Energy funds to power your portfolio – MAGAZINE EXCLUSIVEMAGAZINE EXCLUSIVE

MAGAZINE ARTICLE

This article first appeared in Issue 43 of Master Investor Magazine.

Click here to download the article as a printer-friendly PDF

Get this article and many more – for free! |

The recovery in the oil price has been hugely beneficial for the majority of companies operating in the energy industry, with oil & gas producers and the oil equipment, services and distribution sectors being two of the best performing areas of the UK stock market over the last year.

Between March 2011 and June 2014, WTI light crude traded consistently around $100 a barrel, but the high price attracted additional sources of supply, such as the North American shale projects. This made the market vulnerable, so when demand fell, the price plummeted to less than $30 by the start of 2016. The resulting pressure on cash flows forced many energy companies to reduce capital expenditure to the extent that new oil discoveries are now at their lowest level since the 1940s.

Years of under-investment, coupled with production cuts from OPEC to stabilise the market, has meant that supply is now failing to keep up with demand and that has helped to push the price of WTI light crude back towards $70, despite the headwind of a strong dollar.

Geopolitical tensions are also playing their part. The imposition of sanctions on Iran will remove up to one million barrels of oil per day from the supply chain, while the deterioration of supplies from Venezuela and Libya, due to the internal upheaval in these countries, will make it even harder to meet global demand.

Increases in the price of oil are obviously beneficial to energy companies. But buying individual stocks can be challenging because of the risk of operational failures and the complex nature of many of these businesses.A less volatile option would be to invest in a fund that provides a more diversified exposure to this part of the market.

Most UK equity income funds invest in the oil majors, like Shell and BP, to benefit from their attractive dividends, and even a FTSE 100 tracker or ETF will have a market neutral allocation to the sector of around 16%. If you want a larger exposure you would need to invest in one of the energy funds.

The black stuff

Most of the specialist vehicles available in this area are structured as open-ended funds and invest in stocks operating in the global energy sector. A good example is the £232 million Guinness Global Energy fund, which was launched in March 2008.

Historically, the stock market has valued energy companies according to their sustainable levels of profitability, which is generally calculated using a combination of return on capital employed (ROCE) and free cash flow (FCF). These tend to increase when the oil price goes up or a business is able to reduce its cost of production.

Tim Guinness, the fund manager, believes that the valuation of his various holdings implies that the ROCE will not improve from the current level and that the FCF will fall considerably, but he thinks that that is overly pessimistic. He says that if OPEC is able to deliver a reasonable oil price and the equity markets were to price in a long-term figure of $70, there would be in excess of 50% upside in the fund’s portfolio.

At the end of July, the Guinness Global Energy fund had an equally weighted portfolio of 38 stocks, with the largest allocations being exploration & production, and integrated oil & gas. The biggest holdings included the likes of Valero Energy, Devon Energy, Enbridge, Total and Suncor Energy. During the last 12 months, the fund has generated a return of 25.9%, which is ahead of the 22% produced by its MSCI World Energy benchmark, although over the longer term it has lagged slightly behind.

Disappointing record

There are also a number of smaller funds, like the £48.9 million Artemis Global Energy fund,that have quite patchy performance records relative to their benchmarks. The managers favour the diversified international exploration and production stocks, as well as companies involved in liquefied natural gas, and plan to continue to invest in these areas. Over the last three years, the fund has generated a cumulative return of 52.3%, which is marginally ahead of the MSCI Energy benchmark, although it has dramatically underperformed since it was launched in April 2011.

The $41.6 million Ashburton Global Energy fundwas created in June 2013 and invests in companies involved in oil, gas, coal, renewables and other energy sources. It typically holds between 30 and 70 stocks and is up by 20% in the last year, but those who invested at the outset would only have made a cumulative return of 2%.

Investec Global Energy has attracted £64.6 million of assets under management and holds a portfolio of 57 stocks that are involved in the exploration, production or distribution of oil, gas and other energy sources, including renewables. The largest positions include Total, BP and Royal Dutch Shell. It was launched in November 2004 and has had a decent 12 months, but has consistently lagged behind its benchmark.

Foot on the pedal

A higher-octane alternative is the Junior Oils Trust, which invests in a portfolio of small and mid-cap companies specialising in oil exploration and production. The Fund Advisor, Angelos Damaskos, looks for businesses with substantial reserves and high operational elasticity. These benefit from having a strong balance sheet and can scale back their capital expenditure in-line with their cash-flows, so as to respond quickly to changes in the oil market.

He has put together a concentrated portfolio, with the ten largest holdings accounting for 52.5% of the assets. These include names like FAR Ltd, Faroe Petroleum, Cooper Energy, Tamarack Valley Energy and Carnarvon Petroleum. The latter recently discovered what is thought to be the largest oil find in Western Australia in more than 30 years and its share price rose four-fold as a result.

Damaskos says that the small-cap exploration & production companies have recently started outperforming their larger peers, as investors look to them to provide incremental oil reserves in the next few years of looming short supply.

