Taking the bull out of bullion: the truth about gold and silver

There are always plenty of conspiracy theories doing the rounds on the internet with one of the hottest debates at the moment concerning gold and silver. A quick search on google will soon uncover allegations of market manipulation, as well as wild price forecasts of $10,000 an ounce for gold and $100 for silver – but what is the truth about these key commodities?

The debate about gold and silver is even more intense than normal at the moment because of rising inflation expectations. Central banks in the US, UK, Europe and elsewhere have been ramping up the money supply for years, but the injection of massive fiscal stimulus just as the economy reopens could be a game changer that is just starting to come out in the CPI data.

Commodities, including lumber, copper and many of the agricultural markets, have already moved sharply higher, whereas gold and silver have lagged behind. The most likely reason is that investors are worried that the return of inflation will result in higher interest rates, which would increase the opportunity cost of holding these metals, although there are plenty of more cynical explanations doing the rounds.

The only way to get a clear perspective on the matter is to look at the raw data. As with any other market it is the supply and demand that will drive the price, but you also need to take into account the impact of the pandemic.

Record demand for silver-backed ETFs

According to the World Silver Survey, the average annual price of silver rose by 27% in 2020 with the increase mainly driven by higher investment demand. Silver-backed exchange-traded funds (ETFs) grew by 331 million ounces (Moz), an increase of almost 300% to finish the year at a record 1.067 billion ounces.

There was also strong demand for physical silver investment, which jumped eight percent to 200.5 Moz. This would probably have been even stronger if it hadn’t been for the pandemic-related supply disruptions that caused sharply higher wholesale and retail premiums.

Other sources of demand including industrial, jewellery and silverware were lower than in 2019 as a result of restrictions to economic activity, as well as depressed consumer sentiment and/or loss of income. Supply from mine production was also down as a result of Covid.

The World Silver Survey calculates the market balance before taking into account the net investment in ETFs. This is because it is intended to capture the new supply minus fabrication demand so as to show if the above-ground stocks of silver are rising or falling.

Using this metric results in a surplus of 80.1 Moz, the largest since the available records began in 2010. However, if the net ETF demand of 331.1 Moz is deducted it becomes the biggest shortfall with a deficit of 251 Moz.

Metals Focus, a precious metals consultancy that produces the World Silver Survey on behalf of the Silver Institute, believes that the institutional investment demand will push silver to peak at $32 later this year and that it will average $27.30 in 2021, which would be a 33% increase on the previous year’s average.

The gold market

The gold market was ravaged by Covid in 2020, yet the economic uncertainty helped to push the price up 25% over the course of the year, despite the retracement from its August peak above $2,000 per ounce. Gold is generally thought of as the best hedge against inflation, yet the clearest correlation is with real interest rates, as when these fall, gold tends to rise, as it did during the 1970s.

According to the World Gold Council, the annual demand in 2020 hit an 11-year low at 3,759.6 tonnes. The key factors in the decline were the massive fall in gold jewellery – to its lowest annual level on record − and a 59% reduction in net buying by central banks to 273 tonnes. These were only partially offset by the record inflows into gold ETFs of 877.1 tonnes ($47.9bn) and the three percent increase in investment in gold bars and coins.

Global supply was also down over the course of the year with the four percent fall marking the first annual retracement since 2017. The drop was primarily due to disruptions to mine production caused by the pandemic, with the total supply figure coming in at 4,633.1 tonnes.

Gold sentiment struggled in the early part of 2021 due to the backdrop of a stronger US dollar and higher treasury yields. This was particularly apparent in the ETF holdings that were down around 10% from the peak last year, which is important as they represent the largest swing factor in demand.

There is a good chance that things will turn around though, as jewellery demand should recover once consumer confidence returns. It is also possible that net central bank purchases will increase given that the main reason for the slowdown last year was Russia suspending its buying programme and using the resources to tackle Covid.

The commodities broker SP Angel is forecasting a gold price of $1,761 in 2021 and $1,800 in 2022. Metals Focus is slightly more bullish with a $1,800 average price forecast for the current year.

Disruptions to the paper markets

The physical gold market is valued at around $10 to $12 trillion, whereas the paper futures are worth many times more. In normal market conditions the cost of physical gold bullion products hovers slightly above the spot price that is determined by the trades in the futures market.

