The funds that won’t diworsify your investment

Many of the top performing funds including Woodford Equity Income and Terry Smith’s Fundsmith Equity hold extremely concentrated portfolios. These highly regarded managers have taken on board the point made by Warren Buffett that wide diversification is only required when investors do not understand what they are doing.

Empirical studies suggest that once you get beyond 20 to 30 stocks the additional diversification fails to achieve any further significant reduction in risk. Fund managers that hold a lot more than this are likely to know less about each of the companies, which is unlikely to lead to better performance.

There is some interesting research in this area including a paper published by Yeung et al in 2012 called Diversification versus Concentration…and the Winner is? The study analysed 4,700 different US equity funds using quarterly data over the period from 1999 to 2009.

Yeung and his colleagues looked at the active weights of each of the holdings and ranked them from largest to smallest. They then used this to divide the funds into concentrated portfolios ranging from the top 5 conviction stocks (5 most overweight positions) to the top 30 before studying the performance.

Their results show that the concentrated portfolios generated higher returns than the diversified funds from which they were taken and that the performance improved as the level of concentration increased. It was the same pattern with the risk-adjusted returns as measured by the Sharpe ratio, which suggests that investors were well rewarded for the additional risk.

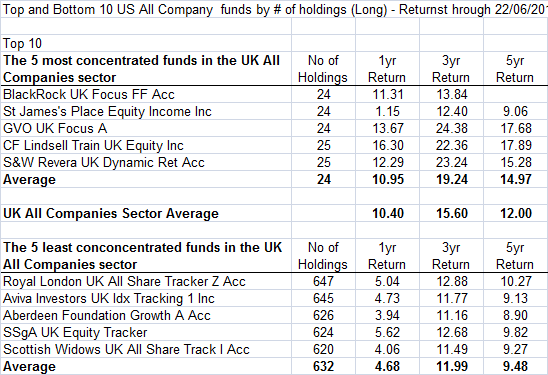

Concentrated portfolios also seem to perform better over here. The five most concentrated funds operating in the UK All Companies sector are listed in the table. These have either 24 or 25 holdings each, which is consistent with the view that you don’t need more than 20 or 30 shares to diversify the majority of the risk.

It is clear from the data that the most concentrated portfolios have typically delivered better annualised returns than the sector average, which has been calculated using all 262 funds. The outperformance is even greater when compared to the five least concentrated funds, which are mostly FTSE All-Share trackers.

If you are looking for an actively managed fund it would appear advisable to focus on those with the most concentrated portfolios where the managers have demonstrated their ability to add value. This will help to avoid the closet trackers and reduce the likelihood that they will diworsify your exposure to the markets.

Source: Morningstar, annualised returns to 22/6/15

Comments (0)