Small Cap catch-up – Iodine, Pizzas, Groceries, Parcels, Sites and Kitchenware

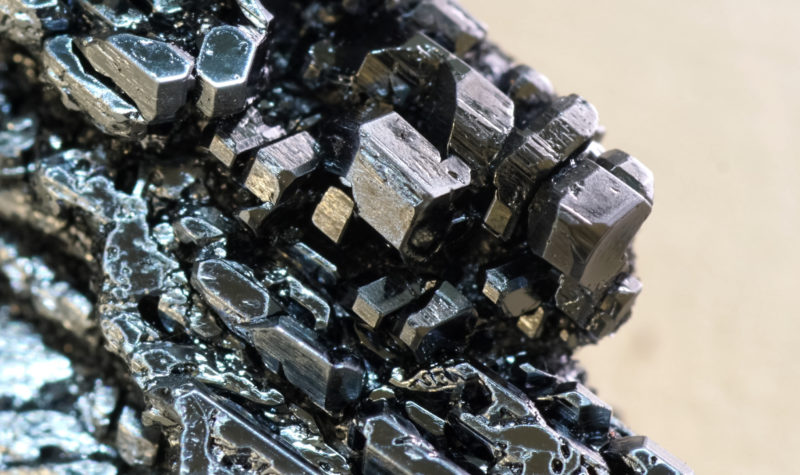

Iofina (LON:IOF) – expanding at a growing pace

The Management at this iodine speciality chemicals group are getting excited by the potential of its IO#9 plant in Western Oklahoma.

The new facility is some six months away from completion.

The £41m group has not only tied up the necessary funding lines, but also contracted with a new brine supply partner.

It has also looked to minimise any supply chain impacts and wishing to expedite the plant’s construction, it has pre-ordered major items and secured contractors in advance.

That new plant, possibly the first of two in the area, will be the sixth such operation within the group.

It expects payback within two years.

So, the group is moving impressively into 2023.

Analyst Jonathan Wright at brokers finnCap sees this move as firing the starting gun on the group’s next growth phase.

His estimates for the current year to end December are for a revenue uplift to $41.9m ($39.0m), with adjusted pre-tax profits rising to $6.5m ($4.9m).

For the coming year he goes for $48.1m sales, $8.0m profits and 3.1c (est 2.6c) earnings per share.

Wright has a price objective of 33p on the shares, which are currently 21.25p and offering some very good upside.

(Profile 29.07.20 @ 13.5p set a Target Price of 18p*)

The Fulham Shore (LON:FUL) – kneading more dough

Despite what is going on out there in the macroeconomy this Franco Manca and The Real Greek restaurant chain, now up to 95 units, did quite well in the first six months to 25 September.

It is performing much to management expectations and represents revenue growth of over 35% compared with the same period in 2019 and some 25% ahead when compared with the same period to September 2021.

It is also still progressing with its new openings programme and has now launched its debut range of Franco Manca cook-at-home sourdough pizzas which are now available in over 500 supermarkets.

Analyst Sahill Shan at Singer Capital Markets rates the group’s shares as a Buy, looking for 24p as his aim.

His current estimates are for the end March 2023 year to show £105.3m (£82.6m) takings, while adjusted pre-tax profits will be standing fairly steady at £3.6m (£3.7m), leaving earnings unchanged at 0.4p per share.

However, for the coming year he sees £120.9m sales, £6.4m profits, and 0.7p in earnings.

Getting its products out into supermarkets is quite a clever move, after all Pizza Express has done unbelievably well with having done similar years ago, and still prospers.

The £70m group’s shares may feel as though they are on their backside, but my view is that holders should not worry.

At just 10.75p they actually look quite buyable.

(Profile 15.12.21 @ 16p set a Target Price of 21p)

Kitwave Group (LON:KITW) – a break above 200p soon

Yesterday’s Pre-Close Trading Update for the year to end October for this delivered wholesale business was very positive.

It reflected both organic and acquired growth, despite exterior hassles.

CEO Paul Young stated that:

“I am pleased to report another strong financial and operational year for the Group. In a challenging environment, Kitwave’s strong market performance is a testament to our proven strategy and our resilience to external market pressures.

As we enter the new financial year, this momentum continues and the outlook for the Group remains positive.

With considerable growth opportunities still available, both in the form of organic developments and through strategic, complementary acquisitions, we look forward to updating the market further on our continued progress.”

Analyst Mark Photiades at Canaccord Genuity Capital Markets rates the group’s shares as a Buy, with a price objective of 345p compared to the 171.25p market price.

