The best trusts and funds for 2022

It is never easy to forecast what is going to happen in the year ahead, but 2022 is likely to be particularly challenging.

To navigate this year successfully, investors will need to decide if the main risk is high inflation and the interest-rate rises to bring it under control, or whether Covid will render these risks a meaningless sideshow.

Asset manager TwentyFour AM recently released its annual outlook for the year ahead. They say that there is currently a disconnect between monetary policy, the economy and the markets − a disconnect that in their view will struggle to survive for much longer.

They are worried that central banks are enforcing early-cycle policies, while major economies are showing mid-cycle characteristics and market valuations in many areas are decidedly at the late-cycle stage. As a result, the firm believes that the “three elements must converge and will do so in 2022, meaning that the low volatility we’ve enjoyed for most of 2021 is likely to come to an end.”

This all sounds pretty pessimistic, but unless there is a major policy error, they expect the near-term volatility to be an intra-cycle dip that presents a buying opportunity. The potential error that concerns them most is that full employment is closer than the Federal Reserve (Fed) predicts. It could therefore be forced to act more quickly, with aggressive monetary tightening not good for risk assets.

A more dangerous scenario in which none of this matters is that another Covid variant comes along that could render the vaccinations largely ineffective. If this were to happen it could herald another round of restrictions that could do a huge amount of damage to the global economy and asset prices in general.

The key things to watch out for in 2022

Ryan Hughes, head of active portfolios at AJ Bell, says that after the strong performance from equity markets in 2021, the coming year looks like it may be a little more challenging, with elevated risks:

“After the strong global recovery, the adjustment to a higher inflationary market makes for a challenging period as investors try to deduce when and by how much interest rates are likely to increase. Recent months have seen significant volatility as differing signals are sent out by central banks and this is likely to persist for some time yet.”

Darius McDermott, managing director of Chelsea Financial Services, says that normally you would look at the economic cycle to make an educated guess about where markets are headed, based on the path of growth, jobs and inflation, but that there are so many uncertainties in the world at the moment that it’s almost impossible to make a call:

“I think we’re in for a volatile period. News flow will dictate the movement and direction of markets for a while, until we know more about the implications of the Omicron variant. If it’s very bad news I wouldn’t be surprised to see another fall like we had in February/March 2020, otherwise we could start the new year more positively.”

While the current news about the Omicron variant is cause for concern, it seems likely that the global economy will muddle through, with the level of growth affected by the measures brought in to counter the pandemic and the general move towards tighter monetary policy to combat inflationary pressures:

“This poses a rather more difficult environment than we have generally seen over the past decade. Rising inflation and interest rates have, for many years, been the ‘dog that didn’t bark’, but there are now signs of pressures building, most notably in wages which tend to represent the ‘stickiest’ form of inflation,” explains Rob Morgan, an investment analyst at Charles Stanley.

A bit more inflation and a little lower growth may not be a disaster for investors, but things could be tougher than they have been used to over the last decade. The key will be to maintain a balanced portfolio, although bonds may not provide the same shelter they used to from falling equity markets, when the biggest worry is the withdrawal of stimulus and higher interest rates.

Equities

The UK continues to sit at a significant discount to other major global markets as it has done since the Brexit referendum in 2016. Some of this is related to political uncertainty, but it’s also largely down to the structure of the index , with its heavy value skew, given the weight of the oil, mining and financial companies in the benchmark.

