The best trusts and funds for the year ahead

No prizes for guessing that it will be interest rates and inflation that will be the key drivers of the markets in the next 12 months. As soon as the inflationary pressures start to recede, central banks will be able to ease back on the brakes and investors will have a better idea of where we are headed.

The sharp rise in inflation to levels not seen in decades has forced central banks to respond with aggressive rate hikes, which have caused a widespread sell-off in most asset classes. If inflation stays sticky, then bonds and shares will continue to struggle, whereas if it falls back quickly it could trigger a big relief rally.

Ryan Hughes, head of active portfolios at AJ Bell, says that the dominating factor through 2023 will be where interest rates are going to stop in the rate hiking cycle that we are now in.

“Current market volatility is intrinsically linked to the lack of certainty around this point and it looks highly likely that we will not have any clarity on it for some time to come yet. With most assets priced off the bond yield, the markets gaining clarity on this will dictate their direction with some stability.”

Rob Morgan, spokesperson and chief analyst at Charles Stanley, says that markets are forecasting that inflation will be quite stubborn and peak rates will be high and prolonged, but he believes it could fall away quite quickly as commodity prices, notably energy, subside and shipping and supply chain costs bed down.

“The dampening effect of higher interest rates is already taking its toll on house prices and consumer confidence and at some point central banks will be able to ease off their tough but necessary action. If that’s the case then opportunities are presenting themselves in interest rate sensitive areas, notably bonds.”

The other main issue is how big the coming global recession will be. Monetary policy works with a lag so a lot of the pain from the recent Fed and other central bank rate rises won’t fully hit until next year.

Darius McDermott, MD at Chelsea Financial Services, says that the big unknown is whether we have a full blown credit cycle with a severe recession, which might kill inflation, but would probably take the stock market down with it.

“At least if inflation falls central banks will be able to ride to the rescue, so the fall in equity markets may not be that bad. The really difficult scenario would be a severe recession with inflation remaining high, although it seems quite unlikely as a collapse in demand in the economy would likely kill inflation as well.”

Of course there is always the geopolitical risk, which is especially high at the moment. If president Putin escalates the conflict in Ukraine or president Xi uses military force in Taiwan it would cause huge global instability. The coronavirus is still around as well, with China’s zero Covid policy playing havoc with economic growth both within the country’s borders and beyond.

Perhaps the best news for investors is that the diversification benefits of equities versus bonds is likely to be re-established and this should make life easier for anyone trying to build a robust portfolio suitable for all eventualities.

Growth funds

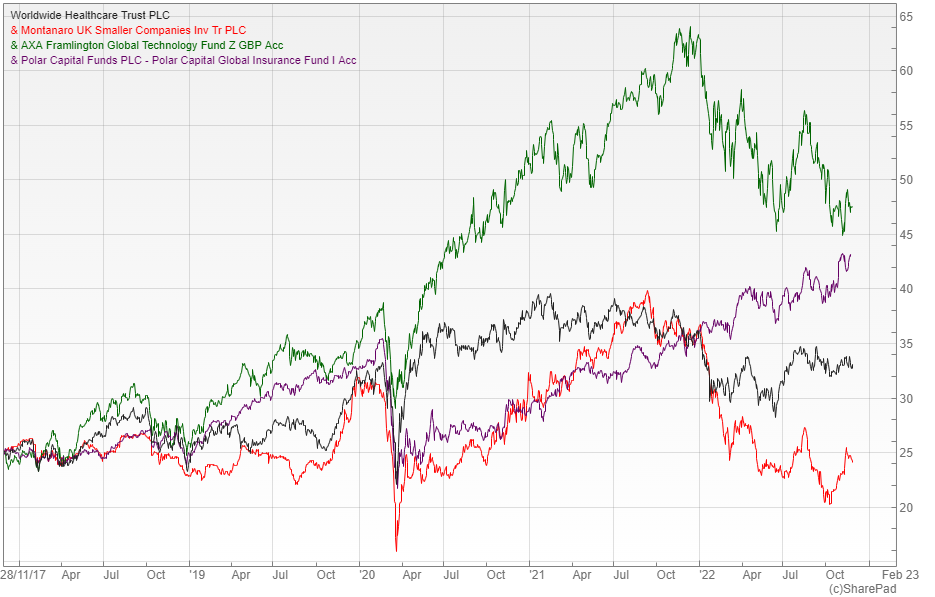

For investors looking for capital growth McDermott recommends the AXA Framlington Global Technology fund.

