Four investment trust bargains

There are a handful of investment trusts that are trading on unaccountably wide discounts despite recent strong performance, which leaves them well placed to be re-rated.

Stifel have just released some interesting research on the rotation from growth to value that has been brought about by the sharp increase in inflation and rising interest rates. In their report they point out that despite the extreme divergence in performance in January, when some value oriented trusts led their growth counterparts by around 10%, the respective discounts hardly moved.

For example, the small cap value specialist Aberforth Smaller Companies (LON: ASL) has had a strong 12 months and only lost two percent in the weak markets in January, yet it remains on an 11% discount. By contrast, the growth focused BlackRock Throgmorton (LON: THRG) fell 15% in the same month but still trades on a small premium.

Stifel believe that this suggests that the market is viewing the recent move as a short term ‘correction’ to overvalued growth stocks, rather than anything more significant. However, if the trend were to continue, there is clearly scope for the discount to narrow at Aberforth, which I covered in more detail last week.

Georgia on my mind

Back in November I wrote about Georgia Capital (LON: CGEO), the only investment trust that focuses on the Georgian market and that was available at a massive 56% discount to NAV. At the time I said that ‘it remains a strategic priority for management to sell one of the large portfolio company assets to provide a catalyst for the discount to narrow’ and that has now happened.

According to the broker Numis, the trust has completed the first stage of its disposal of 80% of its equity interest in its water utility business for US $180m. This holding constituted 18% of the fund’s portfolio at 30 September with the sale price being 13.2% higher than the book value, which is based on an independent valuation conducted twice a year.

Despite the news Georgia Capital is still trading at a 54% discount ahead of the release of its annual results that will include the end of December NAV. Numis believe that the local economy is likely to deliver solid growth over the next few years and that the discount offers significant value.

Select opportunities within UK commercial property

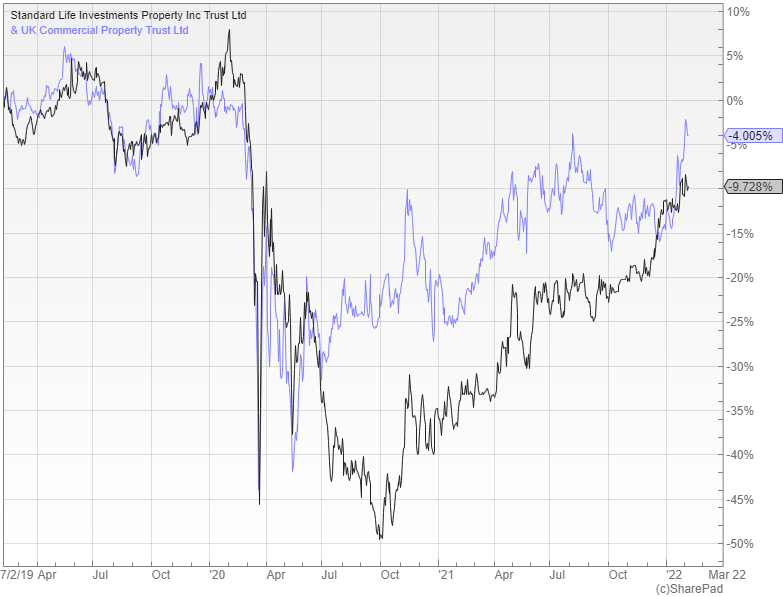

There are also some pockets of value in the UK commercial property sector with a prime example being the Standard Life Property Income Trust (LON: SLI). It has just reported an 8.5% increase in NAV for the fourth quarter, taking the total return for the year to an impressive 28.6%. The broker Investec rate it as a core strategic holding and say that the portfolio is well positioned for the current outlook.

Most of the trust is invested in strongly performing areas like industrials, although about a quarter is in offices which are expected to underperform following the pandemic. Despite its excellent track record the trust trades at an 18% discount to NAV with the shares yielding an attractive 4.5%. Investec has just reiterated their buy recommendation and describe the discount as inexplicable.

Another option is UK Commercial Property (LON: UKCM) that is available on a similar discount, although it is yielding a more modest 2.8% with only around 10% invested in offices. The trust has just announced an NAV total return of 9.5% in the fourth quarter and a significant increase in the dividend to give it a prospective yield of 3.5%. Numis believe that the discount represents an attractive value opportunity given the fund’s significant exposure to industrial assets where outperformance is expected to continue this year.

Comments (0)