Last April, however, there was a massive disconnect when the pandemic forced some of the major refineries to shut down, which led to a shortage of gold and silver bars for delivery. This resulted in liquidity problems for the futures market and significantly wider spreads than normal.

Most of the futures contracts are either rolled over or cash settled. However, there is an option to take physical delivery. The difference between the active COMEX contract and the spot price is known as the exchange-for-physical (EFP). Normally it is a fairly nominal amount and relatively stable, yet it widened out considerably because of the pandemic and didn’t settle back until September.

Market makers will typically take a short futures position to service their clients and hedge it with a London OTC long one, but the pandemic raised concerns that it might not be possible to ship metal across the Atlantic, should dealers need to deliver against their paper positions. This caused a rush to buy-back short futures, pushing their price higher relative to the spot price.

The move gathered momentum as the rising EFP amplified the potential liability and further curtailed the supply of futures. In the end, however, the risk didn’t materialise and the market makers ended up making very high profits by shorting expensive futures and delivering cheaper physical against them.

The positioning of speculative investors in paper gold is a useful indicator of market sentiment. COMEX net long positions peaked at 1,209 tonnes in February 2020 as fears about the pandemic took hold, but they then declined and have only recently started to pick up again. This suggests that momentum could once again be building with the May net longs coming in at 724 tonnes.

Physically-backed gold and silver ETFs

The cheapest and most convenient way to gain exposure to the price of gold and silver is to use a physically-backed ETF. For example, iShares Physical Gold (LON:SGLN) or (LON:IGLN), depending on whether you want a sterling or dollar denominated exposure, offers ‘a direct investment in gold’ and at the end of March held 225.18 tonnes of the precious metal.

It is benchmarked against the LBMA gold price and since inception in April 2011 has achieved an annualised return of 1.17% versus 1.42% for the benchmark. Part of the reason for the lag is the cost, although the total expense ratio (TER) is just 0.15% per annum.

For silver bulls there are funds such as iShares Physical Silver (LON:SSLN) or (LON:ISLN), according to whether you want the sterling or dollar denominated share class. It is benchmarked against the LBMA silver price and since the launch in April 2011 has generated an annualised loss of 5.41% versus a decline of 5.04% from the benchmark. At the end of March it held 798.56 tonnes of the metal.

Over the last 10 years the physical gold ETF has significantly outperformed the physical silver equivalent, although both have followed the same general trend. Silver is the more volatile of the two and is often referred to as the ‘devil metal’ because of it, but many believe that it will do well, both as an inflation hedge and because of the growing demand for its use in solar panels.

With both of these products the underlying bullion is owned by iShares Physical Metals plc that issues debt securities against the value of the metal. Notes are only issued when the gold or silver is transferred to the allocated account in the vault, which in this case is JPMorgan’s vault in London.

In the unlikely event of a default by the custodian, the metal held in the secured allocated account would be identified separately from the assets of the vault holder. The owner, iShares Physical Metals plc, would then be entitled to arrange the removal of the bars and make alternative vaulting arrangements.

Physically-backed ETFs have only been around for about 15 years so they haven’t really been tested in the event of a massive sell-off in gold. Nobody knows for sure if the market price of the ETF would be able to closely track the value of the underlying in extremely volatile conditions if it experienced outflows on an unprecedented scale.

Gold and silver miners

A less direct way to benefit from increases in the price of precious metals is to invest in gold and silver mining stocks. For most people the easiest way to do this is by using a fund that provides exposure to the sector, while diversifying the stock specific risks.

Gold and silver mining companies amplify the movements in the spot prices due to their operational gearing, with any increase in the value of the metals feeding directly into the bottom line. Many are currently making substantial profits and if prices move much higher the shares should experience heavy demand.

Investing in mining shares is different to buying the actual bullion as the price movements take on some of the characteristics of equities. This means that they can rise or fall with the markets, especially in the short-term when sentiment can be a big driver of performance.

One open-ended fund worth considering is Blackrock Gold & General. It is managed by Evy Hambro, who takes a pragmatic approach, preferring the established, larger businesses that have proven reserves rather than the more speculative mining companies.