“Technology has been smashed and in some cases for good reason, but this is not the tech bubble, as many of the large mega cap tech stocks make billions and are still growing. They’re now looking pretty cheap, so if we get a peak in inflation and an end to interest rate rises these names could rebound strongly,” he says.

The £1.2bn fund has a concentrated 56-stock portfolio with large positions in companies such as Apple and Alphabet. It has had a tough 12 months, but is still up around 90% over five years.

Another sector specific option suggested by Morgan is Worldwide Healthcare (LON: WWH), a £2.4bn investment trust.

“The cloud of uncertainty has slowly been lifting on the healthcare sector in respect of drug pricing in the all-important US market. At the same time, the pace of medical innovation is breath-taking, notably in areas such as oncology, obesity and Alzheimer’s and this should continue.”

WWH takes an active and focused approach through the management of OrbiMed Capital, one of the leaders in the field of healthcare and biotech investment. With investor sentiment depressed, the shares currently trade at a seven percent discount to NAV.

Hughes prefers the Polar Capital Global Insurance fund and says that although insurance is a very specialist area, it has strong long-term compounding characteristics.

“Insurance companies keep vast amounts of cash to be able to pay claims and this cash is often invested in bonds that are now offering significantly more attractive yields. As a result, the earnings potential of the underlying cash has increased markedly, which should support strong growth from the sector.”

These businesses are also well-placed to pass on higher costs by increasing premiums, which gives them a solid element of inflation proofing. It is an area that would add real diversification to an existing portfolio.

Ben Yearsley, a director at Shore Financial Planning, doesn’t think that high growth investment will come back into fashion any time soon, so he suggests the UK Smaller Companies sector as an area that could provide some decent capital appreciation. He says that it is unloved and out-of-favour and is due a rebound when markets get certainty on when rates are going to peak.

His favoured option in this area is the Montanaro UK Smaller Companies Trust (LON: MTU). Its shares are down 32% in the last 12 months and currently trade on a discount to NAV of around seven percent.

Investing for income

Income investors have tended to avoid fixed interest for quite a while due to the low yields on offer, but bonds are starting to look tempting for the first time in a decade, after experiencing a massive sell-off as interest rates have risen rapidly around the world.

“Fixed interest has been hugely challenging during 2022 with major losses being seen across the board. Yields have blown out significantly with investment grade bonds in the UK now yielding over seven percent and while this is still below the current level of inflation, high quality bonds rarely offer such a high nominal return, which could be appealing for income seekers,” explains Hughes.

In order to take advantage he suggests the Artemis Corporate Bond fund, where manager Stephen Snowden is prepared to invest away from the benchmark and has done a good job during his three years at the helm. He is well supported by an experienced team and the fund is competitively priced with annual ongoing charges of just 0.37%.

McDermott is also a fan, but thinks of it more as a balanced option offering both income and growth potential.

“Bonds have been smashed with yields going from two percent at the start of the year to more than seven percent. We’ve disliked them for a long time, but after a fall of more than 20% year-to-date they look good value, with the Artemis fund being a solid option with yields where they are now.”

Yearsley says that UK gilts yield three or four percent, but you can get upwards of six percent from investment grade bond funds, which is the area where he would look.

“There might still be more interest rate rises, but markets have already priced quite a bit in and on a risk reward basis investment grade bonds are interesting. In view of that I would buy the Premier Miton Corporate Bond Monthly Income fund.”

The fund invests in UK and overseas bonds and has ongoing charges of 0.35%. It has a historic distribution yield of four percent with monthly payments.

Morgan says that corporate debt has faced the perfect storm of rising interest rates and concerns over deteriorating credit quality.

“Worries could be overdone on both counts and there is an opportunity to lock in to a strong level of return from investment grade debt without straying into high yield bonds where there is greater credit risk.”

He suggests Rathbone Ethical Bond as an option, especially for those who want to screen out unacceptable business practices and lend money to companies that have a positive impact on society. Within the portfolio the average yield to maturity is over seven percent, which shows the substantial level of income available on corporate bonds at the moment.