He is looking for the last year to have seen sales lift to £489.8m (£380.7m), while adjusted pre-tax profits almost quadrupled to £18.7m (£4.5m), lifting earnings up to 21.6p (8.2p) and covering a 9.2p (6.8p) dividend per share.

Photiades has pencilled in £515.8m sales this year, £20.6m profits, 22.9p earnings and a 9.8p dividend per share.

The £121m capitalised group, with 27 depots across the UK, specialises in selling and delivering impulse products, frozen and chilled foods, alcohol, groceries and tobacco to approximately 39,000, mainly independent, customers.

I see these shares, which hit 194p in mid-August, and are now 172.25p, easily breaking through the 200p level soon.

(Profile 14.02.22 @ 145.5p set a Target Price of 180p*)

DX (Group) (LON:DX.) – a different delivery

Since coming back from Suspension, the shares of this delivery services group have been down to a low of 19.70p from the 30p level of ten months prior.

There was a very significant trading volume in the shares upon the re-quote, with 16.8m dealt on the 19 October. That eased down considerably to around 750,000 a day within a week.

But then Gatemore Capital, owner of some 20% of the DX equity, began moves to kick out the group’s executive chairman Ron Series, over a matter of corporate governance.

Dealings were frenetic again by the 26 October with over 9.4m traded.

Now back to around 400,000 a day dealing action has reduced.

The Requisition is currently under consideration and an announcement is due shortly.

In the meantime, the group’s shares have been up to 25p and are now resting at around 23.75p, at which level they represent an interesting purchase.

(Profile 20.02.20 @ 12.5p set a Target Price of 15p*)

Hercules Site Services (LON:HERC) – growing recognition

It took an article in the last Mail on Sunday, by Joanne Hart, to tickle investor interest in the shares of this infrastructure labour supply group.

She described the company as being “a fast-growing UK business with robust long-term prospects.

Britain’s infrastructure is creaking at the seams, several projects are already underway and more should follow.

Hercules can supply these schemes with trained, local labourers and specialised safety kit.

At 42.5p, the shares are a buy.”

Well Joanne is certainly not wrong.

With her help to engender investor interest, the shares which peaked on Monday morning at 56.80p, have since fallen back to the current 51p.

It is worth noting that Tania Maciver, analyst at the group’s brokers SP Angel, rates the shares as a Buy. She has a discounted cash flow valuation on the shares at 74p.

The group’s shares look cheap to me.

(Profile 04.05.22 @ 52p set a Target Price of 64p)

UP Global Sourcing Holdings (LON:UPGS) – almost 150p but not

Since 2 September this marketing group’s shares have been down from 119.5p to as low as 90p early last month.

My conclusion after the group’s Pre-Close Trading Update on that day was that a move back up to 150p could be an easy stride.

Yesterday’s final results for the year to the end of July were just what the doctor ordered.

They showed a 13% advance in sales to a record £154.2m, a 42% increase in adjusted pre-tax profits to £15.8m, with earnings 32% better at 14.7p and a 42% improvement in its dividend at 7.12p per share.

Simon Showman, the group’s CEO, stated that:

“In FY22 Ultimate Products has delivered record financial results, seamlessly integrated the Salter brand, and maintained the incredibly high levels of service that our customers have come to expect from us. It has been a year of exceptional financial and operational progress, all of which was achieved against the backdrop of global supply chain disruption and a deteriorating macroeconomic environment.

It is pleasing to see that our energy efficient products, such as air fryers, are performing well and helping consumers save on energy costs. This aligns with our wider purpose of providing beautiful and more sustainable products for every home.

Whilst the current cost of living crisis represents a substantial challenge to all consumer- facing businesses our proven resilience and adaptability, as well as the quality and value of our products, mean that we are well placed to continue delivering future growth.”

Analysts Chris Wickham and Hannah Crowe at Equity Development have a ‘fair value’ of 250p on the group’s shares.

This year to end July 2023 they estimate £163.4m sales, £16.9m adjusted pre-tax profits, earnings of 15.1p and a dividend of 7.5p per share.

In reaction to the group’s results the shares hit 147p yesterday morning before easing back to close at around the 136p level, up 6p on the day.

So not quite the 150p market yet, but getting very, very close.

Hold tight.

(Profile 13.07.20 @ 74.8p set a Target Price of 100p*)

(Asterisks * denote that Target Prices have been achieved since Profile publication)

Comments (0)