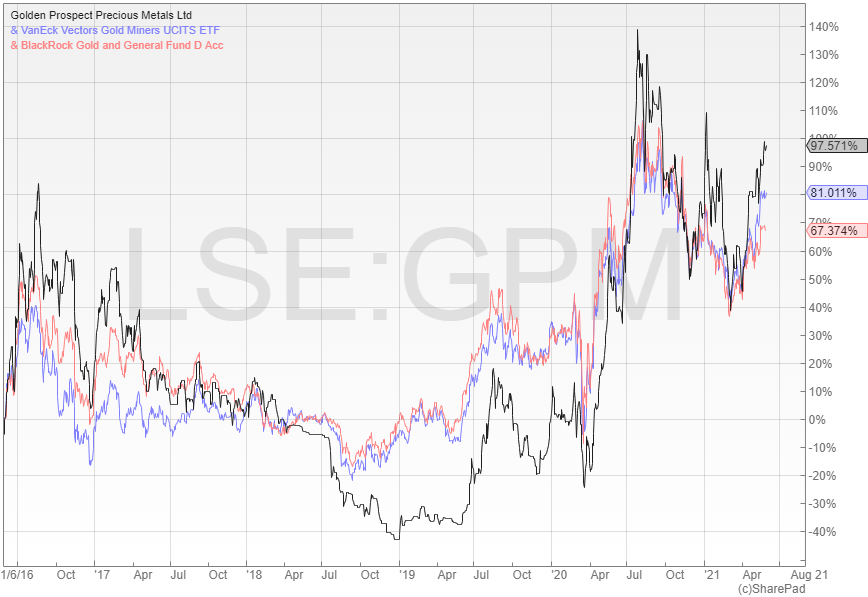

There are also a number of passively managed options with one of the best known being the VanEck Vectors Gold Miners UCITS ETF (LON:GDX). This mirrors the performance of the NYSE Arca Gold Miners index that tracks the largest publicly-traded companies operating in the sector worldwide. It has generated an annualised return since the launch in 2015 of 9.4%.

The only investment trust that provides a pure exposure to gold and silver miners is Golden Prospect Precious Metals (LON:GPM), which my colleague Simon Cawkwell has been advocating for some time. It has total assets of around £50m and is available at a small discount to NAV.

Investing in the actual bullion

Another option is to buy the actual gold or silver itself and there are various places where you can do this. These include the Royal Mint, as well as bullion brokers such as Sharps Pixley, which all have online platforms allowing you to buy and sell the metal in different formats.

Gold coins and small bars are popular but are expensive relative to their precious metal content and will trade at a premium compared to the larger bars. It is the same for silver, which also incurs 20% VAT unless it is stored in a London Bullion Market Association (LBMA) approved vault.

You can expect to pay commission and a bid-offer spread on each purchase or sale and there is also a storage and insurance cost for keeping the metal in their vaults. If you decide to withdraw the bullion you will have to pay a delivery charge and arrange to store and insure it yourself.

Coins such as gold Britannias and Sovereigns that are legal tender do not incur Capital Gains Tax when sold at a profit. This can be a major factor if you are likely to exceed your annual exempt amount of £12,300.

The pandemic had a major impact on the supply and demand of physical bullion and caused significant distortions to the futures markets. Most mines and refineries are now getting back to normal, so it is likely to be the investment demand that drives prices from here.

If inflation picks up and interest rates are kept in check because of the high level of debt, gold and silver should both move higher, although not to the extent of some of the wild forecasts that you can find online. Strong demand from retail investors aided by the Reddit-inspired silver squeeze has pushed up the premium on small bars and coins, but the physically-backed ETFs and gold mining funds provide a cheaper and more flexible alternative that should do the job.

Remarkable to read an article about Gold that doesn’t mention the forthcoming changes coming from Basel 3 and whether it will have an effect on the bullion banks trading. Gold moved down at the end of last year because the negative real interest rate on the 10 year declined. It started to pick up in March when the yield on the 10 year failed to keep pace with the increase in the CPI. It’s a shame that there are very few silver miners on the London market.

Secondary thoughts: the best security is to own Gold Bars (with serial numbers) stored by a non-bank in a safe overseas jurisdiction e.g. Australia, Canada or Switzerland. Of course there are costs and you rely on the broker being competent and not fraudulent.

I have read that the aggregate £ amount owing under Physical ETFs is greater than the value of the Gold held: worrying,

CGT: unfortunately on sale you have to pay 10% or 20% of the Gain above £12,300. You may be able to sell a limited amount within £12,300 Gain, and later buy back in. There were rumours HMG will reduce the £p Annual Exemption.

Gold Coins are exempt from CGT, but the premium price above Gold makes them uneconomic.