There are also options outside of fixed income with McDermott suggesting the Man GLG Income fund. It pays a six percent yield and benefits from depressed valuations, so if things turn out to be not quite as bad as feared, it could do well.

Balanced growth and income

Those who want a mixture of capital growth and income have a decent range of options available to them now that the main asset classes have weakened, allowing yields to rise.

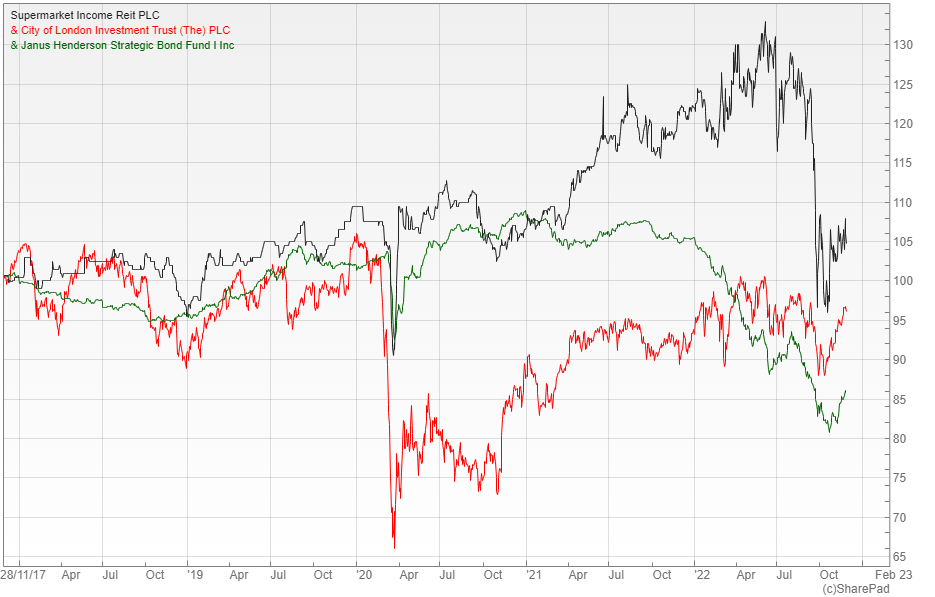

“Lots of investment trusts have been hammered recently including most of the renewable energy sector on worries over valuations and windfall taxes, with other areas brought down with it. The trust I would look at for a blend of growth and income is the Supermarket Income REIT (LON: SUPR). It has lost the large premium it was trading on and now offers a yield of 5.7% with good long-term prospects,” says Yearsley.

SUPR is a £1.9bn trust that owns 49 supermarkets located around the UK, as well as a stake in the “Sainsbury’s reversion portfolio”, which consists of 26 different stores that it holds in a 50:50 joint venture with the British Airways Pension Trustees. Its rental income has a high degree of inflation-linkage and the shares are currently trading on a six percent discount to NAV.

Hughes makes the point that UK equities have been unloved for some time, but offer the appealing combination of a solid yield and the chance of some capital appreciation. He says that one way to benefit would be the City of London Trust (LON: CTY), which gives exposure to larger UK companies and looks to offer a high dividend yield, as well as the potential for growth.

“The trust yields over five percent and has increased its dividend every year for 56 years, while also having an impressive long-term record of outperforming the benchmark. Manager Job Curtis has been at the helm since 1991 and is well supported by the UK equity team at Janus Henderson.”

One of its stablemates, the Janus Henderson Strategic Bond fund, has been singled out by Morgan.

“A truly active manager that invests across the bond spectrum from government bonds to riskier high yield debt could be a good option for investors right now, so a strategic bond fund like this one is worth considering.”

Managers John Pattullo and Jenna Barnard aim to add value by taking strategic asset allocation decisions between countries, asset classes, sectors and credit ratings. It has recently been significantly invested in longer dated, high quality and more interest sensitive bonds, which had been challenging until the recent mini rebound.

Normally, you wouldn’t look at a bond fund for both growth and income, but it is an unusual time and an unusual opportunity exists. Like many of the other recommendations, it would benefit from global inflation subsiding faster than anticipated.

Comments (0)