Eland hopes to close RBL facility in April ready for “transformational” drilling campaign in Q3

By Amy McLellan

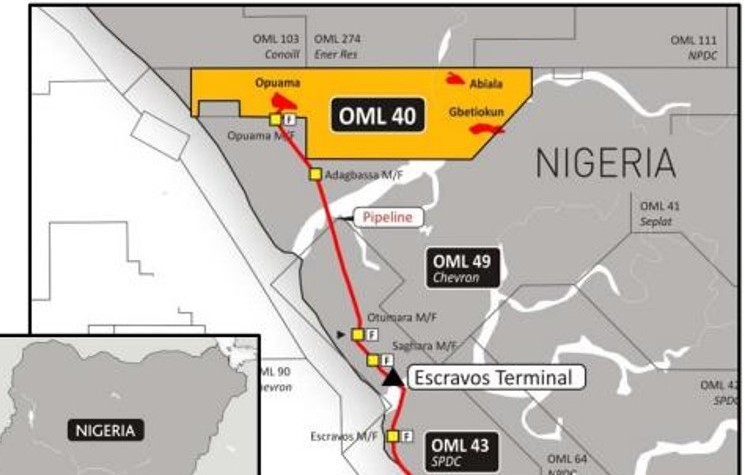

Shares in Eland Oil & Gas ticked a little higher on Wednesday as the company confirmed it is set to have its full reserve based lending facility in place in time for a drilling campaign, which is set to kick off in Q3. The company has long had the backing of Standard Chartered Bank but needed to show consistent uptime from its Opuama oilfield in Nigeria to meet conditions to drawdown a US$75 million loan.

This week the company said the field is pumping over 3,100 bpd gross and production consistency has shown huge improvement, from just 2.6 per cent uptime in August to over 90 per cent in December. Over the whole of Q4, production was almost 74 per cent compared to just 15.7 per cent in the previous business quarter.

And January also started well, with 100 per cent uptime of facilities and export pipeline on the OML40 block but production was shut down to accommodate maintenance by SPDC on the key Trans Escravos Pipeline network: even so, Q1 uptime is currently averaging over 85 per cent.

All conditions have now been met for the committed US$35 million of the US$75 million RBL facility with Standard Chartered Bank and marketing for the syndication of the remaining US$40 million has begun and completed commitments are expected by the end of April. This puts the company on track to start drilling in Q3.

Eland, which has cash of US$8.2 million with US$2.4 million due in for oil cargoes, has had the bad luck of having its improved uptime coincide with the lower oil price: its crude has been selling for around US$63 per barrel from the Forcados Terminal in January and February. Equally, of course, it has the good fortune of being able to contract for rigs and services at a time when the costs are down.

The company plans a re-entry of well OPUA-005, which is currently shut-in but has the potential to produce between 400 – 600 bpd when back onstream to drain another 1.1 to 1.3 million barrels over the life of the well prior to a planned conversion to a water injector.

This work should be completed in May. The second re-entry well is a horizontal side-track of OPUA-007, which is also currently shut-in. This will get underway in Q3 as part of the Opuama development drilling campaign, which will involve seven wells with contingent follow-on drilling activity through 2016.

The seven wells will be drilled from a single surface location and the first two will produce from the D1000 and D2000 reservoirs as well as appraising a number of deeper reservoirs. These wells are commercially robust at oil prices of US$50 a barrel with payback times within six months at expected production levels of between 4,500 – 5,500 bpd.

Subsequent wells in the programme will drain the deeper D5000 and E2000 reservoirs, in addition to the D1000 and D2000. This will start to deliver a real step change in output for the AIM-quoted oil group, putting it on track for a 2015 exit rate of 25,000-30,000 bpd.

CEO George Maxwell says this year will be “transformational …with material increases in production and revenues”. The hope must be that oil prices continue to not only cling on to the current US$60 a barrel level, but start to regain strength as capex curbs start to cut into the global oil glut.

Comments (0)