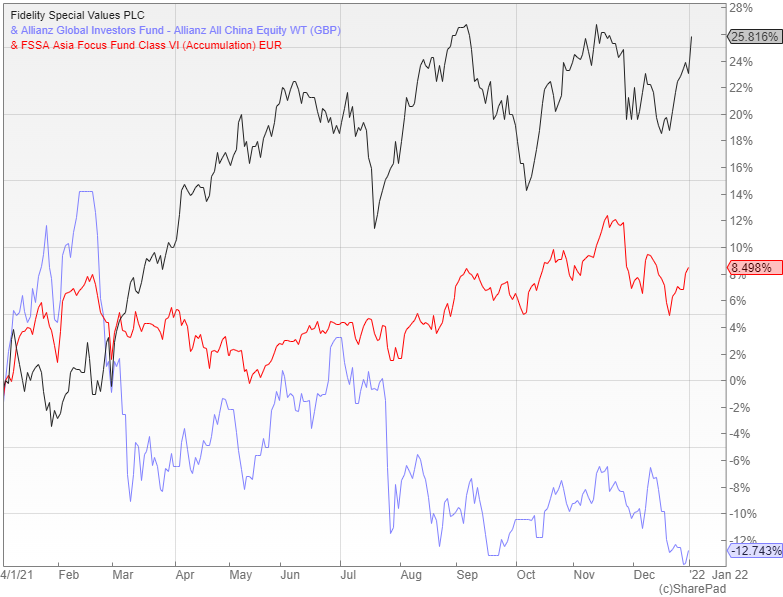

Hughes says that with interest rates looking like they could rise throughout 2022, this should suit the value style and the UK could be a major beneficiary, with the Fidelity Special Values investment trust (LON: FSV) a good way to take advantage:

“FSV has a clear value focus and also looks right across the market-cap spectrum, with good exposure to smaller companies. It is currently 14% geared, reflecting the high conviction that manager Alex Wright has in the opportunities across the UK market, with the key positions including Legal & General, Inchcape and Serco Group.”

Hughes also likes Chinese equities after a horrendous 2021 when the more interventionist policy spooked investors and hammered the value of the big tech companies that dominate the index. Many experts in the region think that the worst of the government moves are now over, while economic growth should continue to be robust at around five percent.

He suggests that a good way to play this would be the Allianz All China fund that invests right across the Chinese market, including in the A shares focused on domestic businesses. Allianz has proved it has a significant understanding of the key drivers of the local market and is prepared to invest very differently from the benchmark.

Ben Yearsley, a director at Shore Financial Planning, likes the wider pan-Asian region and singles out FSSA Asia Focus, which he describes as a core, quality growth fund managed by an excellent team. He says that Asia missed a lot of the Covid rebound last year, but is extremely well placed going into 2022.

Infrastructure

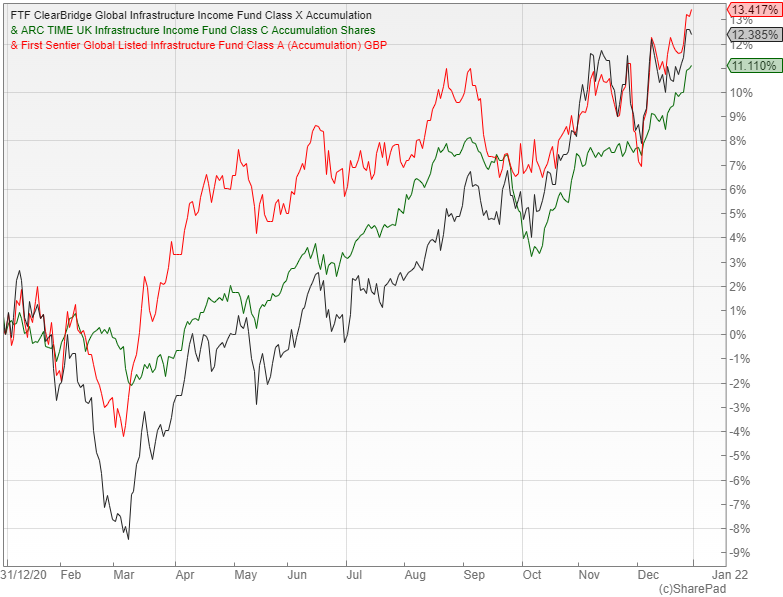

Infrastructure assets should be resilient in a variety of scenarios. They provide a steady income and often have a certain amount of contractual inflation protection built in, which means that they can potentially offer an attractive total return while adding diversification to a portfolio.

For those interested in this area, Morgan suggests the FTF ClearBridge Global Infrastructure Income fund. It is managed by experienced infrastructure specialists based in Australia who have built an impressive track record while consistently delivering a decent yield:

“The fund invests in companies around the world operating in infrastructure-related subsectors. Around 90% of the underlying revenue in the portfolio is inflation-linked, so it should be resilient in a scenario of higher inflation, although it might be more challenged if economic activity drops off, particularly in respect of companies with ‘demand-based’ revenues.”

