is there any fool buying them? In fact there is. The one that thinks there is another fool that will later buy them from her at an even higher price (more-negative yield). But from the perspective of long-term investors, who depend on income to survive, this is a problem that can lead them in the direction of higher yielding bonds and stocks, which by nature carry a lot more risk.

Looking for alternatives

From the perspective of an individual investor, it is difficult to build a long/short portfolio. There are many restrictions on short selling and the proceeds from selling short are not always deposited in the client’s account as cash to purchase other stocks. For such a purpose, ETFs are a much better option than any individual attempt at building a portfolio stock by stock.

There are many ETFs with the purpose of creating long/short portfolios. I believe that Direxion offers some good ones to investors. The company has a family of long/short ETFs that capture 150% (long) / 50% (short) exposures of entire sectors, factors or regions. These ETFs are offered in pairs, which typically oppose related themes like Value over Growth, Cyclicals over Defensives, Large over Small Caps, and so on. Direxion offers these long/short funds in both directions, such that an investor may take a long position in either Value over Growth or Growth over Value. The same is valid to all other themes in the family.

These long/short funds are offered with a leveraged (1.5x) exposure to one side of the trade and a short (-0.5x) exposure to the other side. This mix creates a hedge. We cannot say they are market neutral, as they net a 100% long position after subtracting the short side. But, if an investor chooses the right side, he will outperform the market.

Let me explain this in a little more detail with an example. Suppose that half of the market is composed with value stocks and the other half with growth stocks. You purchase an ETF featuring Value over Growth. If value stocks rise 20% and growth stocks just 10%, the market then rises 15%, which corresponds to the average between the two. Your Value over Growth ETF would show a performance of 25% (1.5 x 0.2 – 0.5 x 0.1). If the market declines and value stocks decline 10% while growth stocks decline 20%, the market would then decline 15% and your ETF would drop by just 5% (1.5 x (-0.1) – 0.5 x (-0.2). Thus, you would outperform the market in either case, even though you would not able to avoid a negative return in the second case.

Like I said, the above portfolio isn’t market neutral. But let’s say you build a true market neutral portfolio. If that’s the case, you can avoid negative returns but not underperformance. Let’s see why by rebuilding the above example but now with an ETF that is 1x long and 1x short. In the upside situation, your return would be 10% (1 x 0.2 – 1 x 0.1) and in the second situation it would also be 10%. You would be able to keep a positive return in both scenarios, but you would underperform the market in the first case. Provided that there is a long-term positive bias for stocks, I would prefer to outperform rather than striving for positive returns at all times.

Long/Short ETF Choice

From a large selection of ETFs, I’m looking into five that I think are worthy of consideration.

Direxion Russell 1000 Value Over Growth (NYSEARCA:RWVG)

The Russell 1000 Value Over Growth ETF is a portfolio that has 150% long exposure to the Russell 1000 Value Index and 50% short exposure to the Russell 1000 Growth Index. In fact, you can reproduce this ETF by yourself. All you need to do is to purchase the iShares Russell 1000 Value ETF (NYSEARCA:IWD) and short sell the iShares Russell 1000 Growth ETF (NYSEARCA:IWF). But then you would have to rebalance it from time to time. Direxion does this for you on a monthly basis, to assure the proportion between the long and short positions are always near 150/-50. This peace of mind comes at a price though. The expense ratio is 0.46%.

