ASX – listed Pura Vida Energy gears up to drill its first potentially high impact and company making well in Moroccan towards the end of 2015

By Stewart Dalby

Pura Vida Energy is not one of those start-ups which adopts a model of finding some production to generate enough cash flow to keep the lights on, as they say. Nor has it decided, for the moment to acquire development opportunities to spread risk before it goes for the big one with an exploration wildcat that could send the share price off the top of the graph and transform the company. It has instead decided to go straight for a large prize.

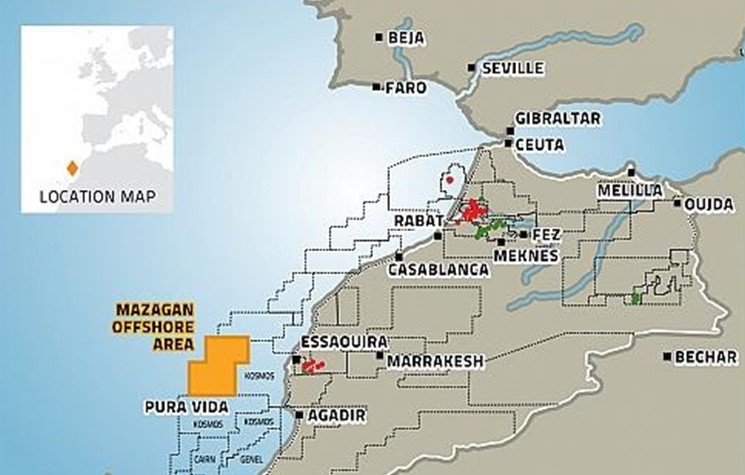

Pura Vida was formed three years ago and is listed on Australia’s ASX. With no production the management went about acquiring high-risk, potentially high-reward assets in Africa which could be company making. It gained the Mazagan Permit Offshore Morocco, the Nkembe Block Offshore Gabon (80 per cent and operator) and the Ambilobe Block Offshore Madagascar(50 per cent).

The most advanced of these projects is the Moroccan Mazagan. This is because a farm -in partner has been found and a well is planned for later this year. As Damon Neaves the Managing Director of Pura put it to Oilbarrel: “What has made the company is that Freeport McMoRan has come in as a joint-venturer and has financial muscle”. Pura Vida has subsequently attracted interest following the farm-in and now has a market cap of A$60 million or an enterprise value of nearly A$80 million if you add in cash of around A$17 million.

Freeport is a US company which has a market cap of US$30 billion. For a 52 per cent stake and the operatorship of Mazagan (Pura Vida is left with a 23 per cent stake and the Moroccan state company ONHYM has 25 per cent) Freeport has farmed-in and will carry Pura Vida to a total of US$215 million for a two well commitment. PVD has negotiated a mechanism within the farm-in agreement that provides protection against cost overruns. The mechanism allows PVD the option to exchange a 1 per cent equity interest for US$4.5 million in gross expenditure over US $215 million with an equity floor of 4 per cent.

The prospectivity of the Mazagan permit is considered prolific with three independent trends containing multiple prospects and leads mapped on 2D And 3D seismic. PVD’s drilling inventory consists of 13 prospects and leads representing 6.7 billion barrels (P50) gross and some 1.5 billion barrels (P50) net.

The excitement for PVD at the moment is that operator Freeport has decided to change the location of the first well from the Toubkal prospect to the Ouanoukrim prospect; a move which Aussie brokers Hartleys and Mirabaud feel should be a catalyst for the PVD share price. The reason for the switch is the new well will attack four stacked structural and stratigraphic traps in the Cenomanian, Aptian and Lower Jurassic. The well, now called the MZ-1, will be drilled to a target depth of 5,600m with the potential to penetrate a fifth objective within the Lower Jurassic.

The MZ-1 well at US$136.6 million will be more expensive than Toubkal. Also while the individual prospects may not be as large as Toubkal, the combination of the four stacked targets (potentially the fifth) have a similar or greater resource size. PVD has estimated there could be 1.4 billion barrels of prospective resources (385 mmbbls net).

The assets in Gabon and Madagascar and Gabon are less advanced, although the Nkembe block has an ongoing 3D seismic programme to identify prospects. Gabon has a long history of oil production. However, neither Hartleys or Mirabuad has put anything for these two countries into their valuations.

Mirabaud has a BUY recommendation with an unchanged target price of A$1.04/share. Hartleys says it has made some adjustments to its 12-month target price because of the change in drill location and the change in risk appetite for oil and gas stocks. Its risked valuation is A$1.44/share with a 12-month target price of A$0.72. It has assigned a geological chance of success (CoS) of 15 per cent. Yes, it is high risk but the current price is just A$0.36.

Comments (0)