Investing in a rising-rate, rising-yield environment

It has been a tumultuous few weeks for UK investors with the political shenanigans in Westminster creating huge uncertainty. September’s ‘mini budget’ put immense pressure on the pound, with gilt yields and interest rates moving sharply upwards. Although things have since calmed down, there is no doubt that the days of ‘free money’ are over.

The fallout from the mini budget was astonishing, forcing one U-turn after another, leading to the replacement of the chancellor and the prime minister. There is obviously still a lot to sort out, but the initial crisis seems to have passed and we now await further clarity on what is to come.

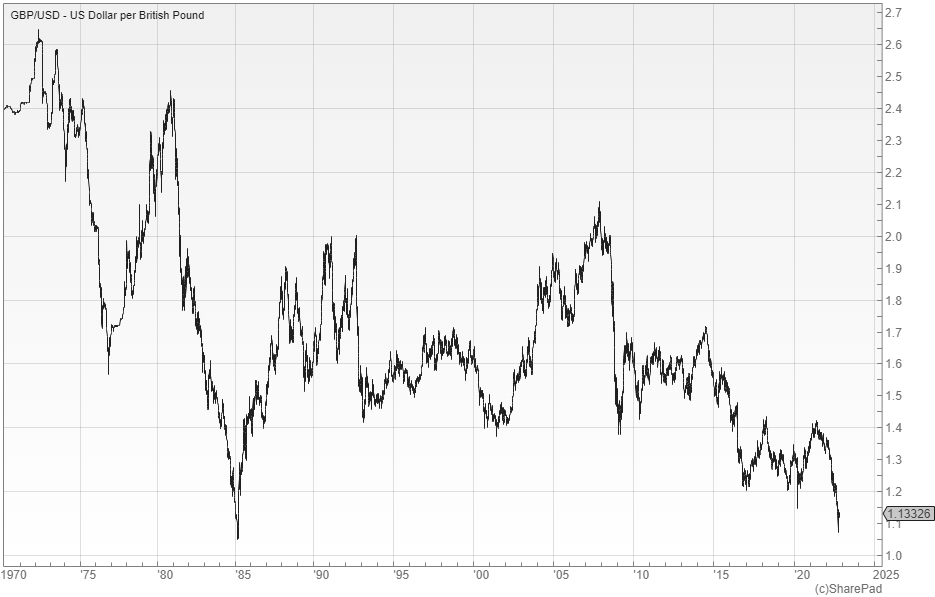

Kwasi Kwarteng’s short-lived tax-cutting spree prompted fears that the pound could reach parity with the dollar, with sterling falling to levels last seen in 1985. This shows how severe the situation was. There were concerns that the government’s plan to target growth would actually result in more borrowing and higher inflation.

UK 10-year gilt yields surged to around 4.5% immediately after the budget, their highest level in many years. This forced the Bank of England (BoE) to start buying government bonds, after previously announcing the intention to reduce the size of its balance sheet, to stabilise the financial markets.

The steps taken to rectify the situation have put a floor under the pound and allowed gilt yields to ‘soften’. UK share prices have clawed back some of their initial losses. It is likely that the appointment of Rishi Sunak as the new prime minister will reduce the pressure and volatility in the gilt market, although the fundamental, longer-term issues remain.

The BoE faces a tricky balancing act as it needs to raise rates materially to bring inflation under control, which could exert upward pressure on gilt yields. However, a rising rate environment could trigger a recession that would add further pressure on the pound.

Where are we heading?

