Wressle-1 update: testing of Penistone Flags yields strong gas flow as Egdon Resources prepares second test to identify oil leg

By Amy McLellan

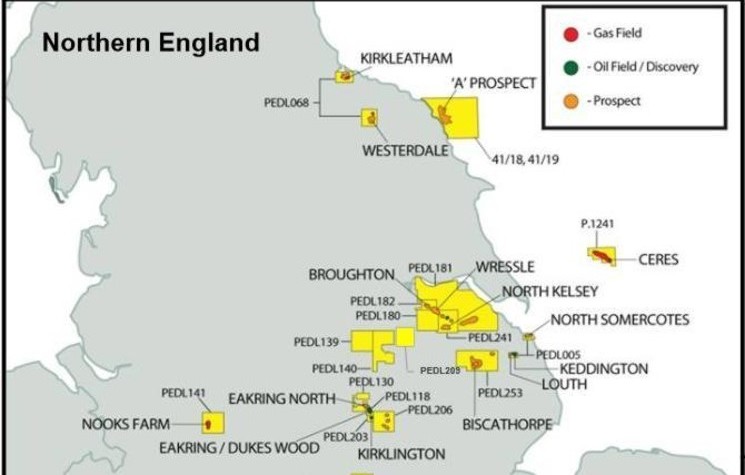

It’s three out of three for the trio of AIM companies behind the Wressle-1 discovery in the East Midlands in the UK, with the third of the three intervals tested free-flowing up to 1.7 million cubic feet per day of gas and up to 12 barrels per day of 35-degree API oil. This was further good news for the co-venturers in PEDL180: AIM-quoted Egdon Resources operates with a 25 per cent interest alongside fellow AIM company Europa Oil & Gas with 33.3 per cent, privately-owned Celtique Energie Petroleum with 33.3 per cent and AIM start-up Union Jack Oil with 8.33 per cent.

This was the output from the first test on a nine-metre perforated interval at the upper part of the Penistone Flags reservoir and a second test will now be conducted to evaluate the gas-oil and oil-water contacts in the lower part of the reservoir to identify the expected oil leg. Gas flow rates were constrained by the equipment and flaring limits imposed by the environmental permit and the company is now analysing the data to estimate what flow rates could be achieved without those limitations.

This latest test builds on the results from the previous two intervals: the Ashover Grit, which tested 80 bpd and 47,000 cf/d of gas, and the Wingfield Flags, which tested up to 182 bpd. Following the second test of the Penistone Flags, the idea is to isolate the Penistone and Wingfield flags to allow a pumped production test from the Ashover Grit and to further `clean-up’ the formation. The partners will then analyse the extent of the discovery, come up with an updated resource estimate – the well carried a pre-drill estimate of 2.1 million boe – and consider development options.

Egdon managing director Mark Abbott said the company was “very encouraged by the early test results”. “We will now be working hard to integrate these test results into our models of the Wressle discovery to enable us to update our resource assessment and to plan for the development of the field where we will look to maximise value from both the oil and gas,” he said.

Indeed, despite the low oil price, the companies are keen to move quickly to monetise this drillbit success, with plans for an extended well test – which requires approval from the Department of Energy & Climate Change – compilation of a field development plan and receipt of all relevant permissions and permits for development before year-end.

Exact timing of the EWT will depend on the outcome of a reservoir engineering review which will define the completion strategy and the surface package of equipment required. And it may not be the only EWT underway in the area, with Europa’s nearby Kiln Lane exploration well currently drilling ahead in adjacent PEDL181.

This is another conventional oil prospect with gross mean un-risked prospective resources of 2.9 million barrels: it spudded last month and success would lead to a similar schedule as at Wressle, with a dedicated test rig brought in for testing operations. What’s more success at Kiln Lane would de-risk other targets on the block.

An exciting start to the year for these onshore drillers.

Comments (0)