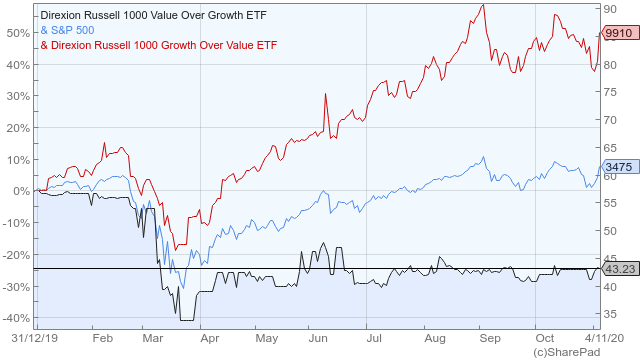

Please note that growth has been the only game in town so far this year and value has been underperforming. I believe that after the dust settles on the US election, value will prevail. However, if you believe that growth will continue to dominate, you don’t need to short sell RWVG. Direxion offers the opposite to this ETF – the Direxion Russell 1000 Growth Over Value (NYSEARCA:RWGV). Growth has been performing very well this year, which is reflected in the 49.2% return experienced by this fund year-to-date, clearly outpacing the 4.3% achieved by the broad S&P 500 index. In particular since the market bottomed on 23 March, this fund has performed stunningly, rising 79.6%. The Value over Growth fund is down 24.4%. But with valuations currently stretched, the trend may well revert in favour of value next year.

Direxion MSCI USA ESG – Leaders Vs. Laggards ETF (NYSEARCA:ESNG)

The Direxion MSCI USA ESG ETF seeks to provide a long exposure to companies with high environmental, social and governance (ESG) ratings and short exposure to companies with a low ESG ratings. This is a unique approach, which allows investors to benefit from a new trend in the market which has been benefiting the leaders in ESG values. The structure of this ETF is similar to that of RWVG. It takes a long position (1.5x) on the ESG leaders and a short position (-0.5x) on the ESG laggards. The fund is structured to offer a similar beta to the US equity market, to keep a similar risk level. Thus, this fund is a real alternative to the broad market. The expense ratio is 0.42%.

Direxion S&P 500 High Minus Low Quality (NYSEARCA:QMJ)

The Direxion S&P 500 High minus Low Quality ETF aims to deliver an exposure to the quality factor. As valuations become stretched and a bullish run approaches an end, investors tend to turn to quality businesses, which usually offer more stable earnings and are better positioned to weather troubled times. QMJ builds a quality rating based on three core metrics: return on equity, accruals, and financial leverage. Again, this fund is long (1.5x) the highest rated companies and short (-0.5x) the lowest rated. In my opinion, quality is a factor likely to prevail in the near term.

Proshares Long Online/Short Stores ETF (NYSEARCA:CLIX)

E-commerce sales have grown at a much faster pace than in-store retail sales for the last few years. Companies like Amazon and Alibaba have been able to retain higher margins than bricks-and-mortar retailers, while enjoying a global presence without the need to invest in physical stores. High street stores are having trouble competing with online stores. The coronavirus lockdowns are helping to sink high street stores even faster. CLIX employs the same methodology employed for the above ETFs. The fund is up 79.2% year-to-date and I expect the trend to continue next year, as it will take time for the pandemic to alleviate. But even if that happens faster than anticipated, I’m not convinced that high street retailers can recover the ground lost to online stores. The expense ratio is 0.65%.

First Trust Long/Short Equity ETF (NYSEARCA:FTLS)

Finally, my last words are dedicated to FTLS. This fund is a little expensive as its expense ratio comes in at 1.59%. It is also a little different from the others as it has a net exposure to the broad market that is less than 100%.

FTLS uses a variety of quantitative tools to select securities. The fund manager builds rankings of stocks based on the Sabrient Systems Earnings Quality Rank (EQR) model and also on proprietary research. Long and short positions are then established based on those rankings. In normal conditions the fund will be 80% to 100% invested in long positions and 0% to 50% invested in short positions. But unlike the four ETFs reviewed above, FTLS never use the proceeds of short sales to leverage its long part. The final result is a fund with less systematic risk than the market, as its beta is usually less than one. This way, the resulting volatility is usually inferior to market volatility.

Final comments

During times of expensive asset prices, it’s difficult to find long-term investment opportunities, in particular from the perspective of a small retail investor without time and resources to read over thousands of financial documents. However, if we accept the fact that investing isn’t about positive returns but much more about outperforming the broad market, then we can find value in opposing factors, stocks, industries, or themes. That’s the case of Value against Growth, GM against Tesla and good ESG companies against bad ESG companies. This way, if we’re able to identify the prevailing trends for the broad market, we can choose the right side of a trade and outperform the market, even if that sometimes doesn’t mean achieving a positive return in absolute terms.

Comments (0)