Has the Chinese tech sell-off created a buying opportunity?

A regulatory crackdown by the Chinese authorities has sent the shares of some of its largest technology companies down sharply with the investment trusts that specialise in the country being badly affected.

There have been almost 50 different interventions since November, when the Chinese government stepped in to prevent the floatation of Ant Financial, a multi-billion dollar financial technology firm that was to have been spun out of the e-commerce giant, Alibaba. Technology companies, delivery businesses and education providers have all been affected and there could be further measures to come.

The area hit hardest is education, but there have also been other notable casualties including the ride hailing app Didi (down by 27% in six months) whose shares plummeted soon after its US IPO when the Chinese authorities launched a data-security investigation. Tencent Holdings’ shares are down 36% after Wechat suspended taking on new users until early August as it upgrades its security system and its music business faces competition regulation, while delivery company Meituan (down 48%) is being pushed to improve working conditions.

Analysis by Numis shows that Tencent, Alibaba and Meituan together make up around 30% of the MSCI China benchmark, with the three most heavily exposed investment trusts each having about a twenty percent allocation. This underweighting has obviously helped to reduce the damage, but Fidelity China Special Situations (LON: FCSS), Baillie Gifford China Growth (LON: BGCG) and JPMorgan China Growth & Income (LON: JCGI) have all still been badly affected with six-month losses of 18%, 21% and 26% respectively.

Caught in the crossfire

The most surprising of these given its value stance is FCSS, although manager Dale Nicholls has responded to the sell-off by saying that the Chinese tech companies are trading at significant discounts to their global peers. He acknowledged that the business models will probably need to be revised as a result of the regulation, yet said that on a risk-reward basis there is the potential to buy at a comparatively cheap price.

BGCG and JCGI both have more growth-oriented strategies, so their exposure to this area was to be expected. It is yet to be seen how the managers will react, although Baillie Gifford tends to stay focused on long-term growth opportunities and has typically been willing to ride-out periods of market volatility or use them as buying opportunities for its preferred stocks.

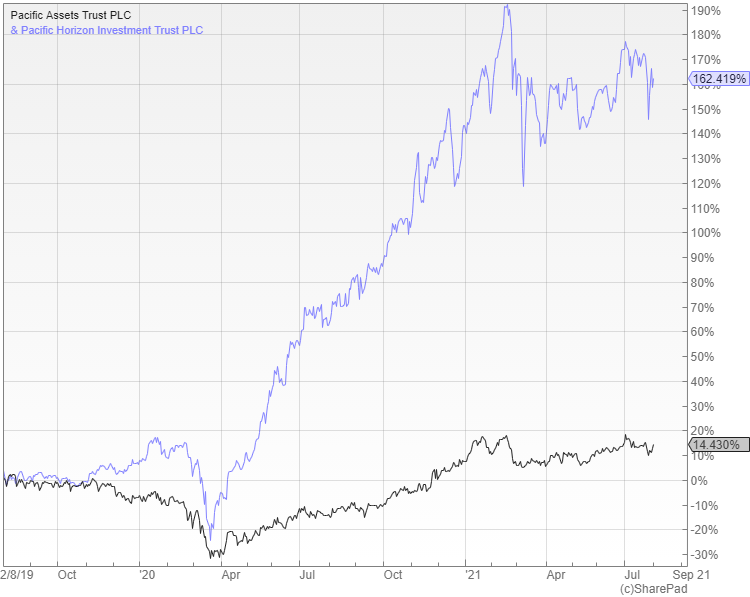

Those trusts that invest in Asia as a whole have been less affected with Pacific Assets (LON: PAC) having no allocation to the Chinese tech giants as they have not typically met the managers’ definition of quality. Pacific Horizon (LON: PHI) that is run by Baillie Gifford only has a low exposure because it has been rotating out of the sector in favour of more cyclical companies.

Buying opportunity?

The interventions have provided a sharp reminder about the regulatory risks of investing in China and these will persist, although the fears should moderate as the country is well aware of the importance of economic growth and innovation as well as the need to create new employment opportunities. If you are uncomfortable about the high level of government oversight, it would safer to invest in one of the regional Asian trusts where the manager has more scope to mitigate the threat.

Given the scale of the sell-off it is perhaps surprising that the discounts haven’t really opened up to create any compelling value opportunities, although Numis point out that JPMorgan China Growth & Income stands out as it is available on a small discount, whereas many of its peers still trade at a premium.

They also think that Baillie Gifford’s Pacific Horizon may be an interesting opportunity as it has de-rated even though its direct exposure to the large the tech stocks is quite low. For more defensively minded investors they suggest Pacific Assets that has again proved its resilience, but is much more of a ‘steady Eddie’.

Comments (0)