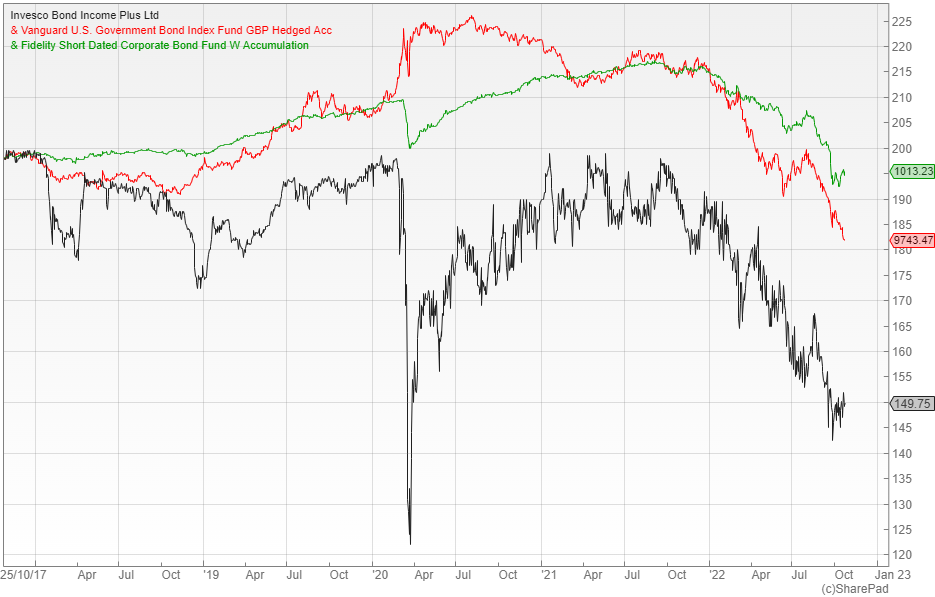

The bond market was one of the biggest casualties of the chaos in Westminster. In the first few days after the chancellor’s speech, the dollar-denominated Bloomberg Global Aggregate Bond index slipped to a 20.8% year-to-date loss, wiping out a decade’s worth of total returns in the process.

Mick Gilligan, portfolio manager at Killik & Co, says that it is reasonable to assume that inflation will eventually come back close to the BoE target of two percent. If that’s the case he thinks that fixed income looks attractive, given the amount of good-quality bonds that are yielding between four and seven percent.

His favoured play is Invesco Bond Income Plus (LON: BIPS). It is currently paying a 7.2% yield and is available at a three percent discount to NAV (net asset value). The trust has fallen 22% in the last 12 months as its fixed-interest portfolio has weakened in the face of rising interest-rate expectations.

Jason Hollands, managing director of Bestinvest, thinks that UK inflation is likely to peak at around 11% this year, but should then abate, in large part due to the energy price guarantee, although it could take some time to return to the long-term target:

“My feeling is that interest rates could peak at around five percent, but there are many moving parts. The Bank of England will need to be mindful of collapsing the housing market, so I wouldn’t rule out a pause or pivot in the New Year if inflation shows signs of slowing and the pace of economic deterioration accelerates.”

He says that people might be tempted to buy gilts given the yields on offer, but that US Treasuries look a safer option, although he advocates hedging the currency back to sterling. One way to do this would be to use the Vanguard US Government Bond Index GBP Hedged fund.

Ryan Hughes, head of active portfolios at AJ Bell, warns that those who want exposure to fixed income should remain in short-dated bonds for the time being, until there is more certainty:

“The Fidelity Short Dated Corporate Bond fund focuses on investment-grade bonds and currently has a duration of 2.5 years and a yield of over 3.5%. While things may still be bumpy, this is a solid fund that should insulate from any increases in volatility in the bond market.”

