Is RIT Capital Still A Decent Defensive Option?

Last year was a disappointing one for investors in the four billion pound RIT Capital Partners Trust (LON: RCP), which reported a loss of 13.3% in its annual accounts to the end of December. The poor result has prompted the broker Numis to question whether it is still delivering the same defensive long-term return profile that has made it so popular over the years.

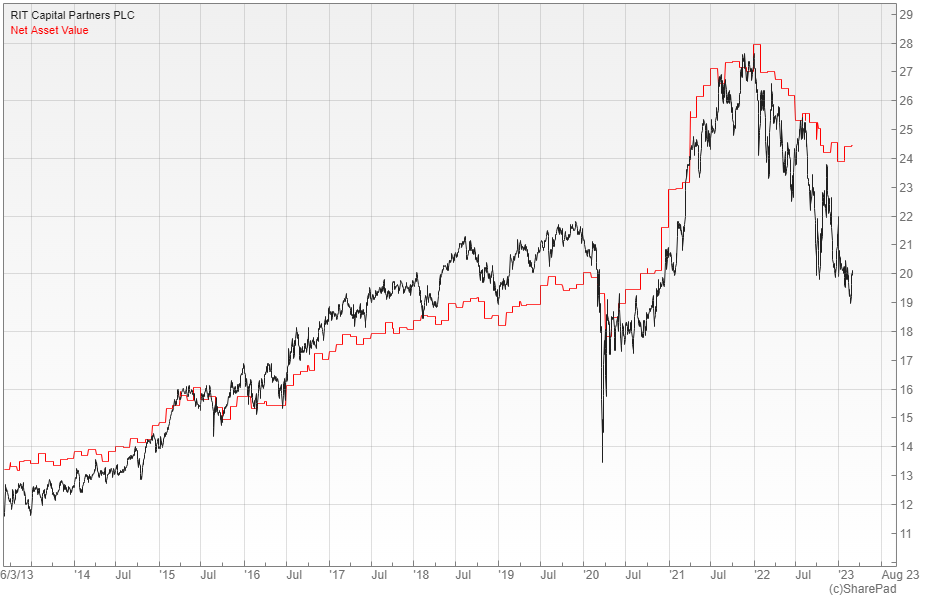

RIT aims to deliver long-term capital growth, while preserving shareholders’ capital but doesn’t have a formal benchmark. Despite last year’s poor performance it has built up a good long-term track record with a share price total return of 11.2% per annum since it was listed in 1988, which represents a meaningful outperformance of global equity markets.

At the end of December the portfolio was mainly invested in three key areas: quoted equity, which consisted of 35% of the assets; private equity that made up another 41%; as well as absolute return and credit that accounted for a further 20% of the fund. Unfortunately over the course of the year the first two of these categories were responsible for losses of 6.7% and 6.2% respectively.

Under The Bonnet

The quoted equity component consists of a mixture of long-only funds, direct stock holdings and hedge funds. During the year the manager shifted the allocation away from growth assets towards more value-oriented strategies to better reflect the current reflationary environment and achieve more of a balance with the growth-focused private investments.

RIT’s unquoted portfolio is also split between direct holdings and third party funds, with the write-downs in the last 12 months mainly being driven by the de-rating in listed stocks that are used to provide the comparable earnings multiples. It is important to appreciate however that this area has been a significant source of growth and has delivered compound returns of around 25% per annum over the last 10 years.

All of the direct private equity investments were valued at 31 December for the year end NAV, while 94% of the private third party fund valuations were end of September with six percent end of December. This suggests that the closing net asset value for the accounts should have been pretty reliable with no meaningful lag.

Where Do We Go From Here?

The managers note the indiscriminate selling of long-duration assets and expect the market to become more receptive for companies with healthy cash flows and continued growth, which may benefit the high-quality private companies and quoted biotech exposure in the portfolio. They are also finding compelling opportunities in Japanese stocks that are benefiting from low valuations and improving governance.

The broker Numis believes that RIT continues to have the potential to deliver the type of risk/return profile that investors generally expect from its approach, with more resilient NAV performance in falling markets, but typically lagging in a strongly rising environment. They point out that it has not pitched itself as an absolute return fund, but aims to insulate against the worst of market declines while participating in the market upside.

Over the last decade, throughout which the existing management team has been in place, Numis calculate that the NAV returns have participated in 64% of the market upside and only 34% of the downside, which constitutes a defensive return profile. They think that the current wider than normal discount of 18% offers an attractive opportunity to buy a manager with a strong long-term track record.

Comments (0)