Yearsley prefers the Time UK Infrastructure Income fund, which invests predominantly in UK-listed infrastructure investment trusts. He says that a key focus is renewable energy, as the UK market has many good options and sustainability of income is important.

Alternatively, there is the First Sentier Global Listed Infrastructure fund that looks to provide exposure to all of the key infrastructure areas in a global portfolio. It benefits from having an experienced team, who have been at the forefront of infrastructure investing for many years:

“With over 40% invested in energy-related companies, it provides exposure to many who are leading on energy transformation, while also giving exposure to critical distribution infrastructure such as railroads and toll roads,” explains Hughes.

Energy transition

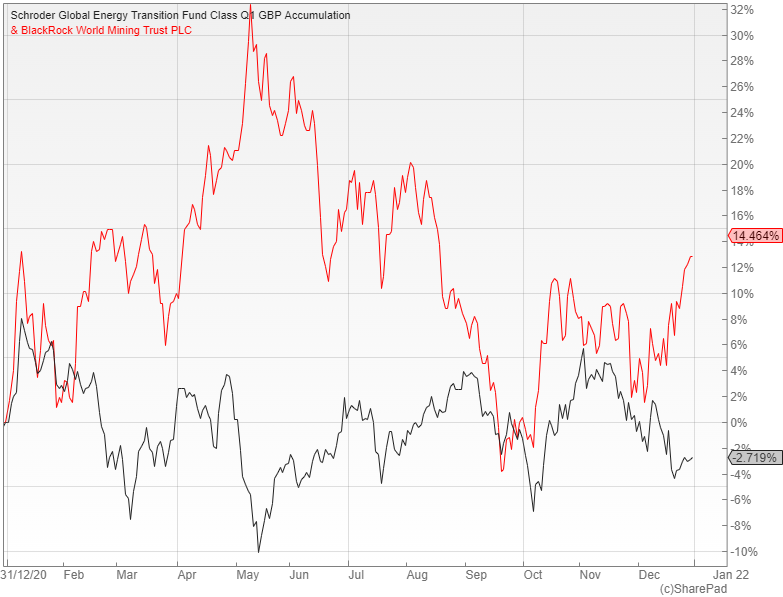

The infrastructure sector is expanding to help meet the transition to net-zero carbon, which demands a huge amount of investment in new, more efficient electricity generation, storage and transmission, as well as a massive rollout of charging points to service all the new electric vehicles:

“To achieve climate goals, how we produce, distribute and consume energy will have to change significantly and will require monumental investment − as much as $120 trillion over the next 30 years − in order to get to net zero in 2050. By investing in industry-leading sustainable companies in areas such as batteries, electric vehicles and wind power, investors are helping to bring about that transition,” explains Morgan.

Energy transition is a multidecade theme where capital will be reallocated on an unprecedented scale, creating investment opportunities across a multitude of sectors and industries. This has recently led to a surge of interest in renewable-energy stocks, with valuations becoming more expensive:

“There is a danger that lots of money is seeking a relatively small number of opportunities in this area in a short time period, which could drive up prices in ‘hot’ stocks. We believe a selective, disciplined and active approach such as the one adopted by the Schroder Global Energy Transition fund is a sensible means to access the space,” says Morgan.

Funds of this nature inevitably entail a high degree of risk, but they could be worth considering for patient, longer-term investors as a more adventurous holding in a well-diversified portfolio.

McDermott suggests that another way to benefit from the transition to clean energy would be the £1.2bn BlackRock World Mining (LON: BRWM) investment trust that invests in mining and metal assets worldwide. It pays out all the income it produces each year and currently has an attractive yield of 3.4%:

“Most of the portfolio is in quoted securities, but it can and does also invest in royalties derived from the production of metals and minerals, as well as physical metals. Recovering global economic growth, accommodative monetary policy, rising government spending and increased focus on ‘green’ capital investment all point towards strong demand for these assets, while supply is still constrained following years of capital discipline,” he says.

Commodities

McDermott says that gold and silver would be a sensible investment to hedge against central- bank mistakes, which are a real possibility. He suggests that the best way to do this would be through Jupiter Gold & Silver, which he describes as a truly unique fund that invests in both physical gold and silver bullion, as well as in gold and silver-mining companies:

“Manager Ned Naylor-Leyland is a passionate advocate for his asset class, and we like the fund’s dynamism and the manager’s willingness to alter its positioning to best suit current market conditions. Its ability to hold up to 70% in silver also offers the potential for higher returns, albeit by increasing the risk profile.”

