Fixed Income ETFs for Avoiding Interest-Rate Risk

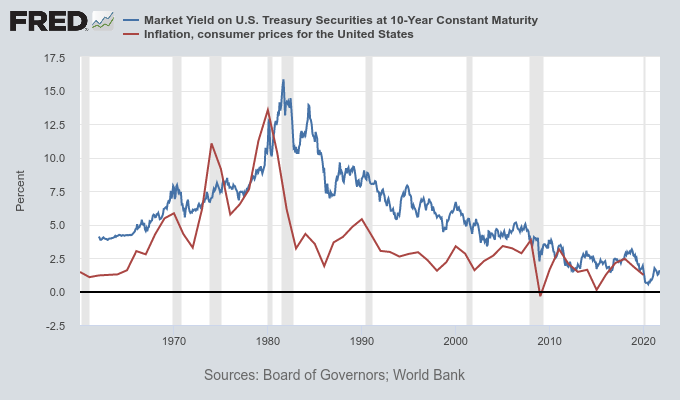

Looking back at bond yields over the last 40 years, all we can see is a steep, never-ending decline. Taking a US 10-year Treasury bond as an example, after hitting a yield of 15.8% in September 1981, the yield entered a prolonged downtrend and retreated to a level as low as 0.55% in July 2020.

Investing in long-term bonds has been a winning game when compared with investing in shorter-term bonds or money-market funds, as the declining yields have led to higher bond prices and lower reinvestment yields. All of this can be attributed to the increasing effectiveness of central banks at containing inflation at very low levels, and to the rising pool of global savings.

However, there’s a lower bound for interest rates (even if less than zero) and given the boom-bust business cycle as well as the potential for rising inflation, there’s no reason to expect rates to remain at the current low levels forever.

The yield on the 10-year Treasury was already reversing a decade-long trend when in October 2018 it rose to 3.15%. However, as inflation remained subdued and central banks kept purchasing assets while keeping their rate targets at very low levels, yields resumed the downtrend.

More recently, in August 2019, yields started rising again from 1.5% to 1.9%. But the pandemic rattled stock markets at the beginning of 2020 and policymakers forced yields down again to a low of 0.55%, in July 2020.

Fifteen or so months later, things have changed significantly. Inflation is climbing and finally forcing central banks to take action while the global economy seems to be heading towards a boom, not a bust.

At a time when global demand for products and services is recovering quickly, there is a global supply shortage of raw materials and labour, which is contributing to an escalation of prices. Whether this is a short-lived phenomenon or a new, lasting trend, remains to be seen. But the risks are unbalanced and clearly weighting more on the side of higher inflation and interest rates than the opposite. This leads us to a situation that is the reverse of what was experienced between 1981 and 2020, and yields may start reverting to some long-term, higher levels. That being the case, long-term bonds are no longer a good investment and may, apart from their high interest-rate risk, derive negative real returns for investors, turning into a liability instead of an asset.

Inverse relation between price and yield and the importance of duration

Before investing in bonds, we should first take a look at the important concept of duration. Duration measures the sensitivity of bond price to interest-rate changes, often measured as the weighted average maturity of bond payments. The higher the duration, the greater the change in bond prices upon a rise in interest rates. As bond prices and interest rates are inversely related, if we expect a rate rise, we should avoid long-term bonds with high duration. To choose the best fixed income opportunity, we should understand the interaction of yield, coupon and maturity with duration.

- A zero-coupon bond has duration equal to its time to maturity

The closer to the present the cash flows of a bond are, the lower its duration, because duration is a weighted average of future cash flows. A zero-coupon bond is a discount bond with just a single cash flow occurring at its maturity. Duration is then exactly equal to timeto maturity, which is the worst-case scenario for someone concerned about the risk of an interest-rate rise. All else being equal, choose a coupon-paying bond to reduce duration.

- The coupon rate and duration are inversely related

The value of a bond is obtained from the sum of discounted future cash flows. The lower the value of the last cash flow, which includes the face-value payment, the lower the duration of the bond, as this last payment is usually bigger, in comparison with the others.

- The time to maturity and duration are positively related

Roughly speaking, longer maturities are associated with higher duration because more payments occur furthest from today. Many investors tend to extend the time to maturity of their holdings at times of very low interest rates to gain some yield. However, they’re ignoring the higher risk that comes with it.

