The specialist REIT paying a six percent inflation-linked yield

The unprecedented jump in UK government bond yields after last week’s ‘mini budget’ has sent the share prices of many real estate investment trusts (REITs) sharply lower. With interest rates likely to rise quicker and further than previously forecast it makes the income that much less attractive, while also adding to the borrowing costs, but there are still some interesting opportunities in the sector.

One such is the specialist Supermarket Income REIT (LON: SUPR) that published its annual results for the year to the end of June last week. The £1.9bn trust owns 49 supermarkets located around the UK, as well as a stake in the “Sainsbury’s reversion portfolio”, which consists of 26 different stores that it holds in a 50:50 joint venture with the British Airways Pension Trustees.

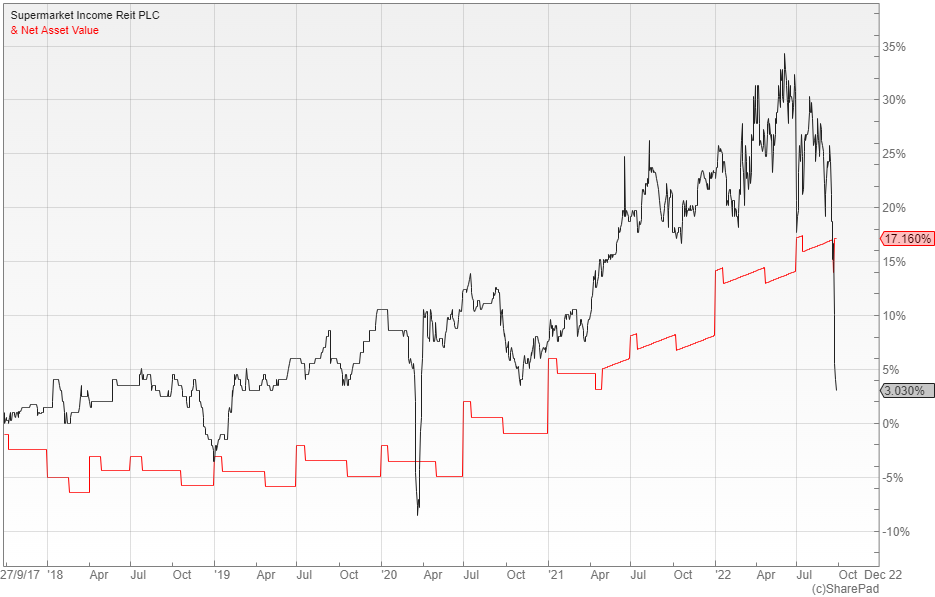

With the shares now trading at around a pound the target dividend of six pence gives them a prospective yield of six percent, which is fully covered by earnings and benefits from a significant element of inflation-linkage. The latest pro forma EPRA NTA of 111 pence puts the trust on a discount of 10% that looks attractive given that it has been trading at an average 12-month premium of 10%.

Positive fundamentals

In the accounts to the end of June the fund achieved like-for-like rental growth of 3.7% with 81% of the leases being inflation-linked, albeit with caps and floors. Of these, 73% are linked to the higher Retail Prices Index (RPI) and eight percent to the Consumer Prices Index (CPI), with two percent subject to fixed reviews and 17% to open market rent reviews.

The broker Winterflood says that this high level of inflation-linkage is particularly appealing given the current inflationary backdrop, while the rental uplift caps, which average four percent, ensure that the rents remain affordable for tenants. In fact, the underlying supermarket sales growth is now outpacing contractual rental growth, which makes the rents even more affordable.

Despite the inflation-linkage and the healthy growth in rent and EPS, the dividend was only raised by one percent to 5.94 pence, with the target dividend increased by a similar amount to six pence per share. This is clearly disappointing for investors, although the caution is probably warranted in the current environment and the prospective six percent yield remains attractive, especially as it is fully covered by earnings.

The debt is fully hedged

The managers have taken the decision to fully hedge the drawn debt to achieve an effective fixed rate of 2.8% until 2026, which gives the fund a conservative pro forma loan to value ratio of 31%. In the current economic environment this looks like a sensible move and should enable the fund to benefit from both the level and predictability of earnings going forward.

During its last financial year the trust was able to successfully raise £506.7m of new equity via two upsized and oversubscribed share issuances, which shows the level of demand for this unusual asset class. It also continues to expand its portfolio with a further five assets purchased for £216.1m post period end.

Winterflood expects SUPR to continue to deliver strong total returns over the coming years on account of its focus on omnichannel stores, which ensures that it benefits from the structural trend of online sales growth. They also point out that the non-discretionary nature of grocery demand means that the sector is likely to prove resilient in the current challenging macroeconomic environment.

Comments (0)