Why Bitcoin is Important

With cryptocurrencies experiencing turbulent times of late, it is worth understanding what drives the growth or otherwise of crypto currencies. In the first part of a new series of crypto currency blogs, Rufus Round, CEO of digital asset trading company Globalblock, explains why Bitcoin shouldn’t be written off.

Why Bitcoin is Important

Accountability

No one can ‘print’ more Bitcoin, but the state can print more dollars (known as fiat currency).

The fact that central banks can print money repeatedly hurts savings by various mechanisms, most simply explained: The greater the supply of a thing, the lower its price. When the dollar supply is increased its’ value decreases, it has less purchasing power. This becomes especially problematic when the prices of goods increases– It is inflation.

The fiat system holds inflation to account for these problems, as if it were an unaccountable force that is beyond control. Being able to account for one side of this equation increases visibility, makes for openness, and enables transparency. For example, if you are an exporter, you will know if your product is increasing in demand because of its quality or need – not because it has become cheaper for foreign buyers to amass.

The Value of Trust

The 2008 financial crisis spawned bitcoin for good reason. The financial system as it currently stands is entrusted with your money and related assets. Blockchains remove the need for a huge part of this system. If you can define a value for the worth of the financial system, you have a base-case of value for the winning blockchain networks.

Bitcoin is the original token that runs on the largest, most widely adopted and most decentralised network. It has huge first mover advantage, and every day it remains un-hacked and secure is another day of added trust.

The Value of Your Work

Everything a human does is a result of effort. Effort, be it mental or physical is powered by energy. As your energy is priced in fiat and paid to you in wages or salary, it is constantly being devalued by the mechanism described above. Your effort is priced by a mechanism that is nearly completely removed from anything to do with energy. Bitcoin is powered by networks that require energy. This amount of energy is a fraction of what traditional finance requires, but it also has the ability to promote an environmentally friendly future.

Bitcoin enables renewable energy projects by capturing the value of the power generated by, for example, a wind farm that uses its excess energy to participate (mine) in the Bitcoin network, enabling it to ‘buy’ energy at times when there is no wind. Bitcoin is energy. You are energy. This is the future.

Exponential Value of Networks

A step into an imminently possible horizon for crypto (not just Bitcoin) blockchains can efficiently bank the unbanked at a global scale with decentralised, digital money held and spent electronically around the world.

Blockchain can also incorporate legal contracts, interact with various participants, and compete with each other. Additionally, the beauty of blockchain allows you to verify provenance, authenticity, ownership, royalty payments, insurance pay-outs, gaming networks, financial models, borrowing/lending/interest rates…

You have the opportunity to use the blockchains with the protocols you agree with – not because they are forced upon you by democratic fiat. This is how the future can look.

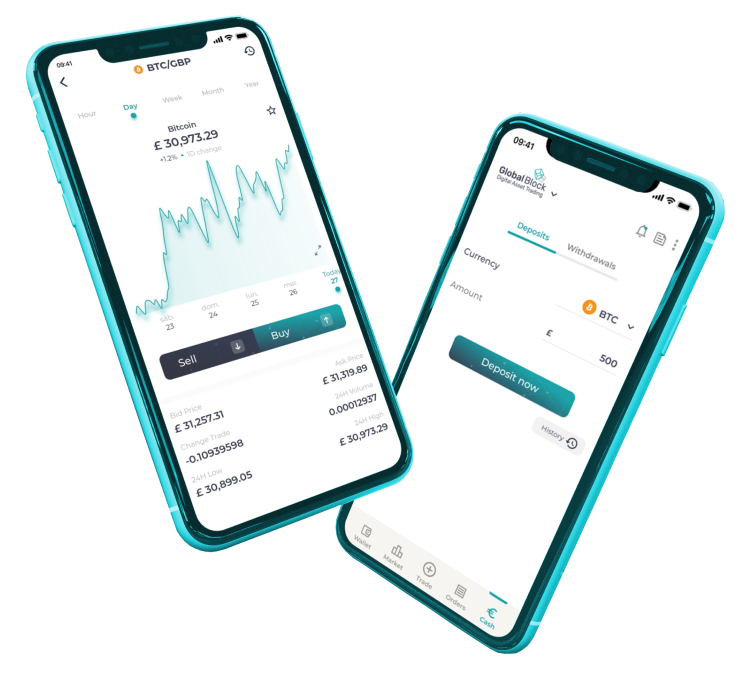

For investors who are new to the crypto space, Globalblock has experts available to speak to them on the phone and provide the support they need. To find out more about Globalblock and for ways to get in touch, click here.

Several good reasons here to be wary.