Polar Capital Global Financials: strong performance with more to come

The global financial sector has experienced a significant turnaround in the last few months, and if the economic recovery continues there is still plenty more upside potential.

Many financial stocks have been through a prolonged bear market that began with the global financial crisis when the sector experienced huge losses. The government response to cut interest rates and compress yields has kept margins under pressure ever since, as banks rely on the difference between savings and mortgage rates to generate their profits.

There has been a remarkable improvement in returns in the last few months as the global economy started to recover from the pandemic and yields ticked up. The cyclical nature of the sector means that it typically outperforms at this point in the cycle, yet the underlying valuations are at a material discount to the broader market.

On average, the price to book ratios of global banks and financials are now 1.1x and 1.3x respectively, versus 2.9x for global equities. The PE ratios of 11.1x and 12.4x also compare favourably to the 19.5x of the broader market, which is not that surprising given that since the October 2006 relative peak, the MSCI ACWI Financials total return is only 103%, less than a third of the MSCI all-country world index total return of 315%.

A direct way to benefit

A direct way to benefit would be to invest in the £304m Polar Capital Global Financials Trust (LON:PCFT). The company has re-rated in the last few months, but the tailwinds are likely to be supportive for the foreseeable future and should enable a sustained improvement in returns.

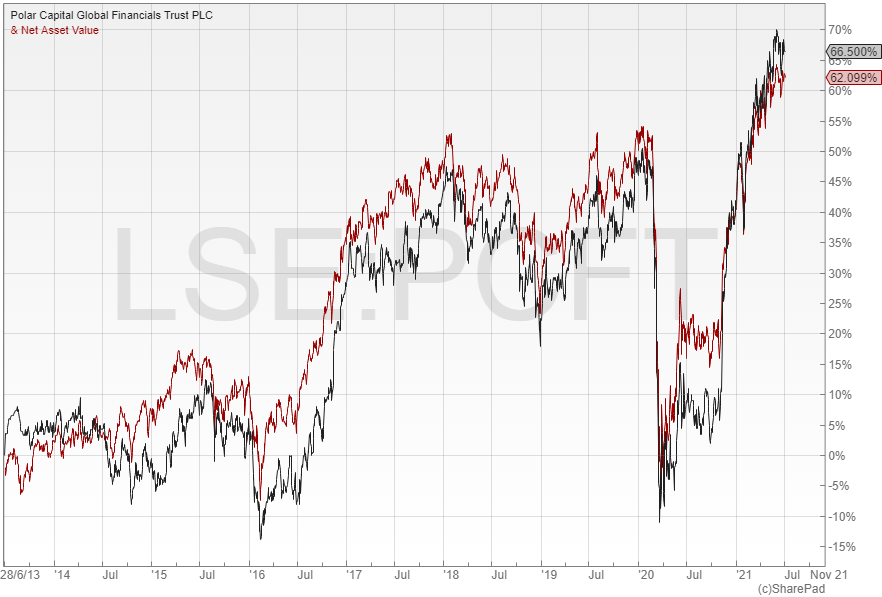

PCFT has just reported its interim results for the six months to the end of May in which it made a NAV total return of 22.2%, which was well ahead of the MSCI World total return of 9.3%. The performance was helped by a well-timed re-positioning in favour of the banks, especially the US regional banks, as well as a healthy level of gearing that currently stands at nine percent.

At the end of May the banks made up 63% of the portfolio, with the next largest allocations being insurance (16%) and diversified financials (13%). There were a total of 80 positions headed by the likes of JPMorgan, Bank of America and Chubb, with the main country weightings being the US (44%), Europe (20%), Asia Pacific ex Japan (18%) and the UK (11%).

Strong upside potential

A first interim dividend of 2.4 pence per share has been declared for the current reporting period, which is in line with last year. If the dividend is maintained at the same annual level of 4.4p by using the revenue reserves it would give the trust a prospective yield of 2.6%.

PCFT shares currently trade at a two percent premium to NAV, after languishing on a discount for most of the last decade, but there is still plenty of scope for further strong performance. If inflation expectations pick up and yields/interest rates increase at a steady pace, the global financial sector could be one of the major beneficiaries.

The broker Investec has a buy recommendation on the fund and says that the sector’s cyclical characteristics are highly supportive as global economic activity continues to recover. They believe that the company has an important role to play as investors look to inflation-proof their portfolios.

Comments (0)