Calgary-based TransGlobe Energy Soldiers On With Strong 2014 Egyptian Production

By Martin Clark

Things are motoring along for Canada’s TransGlobe Energy, despite the failed takeover bid that it faced up to last year.During 2014, it was targeted by Caracel Energy, a deal that fell through after Caracel itself was the subject of an offer from mining giant Glencore Xstrata.

That all seems a long way off now, with independents the world over facing up to far more pressing challenges, notably a sharply different oil price environment. Still, the TransGlobe team have carried on whatever has been thrown at them, working the assets well on the ground in Egypt and Yemen.

The company announced its fourth quarter and year-of-end 2014 results on March 5, declaring a healthy full year average production of 16,103 barrels of oil per day (bopd), although this has slipped back a bit in the early days of 2015.

Almost all of this came from Egypt with just a fraction from Yemen. Although the results were affected by the oil price slump, there was plenty of money coming in from the free flowing oil output.The company ended the year with US$140.4 million in cash and cash equivalents; positive working capital of US$229.7 million, or US$160.6 million net of debt.

Funds flow from operations reached $120.5 million in 2014, it reported.

The company also said that it paid a special dividend of $0.10 per share in May last year on receipt of a reverse termination fee from Caracal, a happy ending perhaps to the doomed merger.TransGlobe remains listed on the Toronto and Nasdaq stock exchanges and is certainly keeping itself very active.

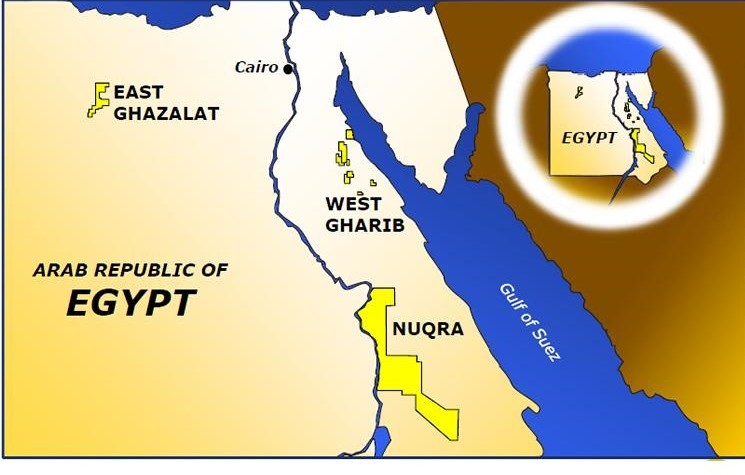

Last year, the company drilled 43 wells and made three oil discoveries on its NW Gharib exploration concession, and acquired large swathes of seismic across various projects in Egypt’s Eastern Desert. Overall, it’s a pretty decent position to be in amid the increasingly gloomy industry outlook.

Indeed, TransGlobe has cut its 2015 capital programme to US$37.5 million in response to low oil prices; its share prices is also way down on this time last year.Of more concern, may be the drift in average production this year, which has seen numbers drop down to 15,092 bopd in January, and then 14,316 bopd in February.The board estimates first quarter average production at about 14,500 bopd.

But there’s lots of good things going on too with a first cargo lifted, consisting of 545,000 barrels of Eastern Desert crude, on January 24, and a second cargo lifting scheduled for April, further evidence of the team’s capabilities in the field.

In December, TransGlobe signed a marketing agreement with EGPC which allows it to directly contract oil shipments of Eastern Desert crude with international buyers. Challenges, for sure, but no different to any other enterprising oil player right now.

With about half the 2015 capex budget going on development work, and the other half on exploration, there are still plenty of reasons to follow this established Canadian producer.

Comments (0)