The most vulnerable areas of the market

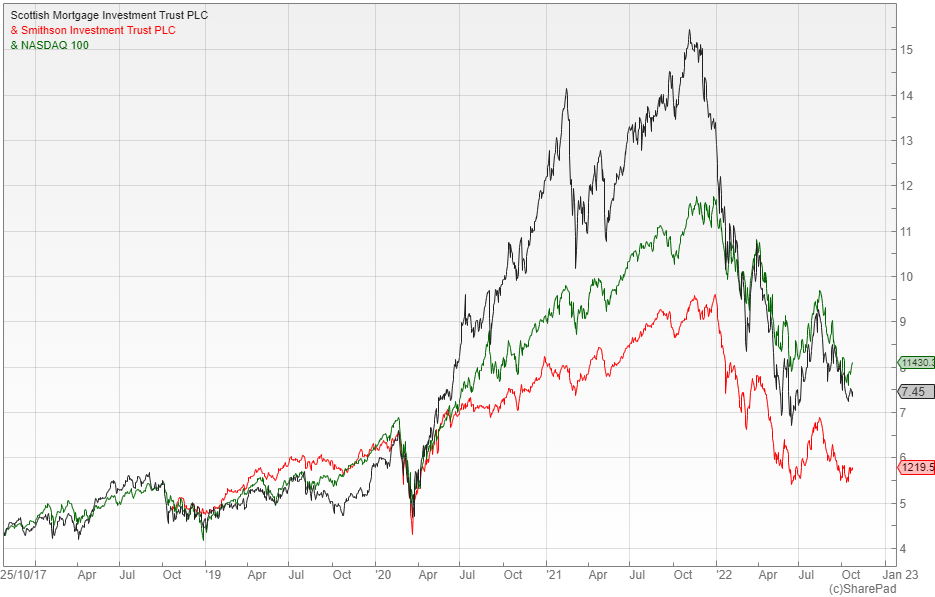

When interest-rate expectations rise sharply, the areas most at risk of a large sell-off are long-duration assets such as long-dated bonds and growth stocks. One way to measure the performance of the latter is to look at the tech-heavy NASDAQ in the US.

Towards the end of last year, the index hit an all-time high of around 16,000, but it has now slipped below 11,000, a decline of more than 31%, putting it firmly into bear-market territory. Funds that invest in these types of growth stocks have also struggled.

A case in point is the popular investment trust Scottish Mortgage (LON: SMT). It has built up an excellent record but has been going through a tough time as a result of the change in the macroeconomic environment. The shares have halved in value since peaking at more than £15 in 2021 and are currently available on a 12% discount to NAV.

It is a similar story with growth-oriented Smithson (LON: SSON), which has fallen from a high of around £20 to close to £12 and is trading on a nine percent discount.

Many asset classes have been affected:

“Rising interest rates increase the cost of capital and have an impact on just about every asset class. Some areas are more sensitive though, particularly those with refinancing needs in the near term, which is why we have seen commercial-property and infrastructure investments hit quite hard as the market prices in higher borrowing costs in the future,” explains Hughes.

James Yardley, senior research analyst at FundCalibre, says that they have not been in favour of fixed income for a long time because of its terrible risk-reward profile and the impact of quantitative easing (QE):

“We’re now starting to get interested again as it’s possible that the huge debt levels in the system will ultimately drive us back into deflation and more QE in a couple of years, which would be very good for bonds.”

Where next for the pound?

The sharp fall in the pound has boosted the value of many overseas investments, especially those denominated in US dollars. It has also helped to support the share prices of large-cap UK stocks with significant international earnings.

One beneficiary has been the City of London Trust (LON: CTY) whose shares are pretty much trading at the same level they were 12 months ago, although there has been a lot of volatility along the way. By way of comparison, the FTSE 250 index of mid-caps, whose constituents are largely dependent on the UK economy, is down around 25% over the same period.

Yardley says that the sterling-dollar exchange rate was oversold in the short term and that although the BoE’s intervention in the gilt market has strengthened the pound, it could be a disadvantage if the Bank is unable to stop its emergency support:

“The Bank of England printing money out of thin air and the Fed doing quantitative tightening (QT) is very negative for the pound. I think there is now a very high chance that we test parity unless the Fed relents its hiking cycle and QT very soon, because I don’t believe that the Bank is going to be able to do QT without breaking the gilt market.”

The easiest way for private investors to deal with the unpredictability of the foreign-exchange markets is to adopt a multi-currency approach. For most people, having a globally diversified portfolio that is exposed to many different currencies should work well over the long term:

“Dollar strength against all other major currencies has been a key theme this year, causing real pain for lots of countries. It is an inflationary headwind for many imports, including energy which is priced in dollars, as well as for emerging-market governments and corporates who have issued dollar-denominated debt,” explains Hollands.

No trend goes on forever and one trigger for a reversal would be when it is clear that the Fed is coming to the end of its aggressive hiking cycle. The dollar strength has helped to cushion investors from underlying losses on their US and global funds, but there is a real risk that people will get ‘burned’ when it flips around.

The best investment trusts

Gilligan says that there are very few investments that can make positive gains in a rising rate environment:

“I think BH Macro (LON: BHMG) should continue to make healthy NAV gains while volatility remains elevated. However, I would caution against buying too much on a short-term view given the high 14% premium to NAV.”

He also suggests looking at trusts that should preserve capital while rates are rising and that are well-placed to take advantage of opportunities from a shakeout in the markets. For this he recommends Capital Gearing (LON: CGT) and Personal Assets (LON: PNL).

