Bowleven banks US$165 million as it completes its farm-out of its Etinde permit offshore Cameroon

By Amy MCLellan

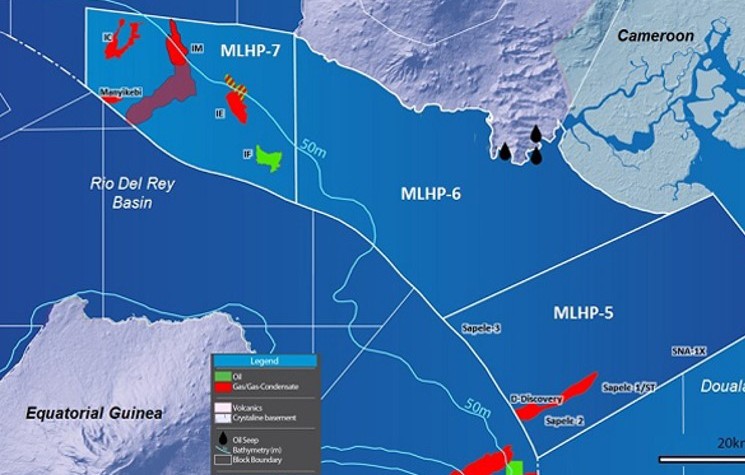

There is good news for followers of Bowleven plc this week as the Edinburgh-based company banked US$165 million as it completed its farm-out of its Etinde permit offshore Cameroon. The company, which with a market cap of around £108 looks undervalued, retains a material 20 per cent non-operated stake in the resource-rich permit, having sold a 30 per cent stake to Russian oil giant LUKOIL and another 10 per cent to privately-held African E&P NewAge in a deal worth US$250 million.

This is truly transformational. In addition to the US$165 million upfront cash injection, there is also an estimated US$5 million to follow for working capital, a net carry on two Etinde appraisal wells worth US$40 million, a further US$15 million on completion of appraisal drilling and a contingent US$25 million at Etinde FID.

This is an important deal on so many levels. Not only has Bowleven reduced its exposure to a level more appropriate for a company of its size but it has partnered with well funded companies with the operational nous to push through a project of this scale and complexity.

The deal also accentuates the financial and commercial savvy of the Bowleven team, led by ex Cairn Energy FD Kevin Hart, who have taken plenty of criticism in recent years for remuneration and slow progress in capturing value from this acreage position.

Hart and his team should be given credit now, however, for signing up LUKOIL when oil prices were still buoyant to secure a lucrative cash-and-carry deal that leaves Bowleven with a front seat in a strategic project and plenty of financial headroom to allow it to advance its existing projects and potentially scout out new opportunities.

The company has pledged to be prudent with its cash pot and, to date, is revealing little about its intentions: more detail on future plans is expected at the release of the interims next Wednesday.

“The cash has just come in through the door,” says a spokesman for the group. “The company has a number of options available to it, not least the acreage it has in Cameroon and Kenya.”

One thing is clear: this was a good deal when it was announced last summer when oil prices were double current levels but looks even better at US$55 oil. Sometimes timing is everything.

Analysts at SP Angel Corporate Finance are certainly of this view. “To be frank, that there has been a delay has worked for Bowleven, as it has put it in as strong a position as it has ever been, and given the decline in oil prices, the resources it now has at its disposal will not only go further on its own assets (given the decline in costs), but the dearth of liquidity will also create additional opportunities for it to pursue,” said the analysts, noting the old adage “cash is king”.

Comments (0)