Taipan Resources seeks US$10 million in damages from Afren

By Amy McLellan

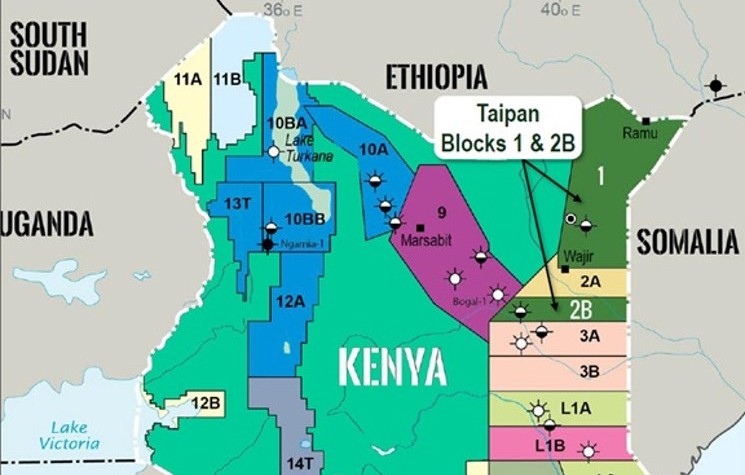

Shareholders in Taipan Resources may be keeping a close eye on Block 2B in Kenya, where the TSX Venture-quoted company has a material 30 per cent stake in a potential basin-opening wildcat, but this week also brought news of its Block 1 project.

Unfortunately, this news was not so encouraging, with the small cap announcing it has started arbitration proceedings against its partner, East African Exploration (EAX), a wholly-owned subsidiary of troubled Afren plc.

London-listed Afren, which has been on the ropes since last summer after its CEO and COO were sacked for “unauthorised payments”, first farmed into the project in 2009 as it rolled out its strategy to build a pan-Africa E&P business.

Afren has an 80 per cent stake in the Anza Basin block with Taipan holding 20 per cent. Yet, unlike in Block 2B, where the high impact Badada-1 is now mid-drill, progress has been slow on Block 1 and Taipan is now claiming damages from its partner to cover costs incurred because of Afren’s alleged mismanagement of the project.

As yet, with the matter in the hands of lawyers, there is little that can be disclosed about the nature of the alleged breaches to the Joint Operating Agreement. Taipan claims Afren failed to meet minimum work obligations and failed to follow good industry practices and agreed contract award and accounting procedures.

Given the tidal wave of unsound practices unearthed by last year’s independent review of Afren, which lead to the dismissal of CEO Osman Shahenshah and COO Shahid Ullah, Taipan’s claims will perhaps not surprise too many in the City.

It is unclear how the failures under the JOA have impacted on Taipan but it has identified a sum of “not less than US$10 million as restitution for the damages it has suffered as a result of EAX’s breaches of contract”: that’s a significant sum for a small cap like Taipan.

Last year the Canadian company, having raised C$6 million in a private placement financing, paid Afren more than US$3.5 million to restore a default under the JOA, thereby restoring its rights and entitlements. This fundraise also meant Taipan was fully funded for a first well that was due to drill on the Block before the end of 2014: this much anticipated spud did not materialise and there remains a two well commitment in the current exploration period, which expires in October 2016.

The lack of progress on Block 1 is frustrating for Taipan: small cap frontier explorers live or die by success with the drillbit and it means that rather than exposing investors to two high impact wells in 2014-2015, there is currently only one underway.

That well, Badada-1 in Block 2B, is making good progress according to the most recent update issued earlier this month. The well is drilling to a total depth of between 3,000 and 4,000 metres to test primary targets in Tertiary age reservoirs with gross unrisked recoverable resources of 251 million barrels of oil equivalent and possibly also a secondary objective in upper Cretaceous age reservoirs.

Success here would derisk other prospects on the block for follow-up in 2016/17, opening up the little known Anza Basin. These Tertiary reservoirs are believed to be analogous to those in the Lokichar Basin where in recent years Tullow Oil and Africa Oil have made a run of breakthrough discoveries, putting Kenya on track to join Africa’s club of oil producers in the not too distant future.

Taipan operates Badada-1 with a 30 per cent stake, having reduced its exposure through two farm-outs that have helped fund this frontier drill: 55 per cent was farmed-out to London-listed Premier Oil in in 2013 and 15 per cent to AIM’s Tower Resources in April 2014. Given the deepening troubles at debt-laden Afren, however, it looks like it will be some time

Comments (0)