Yearsley prefers the more broadly based Amati Strategic Metals, a new fund, launched in March 2021, which has assets under management of just £46m. At the end of October, it had a 43% allocation to gold, 16% to silver, 19% to speciality metals and 17% to industrial metals, with the remainder in cash:

“Most metals funds focus on gold and silver, but this one is interesting as it will look at a much broader spread including those crucial to the electrification of countries. The current mix includes graphite, nickel, cobalt and lithium, as well as gold and silver.”

In their latest factsheet the managers point out that the strong negative correlation between the price of gold and real (after adjusting for inflation) interest rates largely broke down in 2021. They think that this was due to investors taking the view that the current bout of inflation is transitory and that interest rates will gradually increase over the next two years.

The managers believe that this presumed thesis is wrong and that the persistent nature of inflation coupled with a softening of nominal rates is leading to the reinstatement of the negative correlation. If they are right, it would suggest that the price of gold should rise, hence their large allocation to gold.

Other options

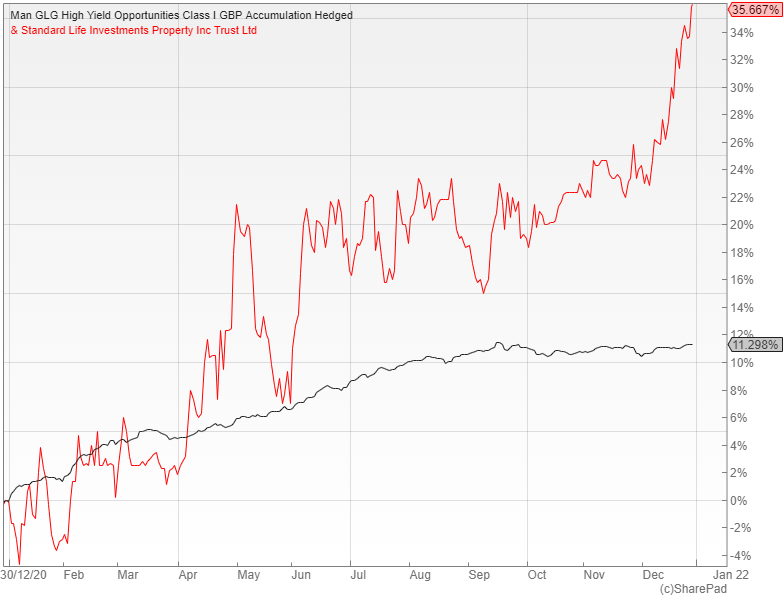

Some parts of the commercial-property market are likely to be resilient and provide a steady income with capital growth on top. The cheaper areas with overcapacity should be avoided due to the structural challenges, but other sectors such as warehouses, logistics, data centres and health-care properties could be worth looking at despite the more expensive valuations:

“The £475m SLI Property Income Trust (LON: SLI) currently offers good value as it is trading on a 12% discount to net asset value and offers a high yield of 4.6%. Further recovery from the pandemic could ‘play into the portfolio’s hands’, given its greater focus on secondary assets,” explains Morgan.

McDermott says that if you want fixed-income exposure, high-yield debt is probably the only area that has a chance of giving a real return after inflation. He suggests that the best option in this space is Man GLG High Yield Opportunities, an unconstrained, concentrated, global, high-yield bond fund that is driven by individual bond selection, but guided by top-down thematic ideas:

“Manager Mike Scott is very experienced and has an excellent track record in navigating the extra risk in the sector, while achieving above-average returns. He looks for mispriced opportunities from across the speculative end of the market and trades them − buying opportunities he thinks are too cheap and shorting some he thinks are too expensive, enabling him to profit when the price falls.”

There is no doubt that 2022 is a difficult year to forecast, with the main question for investors being the persistent or transitory nature of the current bout of inflation and the future path of the pandemic. The only way to protect against these radically different threats is to maintain a balanced portfolio, although tilting in favour of some of the above areas should improve overall, risk-adjusted returns.

Comments (0)