Both of these trusts would come into their own in the event of an extreme market sell-off, at which point they would be likely to materially increase their equity exposure, which should leave them well-positioned for the next 10 years.

Hughes says that commodities have historically proven to be a useful hedge against inflation and that the BlackRock World Mining Trust (LON: BRWM) is managed by one of the most experienced teams in the market:

“The trust gives exposure to a wide range of commodity producers with copper and gold featuring heavily. Large holdings include BHP, Glencore and Anglo American with the fund yielding over seven percent at present, as the underlying companies return their excess profits to shareholders.”

The best funds

Yardley says that renewable-energy benefits from RPI-linked government subsidies and higher power prices are his reasons for recommending the VT Gravis Clean Energy Income fund:

“There are many renewable-energy investment trusts available with high dividends, but VT Gravis Clean Energy Income is the perfect play on this theme as it invests in a number of them. It provides an anchor to portfolios through defensiveness and steady income with a 3.5% yield, which is a great way for income investors to protect themselves from inflation.”

Hughes prefers FTF Clearbridge Global Infrastructure Income. It invests in infrastructure around the world, albeit with a focus on the utilities that provide our energy needs:

“This gives it significant exposure to electricity, gas and renewables as well as the more typical broader infrastructure plays such as toll roads, rail and airports. The team at Clearbridge are hugely experienced and the fund offers both a hedged and unhedged share class depending on your view of sterling at the moment,” he says.

Another option Yardley suggests is Cohen & Steers Diversified Real Assets, which combines the wide range of expertise at Cohen & Steers with a portfolio that can offer attractive returns with solid inflation protection:

“While this fund is a relative newcomer to the UK market, it offers investors a single destination for a range of inflation-protecting assets, built with an eye on diversification, as well as returns. It should also offer investors a return profile very different from other funds, which we believe makes it a compelling choice, especially in tough inflationary environments.”

Alternatively, he singles out LF Ruffer Diversified Return, a fund that aims to generate consistent positive returns, regardless of how the financial markets perform. It has the protection of capital at the heart of its process and is the open-ended equivalent of the Ruffer Investment Company (LON: RICA).

For a more ‘aggressive’ option Hughes recommends the Xtrackers MSCI World Financials UCITS ETF, which provides exposure to over 200 of the world’s biggest financial companies for 0.25% per annum:

“As interest rates increase, financial companies are able to grow their profitability as the spread they earn on lending compared to saving typically expands. As a result, having exposure in this environment could be a sensible way to embed some protection from rising rates.”

Large-cap UK equity funds

Hollands says that he would focus on large-cap UK equities at the moment, because the FTSE 100 has very high exposure to energy, consumer staples and healthcare − the three sectors that have historically outperformed during periods of high inflation and low growth. It also has a very low weighting in growth sectors like tech.

His first pick is TM Redwheel UK Equity Income, which is managed by Nick Purves and Ian Lance, who take a long-term approach, targeting companies that they believe are trading well below their intrinsic value, with the potential to rerate over time. It is currently yielding 4.3%:

“This means that the fund has little exposure to the types of growth stocks that are particularly vulnerable in a rising rate environment. It has 19% invested in energy companies, which are one of the most defensive sectors during periods of poor growth and high inflation, as well as 18% in financial companies that can benefit from rising rates.”

For those who prefer passively managed funds, he suggests the iShares Core FTSE 100 UCITS ETF, a low-cost way to gain exposure to UK large-caps, with tiny annual costs of 0.07%.

Another active option is TB Evenlode Income. It mostly invests in large, international, UK-listed businesses alongside a handful of overseas holdings. Around 85% of the portfolio’s revenues are made outside the UK, which means that it will benefit from the strength of the dollar when converting the revenues back to sterling:

“About 78% of the portfolio is invested in companies with low economic sensitivity that helps to mitigate the squeeze caused by higher borrowing costs. The managers target businesses with strong cash flows and avoid those with high levels of borrowings, as the latter will struggle to refinance on favourable terms with interest rates rising globally.”

Lots of ideas in the Sudbury article. Lots of coulds, would, might, in the past ….

Lots of blah, blah, blah ….

PS I do not think that sterling will see dollar parity. Now euro ….