Keeping the Faith at the Monks Investment Trust

A few weeks ago I wrote about the challenges facing Scottish Mortgage (LON: SMT), whose growth-oriented approach has been put under severe pressure by the sharp rise in interest rates. It is a similar story at its less well known stablemate Monks (LON: MNKS),which offers a lower risk way to benefit from this type of strategy.

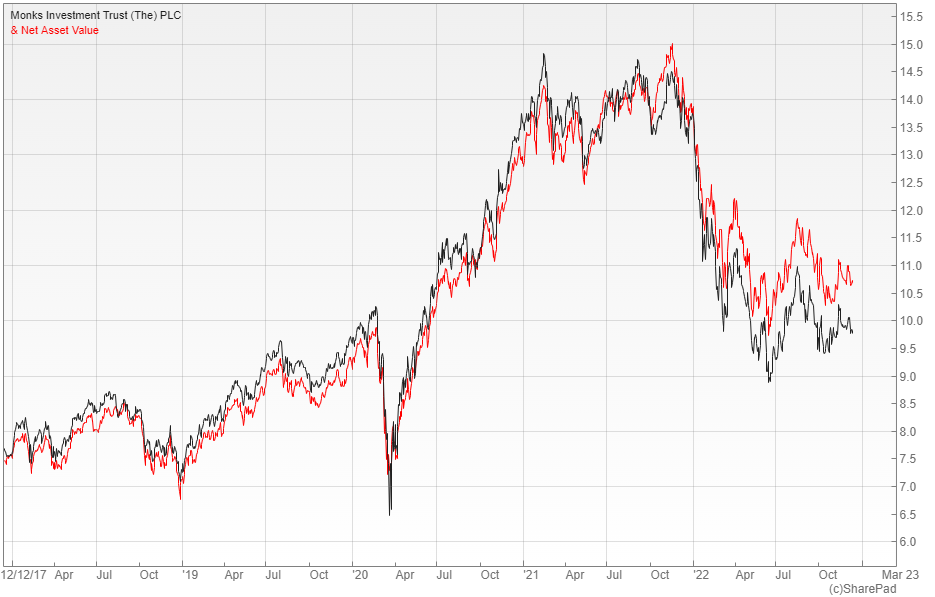

The £2.7bn Monks aims to harness the best of Baillie Gifford’s global ideas, but has a much smaller allocation to China (3.2% of NAV versus 18.3%) and unquoted investments (5.3% versus 35.6%) relative to Scottish Mortgage. This hasn’t been enough to stop it from going through a difficult time, with the shares down around 30% in the last year, although there has been some stabilisation in the relative and absolute returns in recent months.

In the latest interim accounts, the manager underlined the importance of a consistent approach, yet there was also a degree of pragmatism evident as a rigorous review of the portfolio had resulted in an uncharacteristically high number of sales. These included quite a few Chinese holdings, where there appears to have been a significant change in Baillie Gifford’s view recently.

Keeping the Faith (in a Pragmatic Kind of Way)

Monks is still operating in an extremely challenging environment, with the manager noting that the sort of structurally expanding businesses that they invest in, particularly those where the profits lie a few years out, remain out of favour. Despite this they are keeping faith in their strategy of identifying and owning growth companies for the long run and are confident that their holdings are well-placed to navigate a period of rising costs and potentially weaker demand.

This did not stop them carrying out a ruthless weeding exercise that saw them sell 20 holdings in the six months to the end of October. These consisted of stocks in three broad categories: those materially challenged in an inflationary environment or a potential tapering of consumer demand; China; and those where the investment case has played out or where the manager has been disappointed by the company.

The change in respect of China is the most interesting aspect, with the manager saying that the prevailing regulatory environment makes it increasingly difficult for private enterprise to generate the supernormal profits that they look for. On a more positive note, the sharp sell-off has allowed them to acquire several high quality companies such as Adobe and Royalty Pharma at attractive valuations.

Outlook

Writing in the accounts, the manager highlighted the superior gross margins of their rebalanced portfolio (40% versus 29% for the broader market) and lower indebtedness (net debt to equity of 10% versus 50%), which are particularly important given rising input and funding costs and less certain demand. Looking ahead, the forecast level of growth is double the market over the next 12 months, with the manager’s conviction strengthening over longer periods.

In the year to date Monks shares are down 28% and are currently available at an eight percent discount to NAV, whereas Scottish Mortgage has lost 43% and is trading on a similar discount. It is also worth noting that Monks has one of the most active buyback programmes in the investment trust industry, a policy that has helped to enhance the NAV and reduce the discount volatility.

Investec like Monk’s differentiated approach to growth, which provides a diversity of different return drivers and results in a varied and balanced portfolio. They regard it as a core holding for investors looking for a well-managed and low-cost global growth portfolio and have issued a buy rating.

Comments (0)