A very simple example gives an idea of the impact a change in yield has on bond prices for varying maturities. Let’s say there’s two coupon bonds trading at face value: a 10-year 0.5% coupon bond and a 100-year 2.5% coupon bond. If there is a change of 100 basis points (1%) in the yield of both bonds, the first would see its price decline 8.4% while the second would sink 27.6%. Thus, the higher yield associated with longer time to maturity comes with higher interest-rate risk.

- The yield to maturity and duration are inversely related

The higher the yield, the lower the duration, as although a higher yield reduces the present value of all expected cash flows, it reduces the value of more distant payments like the face value, by a greater proportional amount. The consequence is then a higher weight given to coupon payments than to the par value repayment, which corresponds to a lower duration. This means that, for example, interest-rate risk is lower for a B-rated bond than for a AAA-rated one.

A few bond ETFs

With all this in mind and provided there’s a high risk for future interest-rate hikes, investors should seek bonds with higher yields, higher coupon rates and/or lower maturities, as they come with lower duration. Alternatively, floating-rate bonds are also a good way of dealing with duration.

iShares Floating Rate Bond ETF (BATS:FLOT)Assets under management: $7.0 billion

- 30-day SEC yield: 0.16%

- Effective duration: 1.48 years

- Expense ratio: 0.15%

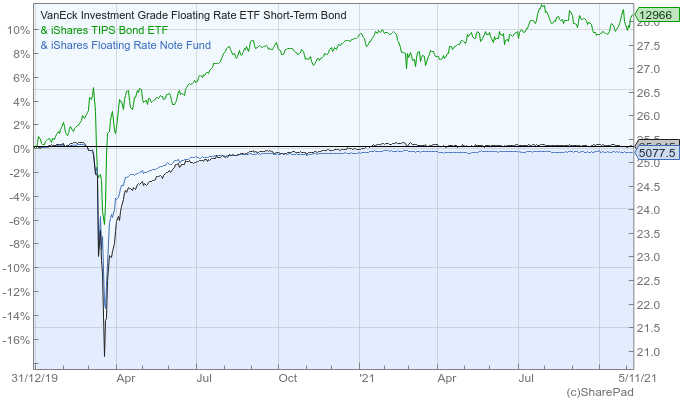

The iShares Floating Rate Bond ETF offers an alternative exposure to the debt market, in which interest-rate risk is minimised and investors no longer need to be concerned with the impact an interest-rate rise may have on their holdings. Unlike traditional bonds, for which coupon payments are fixed and remain unchanged over the life of the bond, FLOT invests in debt, with coupon payments calculated in reference to a benchmark interest rate, such as LIBOR. This way, coupon payments will fluctuate along with prevailing market interest rates, resulting in an effective duration of just 0.09 years.

The fund invests in more than 400 debt securities, with a weighted average maturity of 1.5 yearsThe bond issuers are top global companies like Goldman Sachs, Citigroup and Mizuho Financial Group, as well as some big institutions such as the International Bank for Reconstruction and Development and the European Investment Bank. More than half of the holdings are concentrated in the banking sector. It’s the biggest floating rate ETF, with $7bn in assets under management, all issues are investment grade and the expense ratio is 0.15%.

The good news about FLOT is that you can effectively erase interest-rate risk from your portfolio and if rates start rising so will your income. However, this ETF comes with a very low, 30-day SEC yield of just 0.16%. Additionally, if you avoid interest-rate risk on one side, you have reinvestment risk added on the other. The target maturity of FLOT is less than five years, which means the fund is constantly reinvesting funds.

VanEck Vectors Investment Grade Floating Rate ETF (NYSEARCA:FLTR)

- Assets under management: $784.7 million

- 30-day SEC yield: 0.24%

- Effective duration: 0.06 years

- Expense ratio: 0.14%

FLTR invests in short-term, US dollar-denominated, investment-grade bonds. The majority of the bonds are issued by US companies (56%), but the fund also includes issues by companies across other developed countries. Its top holdings include debt securities issued by HSBC, Verizon, Morgan Stanley and AT&T and 78% of the issues are from financials. Its ongoing charges are 0.14%.

iShares TIPS Bond ETF (NYSEARCA:TIP)

- Assets under management: $36.5 billion

- 30-day SEC yield: 2.00%

- Effective duration: 7.66 years

- Expense ratio: 0.19%

The iShares TIPS Bond ETF targets US Treasury Inflation-Protected Securities (TIPS), which increase in principal value along with the rate of inflation to ensure investors are protected against inflation. TIPS are benchmarked to the consumer price index, and their value is adjusted accordingly.

