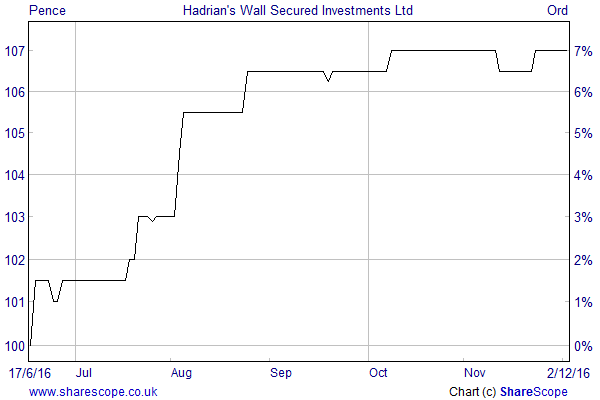

Hadrian’s Wall is an attractive proposition for income seekers

Since the financial crisis of 2007-09 the banks have pulled back from some of their traditional lending activities and left a gap in the market that others have been able to take advantage of. A prime example is loans to small and medium sized enterprises (SMEs), with many of these organisations having to look elsewhere for the capital they need to run their businesses.

Lending to SMEs can be a lucrative area as the interest rates are normally higher than for personal loans and can be up at the 9% or 10% level. The challenge is to make sure that the borrowers can pay it back, which is why a new secured lending fund operating in this sector is worth a closer look.

Hadrian’s Wall Secured Investments (LON:HWSL) raised £80m when it floated on the LSE in June. It will use the money to invest in UK commercial loans secured by assets such as equipment, plant and machinery, property and trade debtors. Once the capital has been fully deployed the fund will target an annualised dividend yield of at least 6% on the £1 issue price and it expects that this will increase over time.

It had been hoped to attract in excess of £150m of funding from the initial placing but the demand was lower than anticipated, although there was no shortage of potential borrowers, with the fund having letters of intent in respect of £500m of investment opportunities. These were from the likes of the specialist lender Wellesley & Co, the peer-to-peer provider Landbay Partners and the online platform FundingKnight.

The fund is run by International Fund Management Ltd, which is a part of the Channel Islands-based Praxis IFM Group, but the management has been delegated to Hadrian’s Wall Capital Ltd, a specialist that operates in this area.

A promising start

HWSL has recently issued its first quarterly newsletter covering the period from launch to the end of September. Initially the deployment of capital was held up by the result of the EU referendum, which took place immediately after the IPO, but things have now picked up and they expect to be fully invested during the first quarter of 2017.

The process of making a loan normally takes from 45 to 90 days from the first enquiry to the completion of the transaction with each of them typically in the £1m to £6m bracket. By the end of September they had evaluated £145m of potential investments of which £30m was still in progress. Their first loan was an advance of £5m on a five-year term to a company that provides auto leases with a 9% yield on the amounts drawn.

They conclude the newsletter by saying: “The Company has a strong visible pipeline of transactions meeting the Company’s return objective and expects to achieve the targeted level of dividends on an annualised basis once the capital is fully deployed.”

On the 31st of October the fund announced the payment of its maiden dividend of 0.2 pence per share covering the period to the end of September. The dividends will be paid quarterly and the annual management fee is 1% of net assets.

HWSL looks like a secure source of yield for income investors, but you would have to be prepared to pay a premium for the security as the shares are currently trading on a mid-price of 107p compared to the end of October NAV of just under 98p. This puts them on a premium of 9%.

If you think that is a little steep it is worth looking at some of the alternatives. For example, the MedicX fund (LON:MXF), which rents out primary healthcare properties, is trading at a 25% premium to NAV. The infrastructure sector is valued at an average premium of 12.5% and the asset backed debt sector – of which Hadrian’s Wall is a member – is trading on an average premium of 1.2%.

Peer-to-peer lenders

The other main providers that have stepped into the void left by the banks are the peer-to-peer (P2P) lenders that I discussed in October. These cater for different categories of borrowers and it is interesting to see the huge variation in the way the market thinks about them.

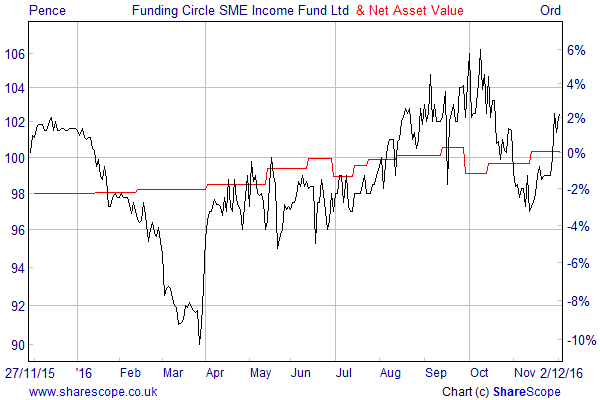

Funding Circle SME Income (LON:FCIF) is probably the closest to Hadrian’s Wall in terms of its target audience as it lends to small businesses. Most of its debts are secured or carry personal guarantees from the company directors.

FCIF has deployed more than £151m of its £161m capital with loans to 1,500 different borrowers. The fund aims to generate a target NAV return of 8% to 9% per annum with a target dividend of 6p to 7p per share. This would be equivalent to a yield of 6% to 7% based on the £1 issue price.

It has recently declared a quarterly distribution of 1.625p, and if the fund can maintain this level it would achieve its annual income objective. The mid-price of the shares is 101.5p which puts them on a 2% premium to NAV.

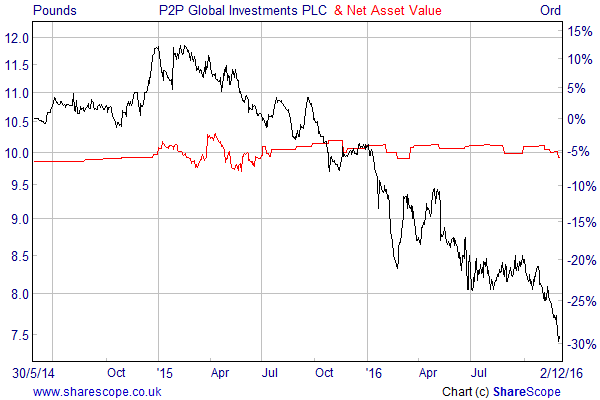

The market has a very different view of P2P Global Investments (LON:P2P), which makes unsecured loans to consumers and SMEs. It is much bigger with a market value of £620m, but the performance has been poor and the shares now trade on a 25% discount to NAV despite having an active share buyback programme. This puts them on a prospective yield of over 8%, although the market is obviously doubtful about whether the dividends will be paid.

Hadrian’s Wall and Funding Circle both appear to be on course to offer a 6% yield from a portfolio of secured loans to SMEs. They look like an attractive prospect for income investors despite trading at a premium to NAV. As long as they can meet their investment objectives they should be able to avoid the massive de-rating suffered by the likes of P2P Global Investments.

Comments (0)