As you would expect, the Junior Oils Trust is an incredibly volatile fund and although it has had a good couple of years, with annual returns of around 18%, it is still down by 2% since it was launched in October 2004. It is very much a niche product with assets under management of just £12.2 million.

The passive alternative

The mixed performance record achieved by the majority of the active funds suggests that it is worth considering some of the passive alternatives. These benefit from lower fees with a good example being the iShares MSCI Global Energy Producers ETF, whichinvests in companies primarily engaged in the business of energy exploration and production.

The iShares ETF was launched in January 2012 and has attracted net assets of $48 million. It provides exposure to 210 different holdings, but is heavily weighted in favour of the oil majors like Exxon Mobil, Chevron, Shell and BP. Over the last 12 months, the fund has generated an impressive return of 30%, although the long-term performance is much more modest. Its total expense ratio (TER) is just 0.39%.

SPDR MSCI World Energy UCITS ETF tracks the performance of companies in the energy sector and currently has 82 holdings with the largest positions being similar to the iShares ETF. It has net assets of $389 million and a TER of 0.3%. Over the last year, it has generated a return of 21.5%, although since inception in January 2009 it has made a much more modest gain of 5.7%.

Investment trusts

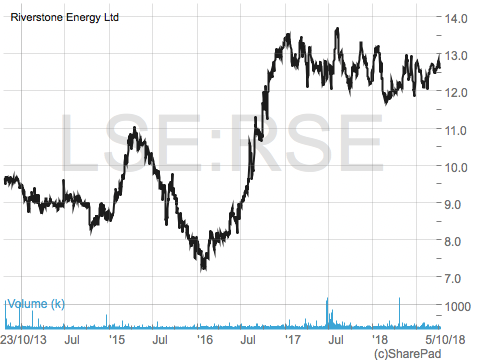

The main investment trust operating in the sector is the £1.4 billion Riverstone Energy (LON:RSE), which listed in 2013.It has an extremely concentrated portfolio and several industry heavyweights as directors. See fund of the month below.

If you are more interested in dividends you might prefer the£104m BlackRock Commodities Income Investment Trust (LON:BRCI). This invests in the broader commodity sector,so it is not a pure energy play, but it does have a significant allocation to oil stocks, with Royal Dutch Shell, BP and Exxon Mobil all making it into its top 10 holdings. At the end of July, the integrated oil sector made up 26.8% of the portfolio, with exploration & production accounting for a further 16.3%.

BRCI’s longer term performance has been pretty volatile, which is what you would expect, although the recent returns have been stronger with a three-year increase in the NAV of 61%. The fund is currently paying a quarterly dividend of 1 pence per share, which gives it an attractive prospective yield of 5.3%, with the shares available on a 6% discount.

Another income orientated option would be the £127 million Middlefield Canadian Income Trust (LON:MCT), which invests in a portfolio of US and Canadian equities.The managers are optimistic and say that if oil stays in the current range of $60 to $70, it would generate healthy margins for Canadian energy producers. They also point out that with the US pulling out of the Iran nuclear deal, there could be greater than expected reductions in supply during the rest of this year.

At the end of July, they were overweight the energy sector with an allocation of 13.1% and had a further 15.6% invested in energy pipeline operators. Over the last three years, the fund has generated a cumulative share price return of 55% and it is yielding an attractive 4.9% with quarterly dividends. The shares are currently trading on a 10% discount to NAV.

FUND OF THE MONTH

Riverstone Energy (LON:RSE) has a unique mandate amongst the UK-listed investment trusts as it concentrates almost entirely on the exploration & production, and midstream sectors. The £1.4 billion fund invests in companies that have management teams with proven track records and has gradually built-up a portfolio of 14 holdings – only one of which is quoted − with the focus on productive basins with low costs of production, such as Permian and Eagle Ford in North America.

A high oil price above $60 enables the fund to realise significant value from its mature investments, and during the six months to the end of June it was able to take advantage of that by selling its holding in Three Rivers and part of its stake in Centennial Resource Development. After some modest new investments, it finished the period with a cash balance of $236 million and no debt.

The fund manager believes that the current cycle is generating attractive opportunities in the midstream, oilfield services and power sub-sectors. He also thinks that energy producers in low-cost basins, with strong operational capabilities and an oil-weighting will continue to outperform. It is possible that the cash balance will eventually be reinvested in these sorts of areas, although the board has said that it will consider returning it to shareholders.

Riverstone is a highly specialist vehicle with a concentrated portfolio that is highly sensitive to changes in the price of oil and the principals involved in running the fund all have a considerable personal investment at stake. The analysts at Numis rate the management team highly and have issued a ‘buy’ recommendation on the fund. Over the last three years, it has generated a NAV total return of 54%, yet it is estimated that the shares are trading on a 21% discount.

Fund Facts

Name: Riverstone Energy (LON:RSE)

Type: Investment Company

Sector: Energy

Total Assets: £1.4 billion

Launch Date: October 2013

Current Yield: 0%

Gearing: 0%

Ongoing Charges: 2.1%

Website: www.riverstonerel.com

|

Comments (0)