The problem with these instruments is that they’re a really good hedge against inflation, but only when prices are rising fast and have been for some time. Investors start to pile into these instruments way before inflation materialises, sometimes leading their real yields to negative values, in the expectation they will turn positive over time. But, if inflation doesn’t materialise, investors end up losing money. I suggest using TIPS with care and only if the expectation is for rising and persistent inflation. Otherwise, investing in the short spectrum of the bond curve may be a better option to avoid rate risk.

iShares Floating Rate Income Strategies Fund (NYSE:FRA)

- Assets under management: $492.5 million

- Distribution rate: 5.86%

- Effective duration: 0.26 years

- Expense ratio: 0.75%

FLOT doesn’t offer much for those looking for income. Its high-quality, investment-grade holdings, combined with the interest-rate protection it provides lead to low income. But, if you’re willing to keep rate protection and to go down to the junk side of the debt market, there’s FRA. This fund invests 80% of its assets in floating-rate debt securities. However almost all debt is below investment grade, consisting of secured and unsecured senior floating-rate loans. Total return for FRA has been way higher than for FLOT but risk is also higher, in this case credit risk. The expense ratio comes in a bit high, at 0.75%.

Vanguard Short-term Corporate Bond ETF (NASDAQ:VCSH)

- Assets under management: $50.0 billion

- 30-day SEC yield: 1.07%

- Effective duration: 3.0 years

- Expense ratio: 0.05%

If you’re primarily concerned with the risk of rising interest rates, but still want something more than FLOT can offer in terms of income, VCSH is worth a look. VCSH targets investment-grade bonds, invests in more than 2,300 issues, with an average maturity of three years, which is a bit higher than FLOT’s. The key differences between VCSH and FLOT that lead to a higher income from VCSH are the higher maturity of the holdings and its fixed-rate nature. While the effective duration is 0.09 for FLOT, it is 3.0 for VCSH. This means that there’s more interest-rate risk here. However, three years is still very short term and the exposure to rate risk is still low. The 30-day SEC yield is currently 1.07% and the ETF has a tiny expense ratio of just 0.05%.

SPDR Blackstone Senior Loan ETF (NYSEARCA:SRLN)

- Assets under management: $8.0 billion

- 30-day SEC yield: 4.21%

- Effective duration: N/A

- Expense ratio: 0.70%

SRLN invests in senior, secured, floating-rate bank loans, which offer some good opportunities for investors through much higher yields than bonds, while still enjoying seniority to unsecured claims in case of bankruptcy or any other credit event. This ETF offers a different perspective of the debt market, which investors are unable to tap into unless through a fund like this. However, it comes with high credit risks, as most holdings are rated below investment grade. In fact, two thirds of the holdings lie between B and B-, , but it still deserves attention at times of very low interest rates.

WisdomTree Interest Rate Hedged U.S. Aggregate Bond Fund (NASDAQ:AGZD)

- Assets under management: $217 million

- 30-day SEC yield: 0.94%

- Effective duration: 0.09 years

- Expense ratio: 0.23%

The WisdomTree Interest Rate Hedged U.S. Aggregate Bond Fund is very small in comparison, as it manages just $217m in assets. However, it’s a sophisticated fund in terms of the way it deals with duration to minimise interest-rate risk. To reduce interest-rate risk, AGZD carries a few short positions in Treasury securities. These short positions allow the fund managers to go deeper in the maturity of the long holdings. The fund holds more than 2000 individual bonds, with 45% of them carrying a maturity longer than 10 years. All bonds are of investment-grade quality.

Conclusion

When interest rates are very low and start rising, fixed income is less attractive. While investment-grade issues and shorter-term bonds provide peace of mind, they offer too little to investors in terms of income. But, the higher-yielding longer-maturities and junk bonds come with increased interest-rate risk and credit risk, respectively. It is hard to achieve the right balance and it depends on the risk choices of each investor. However, interest-rate risk is increasing at a faster pace than credit risk at a time when the economy is growing. Thus, the only way to get something out of the bond market is to accept a little more credit risk than a US government bond carries, but to keep duration low.

Would you not recommend something like 3GIS which gives leveraged exposure to U.K. gilts. Inflation is rising, interest rates and yields on gilts are at an all time low, so with inflation you’d expect interest rates to rise yields on gilts to rise and therefore 3GIS to rise as the value of gilts fall.