Infrastrata is on course to find the funding for the first well on its gas storage project in Northern Ireland

By Stewart Dalby

Infrastrata’s potential salt cavern gas storage project in Northern Ireland has seemed like a bit of a Cinderella in the portfolio after the group diversified into more exciting exploration projects following the collapse of another gas storage scheme in Dorset in southern England.

The Islandmagee gas storage project in County Antrim, Northern Ireland, appeared to be left on the shelf following the pull-out of partner, BP Gas Marketing, last year to concentrate on other projects, having spent £5 million advancing Islandmagee.

The project also looked stalled because funding (£4 million) was lacking to drill an important well to extract a salt core. But the project was recently given a boost with news of a €2.5 million (£1.9 million) matching grant from the EU towards the drilling of the Islandmagee-1 well, which is required to provide further data to understand the rock mechanics and composition of the salt to complete engineering design ahead of FID in 2016.

Now Infrastrata is planning a placing and subscription of 52,000,000 new ordinary shares to raise £2.1 million (the other half of the well cost). The placing has to get the approval of shareholders at a General Meeting on February 23, but it is hoped that the placing and subscription shares will be admitted to AIM on February 24. The well is planned for May and the investors will have a 20 per cent stake.

This is a major strategic project. It will consist of seven salt caverns which if and when built in five years time. This will give it capacity of 16 billion cubic feet of gas. This is enough for one month’s supply for the whole island of Ireland and still be enough to send some gas back through the inter-connector to Scotland.

It is a major project because it has a capex of £270 million. However, Infrastrata will not be in the for long haul. The company’s CFO Stewart Gerrity told Oilbarrel: “The company’s intention is to realise value for shareholders from the company’s interest in this project as soon as practicable.

With the collapse of the oil price exploration is perhaps not exciting as it was perceived to be, but Infrastrata can look forward to an interesting 2015 as the AIM micro-cap plans up to three wells, one of which could be a basin-opener.

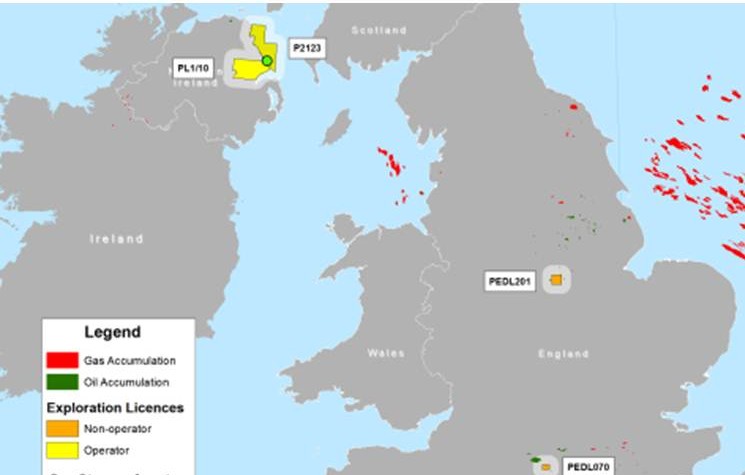

The company is focused on the UK, where it has eight licences, four as operator.

In Northern Ireland the company holds a 1,300 sq km block in the central Larne Lough Neagh Basin, which, said Hindle, has been “completely overlooked” by the industry, with just six wells drilled despite its potential to be an onshore extension of the prolific East Irish Sea Basin. There is just one well on Infrastrata’s licence, drilled by Shell back in the 1971 without any seismic.

Indeed, lack of seismic has been a key reason for the basin’s neglect. A layer of basalt at the surface makes imaging difficult but Infrastrata has applied new technology to this problem, allowing it to create a model of the subsurface and identify previously unseen prospects.

One of these, Woodburn Forest, will be tested in 2015: a £4 million well will drill to 2,000 metres to target Triassic and Permian sandstones as well as additional potential in the Carboniferous. The well carries a P50 prospective resource of 40 million barrels (11 million barrels net to Infrastrata).

“In Dorset, the company has an interest in a 900 sq km block near the giant Wytch Farm oilfield. This is an area that sees sporadic flurries of interest from industry, and rightly so. It seems the Basin could ultimately produce over 700 million barrels, of which 100 million could be in its licence.

There are two targets here: the offshore Colter prospect, which could host 50 million barrels in the Triassic and where a 1989 well drilled on the margins found a 10 metre oil column in the Sherwood Sandstone. “We believe there’s a significant structure updip of that,” said Hindle.

Then there’s the onshore/offshore Purbeck prospect near the Kimmeridge oilfield, which is a smaller prospect – around 10 million barrels – but equally a lower cost drill. Seismic work in 2015 will help refine the drilling location, with farm-in partner Southwestern Resources required to make a decision by February 2016.

In the North Sea, the company and its partner Carstone Exploration were awarded a block in the UK’s 28th licensing round. The block hosts the Oulton oil accumulation, where there could be 16 million barrels of oil and tie-back opportunities to nearby fields. Oulton was discovered by Amoco in 1974, when it flowed 1,000 bpd on test. Under the Promote terms of the license award, the companies have two years to work up the project and farm-out to fund next steps.

The placing is priced at 4p. The shares are currently priced at 4.13p.

Comments (0)