Pressure Technologies looks set to take off after recent disposal of loss-making operations

I took notice of a company statement from Pressure Technologies (LON:PRES), on the 7th June, that it had appointed a new nomad, a new broker and a new financial public relations company.

Furthermore, that its interim results will be announced on Tuesday 25th June. Looking at other recent news from the company shows it reported that it had sold off one of its main operations in a £10.1m deal, leaving it able to concentrate upon the development of its other interests.

I have to admit that I did not know about this company beforehand, but now I am glad that I have been able to suss it out before those results.

The disposal of Greenlane Biogas, its alternative energy division, helps to reduce company debt and will now focus group management time upon the development of its specialised precision engineering businesses.

Leader in high-pressure systems

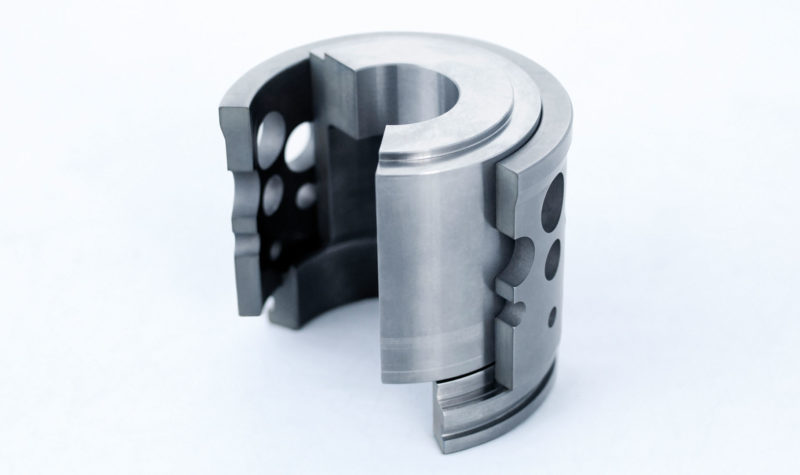

Floated on AIM in 2007, the company was founded upon its leading position as a designer and manufacturer of high-pressure systems serving the global energy, defence and industrial gases market.

Today, it has two main divisions: precision machined components and cylinders.

A main subsidiary is the Sheffield-located Chesterfield Special Cylinders (CSS) company. It has been a leader in the design, development and manufacture of high-pressure seamless steel gas cylinders for over 100 years.

Never miss an issue of Master Investor Magazine – sign-up now for free! |

It is one of only five companies across the world that can compete for ultra large cylinder contracts. Its high-pressure cylinders are a critical component for a number of end applications from defence submarines, to oxygen cylinders in fighter jets, and also for the bulk storage of gases to ultra large air pressure vessel systems used for motion compensation on floating oil platforms.

It is a key supplier to the growing hydrogen sector, providing complete storage solutions and asset management. It has recently won contracts globally with various NATO navies. Whilst the increase in the use of hydrogen fuelled buses means that its systems are in use and demand across Europe.

CSC has long-term contracts to supply bespoke products and services for the key submarine build programmes and for surface vessels, such as the Type 26 Frigate.

The current defence spend is being driven by the need to update ageing warcraft and pressure from the US for NATO allies to increase defence spending.

In 2013, it set up a German based operation to serve the defence, renewables, transport and storage sectors across mainland Europe and Scandinavia.

To handle the increase of its capabilities, the company has just got underway with a £1m plus investment in a machining centre, shot-blasting facilities and an ultrasonic testing (UT) scanner for its Sheffield manufacturing site.

This main subsidiary also has a spin-off operation, Integrity Management (IM), using the CSC unrivalled industry knowledge and experience. It is a growing part of the business, offering its services where cylinders cannot be removed for routine maintenance and are inspected and certified ‘in-situ’.

IM is the principal provider of inspection and testing services to the MoD for ongoing cylinder performance and safety management on the Astute, Vanguard and Trafalgar classes of nuclear submarines.

The Precision Machined Components (PMC) businesses are leaders in their markets, with world-class lead times, highly specialised precision engineering skills and a blue-chip customer base.

Serving the oil and gas market, these businesses specialise in supplying key high integrity components, made from super alloys, manufactured to exacting standards and tolerances. Those special components are destined for extreme or hostile environments, such as deepwater and subsea oil exploration and also for wear parts for offshore and onshore oil production.

Improving market conditions

CSC last year had a revenue of £9.9m and made an operating profit of £1.1m, whilst the PMC side had an £11.2m revenue with £1.5m of operating profit.

Overall group revenue was £32.2m whilst its year-end operating profit was just £0.5m, due to the losses in the, now sold off, Greenlane Biogas company.

The group now looks well placed to take advantage of improving market conditions. The further strengthening of its balance sheet through recent disposals, will help to support its investment and accelerated growth in its target markets.

Order intake and general bidding activity indicate a period of increased market activity, particularly for the oil and gas sector.

The trading outlook for the current year remains encouraging, based on year-end order books in its core manufacturing divisions.

The company only has 18,595,165 shares in issue, which at just 117p each, capitalises it a mere £21.75m.

At the last visible count I see that holders include: Gresham House Asset Management (19.63%); Artemis Investment (19.35%); Schroder Investment (6.63%); Hargreaves Lansdown (4.97%); and Unicorn Asset Management (3.05%).

I will wait until the interims are published before I glean what brokers estimates will suggest for this year and for the next couple of years.

Strong recovery prospect

However, at just 117p each, I really do rate this stock as a strong recovery prospect and that its shares could well be significantly undervalued in relation to its potential.

Being cautious, which is unusual for me, I know, I will just put out a 2019 target price of 170p, to be achieved within the year. Remember that this company is a highly specialised manufacturer and with a clear profits trail in sight its shares could easily be very much higher.

Comments (0)