The Investment Trusts Most And Least Exposed To The Sell-Off

It has been a challenging few days for investors with the markets unsettled by a couple of unexpected events. The bearishness all started when the chair of the Federal Reserve, Jerome Powell, said that the ultimate level of interest rates was “likely to be higher than previously expected.”

In December, policymakers had estimated that US rates would peak at 5.1%, but Powell’s statement pushed the rate expectations higher, with the futures markets suggesting that they could top out at just over 5.5%. This prompted a sell-off in the equity market that gathered momentum when it was announced that the Silicon Valley Bank (SVB) − a US lender to many start-ups and tech companies – had collapsed.

The ramifications and extent of any contagion is still unclear, although the fear was enough to send several investment trusts close to double digit losses last week. These included the tech and start-up focused mandates such as Augmentum Fintech (LON: AUGM), Schiehallion (LON: MNTN) and Chrysalis (LON: CHRY), as well as areas sensitive to global growth like the commodity funds BlackRock World Mining (LON: BRWM) and Baker Steel Resources (LON: BSRT).

Those Most At Risk From The Collapse Of Silicon Valley Bank

At time of writing the FTSE 100 was down another two percent with last week’s biggest fallers experiencing further selling pressure, although a number of investment trusts have provided reassuring updates about their exposure to SVB. Deposits with the bank were guaranteed by the Federal Reserve overnight and the UK bank’s customers will be able to access deposits from today after the sale of the UK arm to HSBC.

Augmentumhas announced that of its 25portfolio companies, only two have balances with SVB UK. These holdings represent about 2.6% of NAV, although they have sufficient funds at other UK Tier one banks to continue trading while a resolution is sought.

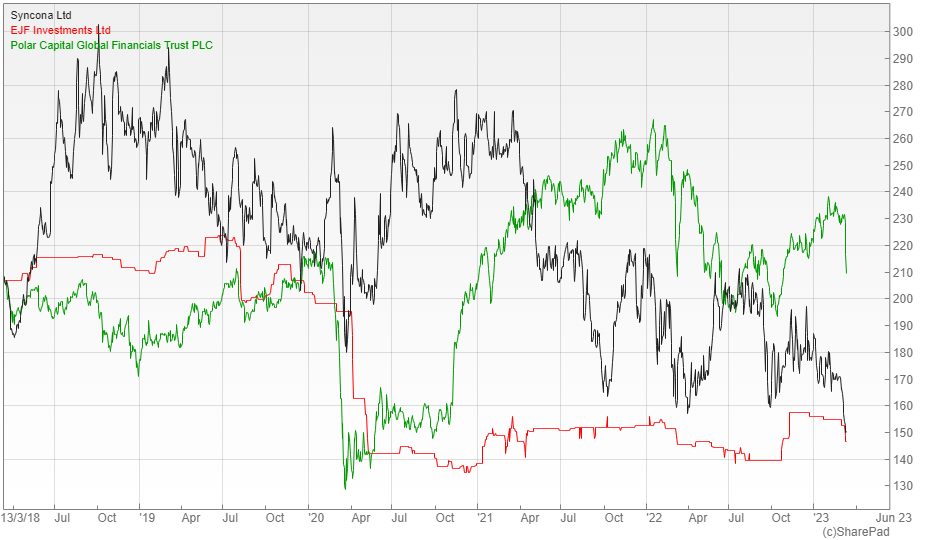

The life sciences focused investment trust Syncona (LON: SYNC) has said that it has minimal direct exposure to SVB, equating to 0.2% of NAV, yet its indirect exposure via the underlying holdings is estimated to be six percent, of which the majority is held with SVB UK.

The broker Numis says that it will take time for some trusts to establish the full picture, so there may be more announcements to follow, although it appears that government actions may limit the impact. Those most at risk could be EFJ Investments (LON: EJFI), which lends to regional US banks and Polar Capital Global Financials (LON: PCFT) that has significant exposure to the banking sector.

Beneficiaries Of Higher Interest Rates

The collapse of SVB has caused the market to reprice its expectations of the Fed rate hike schedule, with Goldman Sachs now predicting no increase in March. In fact the crisis has caused US Treasury yields to slide significantly as investors have sought the perceived safety of US government bonds.

If the collapse of SVB blows over with no significant contagion elsewhere in the markets then it is likely that interest rate expectations will increase and once again become the dominant driver of returns. This would be a headwind for most investment trusts, but not those that invest in floating rate bonds.

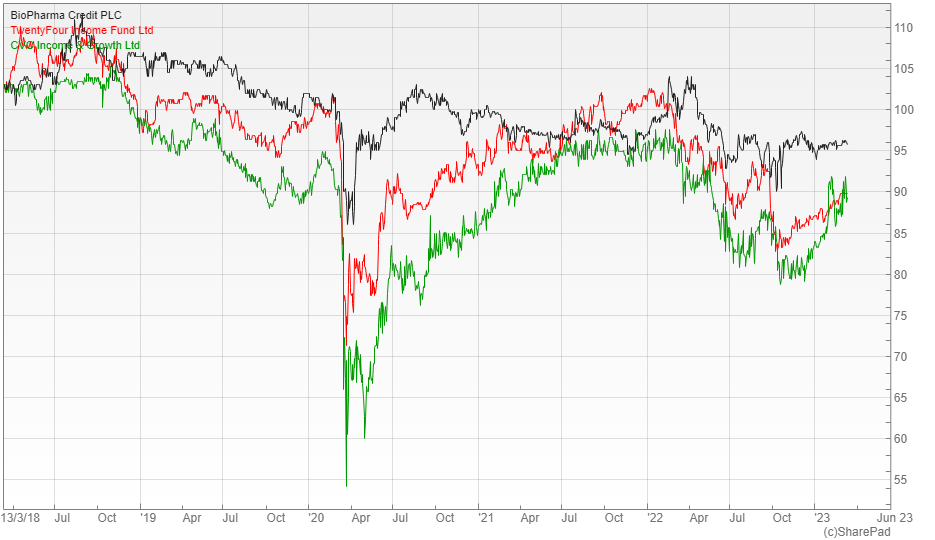

Numis says that floating rate debt benefits from an increase in the income generated when interest rates rise and capital values are generally resilient, although not immune if the wider bond market experiences stress. One trust that invests in this area is BioPharma Credit (LON: BPCR) that has a US focused portfolio of loans that are predominantly floating rate and should benefit if rates continue to move higher.

There are also several other trusts that have already benefitted from higher rates and significantly increased their dividends as a result. These include: TwentyFour Income (LON: TFIF) that is yielding over six percent and CVC Income & Growth (LON: CVCG), which has recently raised its dividend target to give it a prospective yield of 7.4%.

How amazing. A whole article and not one mention of Scottish Mortage Trust. It has holdings in so many usa tech stocks. Most of which are not on tradeable markets and therefore have not been revalued since the tech crash in the USA.

Price today 670p versus 52 week high of £10.81 , before revaluation of some very illiquid assets.

Be careful and DYOR.

Rgds Tolle