The peer-to-peer investment trusts that pay a 7% yield

Investors looking to tap the peer-to-peer (P2P) lending boom would do well to seek out a suitable investment trust in the sector. Investment trusts are the ideal vehicle to provide exposure to less liquid parts of the market, as investors are able to buy and sell the shares on the stock exchange whenever they want without it affecting the underlying portfolio. The best known examples include property, private equity and infrastructure funds, but it is also relevant for the relatively new area of P2P lending.

P2P has grown rapidly since the 2008 financial crisis as it allows people to bypass the banks with individual investors able to lend to individual borrowers. Cutting out the middleman makes it possible for investors to earn a better return and for the borrowers to pay a lower rate of interest.

The advantage of investing via one of the funds is that it offers much greater diversification across different borrowers, platforms and geographies. You also benefit from the due diligence of the investment manager in selecting the best loans and don’t have to tie your money up as you can sell your shareholding whenever you want.

There are six P2P investment trusts listed on the London Stock Exchange and between them they have a combined market value of just over £1.5bn. Four of them yield over 7% − the other two are just getting started – and they are trading on an average discount to net asset value (NAV) of almost 5%, which makes them worth a closer look.

P2P Global Investments (LON:P2P) is the oldest and largest of the funds, with a market value of £700m. It aims to provide shareholders with an attractive level of dividend income and capital growth and by the end of August it had built up a portfolio of 138,000 peer-to-peer loans.

P2P has achieved a steady NAV and for the first 18 months or so the shares traded at a healthy premium, but at the start of 2015 they entered a steady decline and are now close to a 20% discount. A lot of this is due to the poor sentiment arising from a scandal in America at the P2P provider, Lending Club, as well as fears about the impact of Brexit on bad debts, but the shares are now yielding over 7% with established quarterly dividends, which suggests that much of the bad news is already priced in.

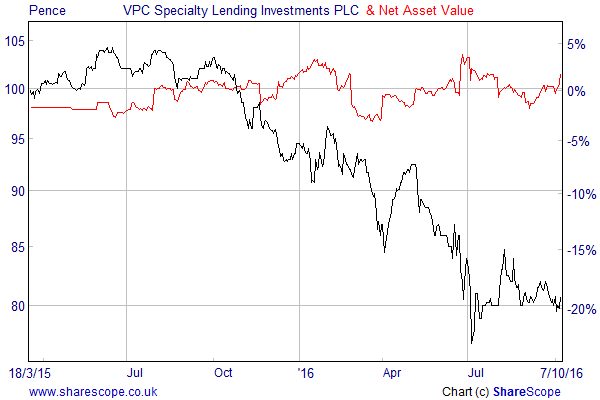

The second largest fund in the sector, VPC Speciality Lending (LON:VPC), is also trading on a double digit discount of 16.3% and yielding just over 7%. It listed on the stock exchange in March 2015 and by the end of August had established a portfolio of 636,000 loans of which 71% were to consumers and 29% to small businesses. Most of these were in the US with the UK making up just 18% of the overall exposure.

VPC has followed a similar path to P2P Global Investments with the shares sliding from an initial premium to a large discount. At 80p they are now 20% below their issue price and the company has also had to cut its first quarterly dividend for the year, from 2p to 1.5p, and dip into its reserves to pay for part of it.

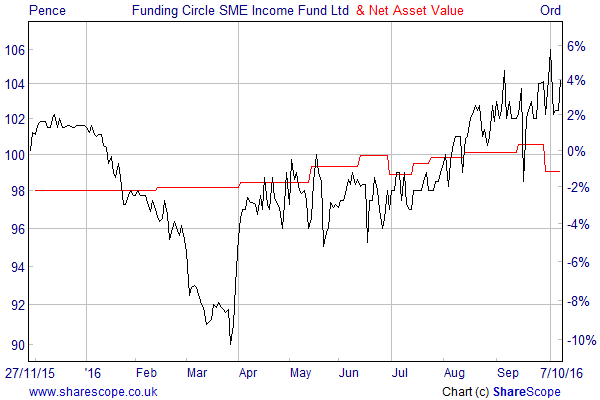

Investors have fared better with Funding Circle SME (LON:FCIF), which launched in November 2015 and is trading about 4% above its issue price of a pound a share. The fund raised £160m and by the end of August it had used this money to make a total of 2,200 loans to small businesses in the UK, US and Continental Europe, with about two-thirds of the portfolio exposed to companies based in this country.

FCIF has recently declared a quarterly interim dividend of 1.625p per share that is payable at the end of October. If it maintains this level for the rest of the year it would give the fund a prospective yield of just over 6%, assuming that it can successfully finance the payments.

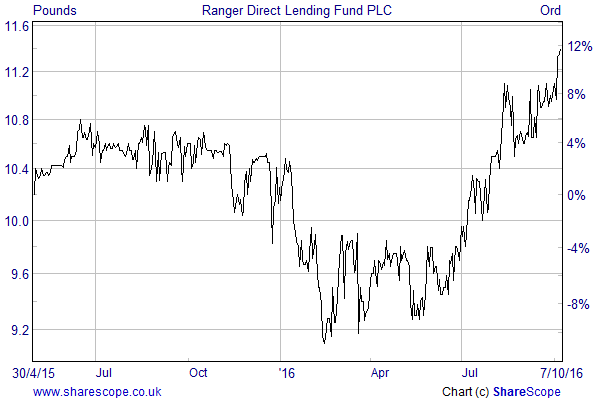

Ranger Direct Lending (LON:RDL) launched in May 2015 and is targeting a 10% dividend yield based on the issue price once the portfolio is fully invested and the leverage is in place. Almost three-quarters of the loans are secured with most of them originating in the States. RDL shares are up 14% on the issue price of £10 and trade at a small premium with the dividend building up nicely.

The £150m Honeycomb Investment Trust (LON:HONY) has an even shorter track record having floated in December 2015. It is aiming for a dividend yield of 8% on the issue price, but is still building up towards it and the shares are pretty much unchanged since launch. The only other option is the SME Loan fund (SMEF), which is much smaller at just £50m.

Gordon Smith, a fund analyst at the broker Killik and Co, says that they currently favour Funding Circle SME Income as it is focused solely on the small business market where there are greater barriers to entry due to the requirement for a manual element of the underwriting process.

“Since its launch in 2010, Funding Circle has built an experienced risk and analytics team and grown to a market leading position within the UK. The company is focusing on secured lending or, where unsecured, the majority of loans carry personal guarantees from the underlying company directors.”

He goes on to say that Funding Circle provides greater transparency on the underlying loan book and charges lower fees with the investment trust only exposed to platform servicing fees and not management or performance fees like many of the others.

“Funding Circle also applies more modest levels of leverage – up to 25% of net assets versus 150% targets for some of its peers – and whilst this translates to a lower target return we think this is prudent given the fact that the sector remains in its infancy.”

Comments (0)