Earn a seven percent income from these two high yielding trusts

Yields are generally still pretty low right across the board, but there are two investment trusts with recent buy recommendations that are both paying a sustainable income of seven percent.

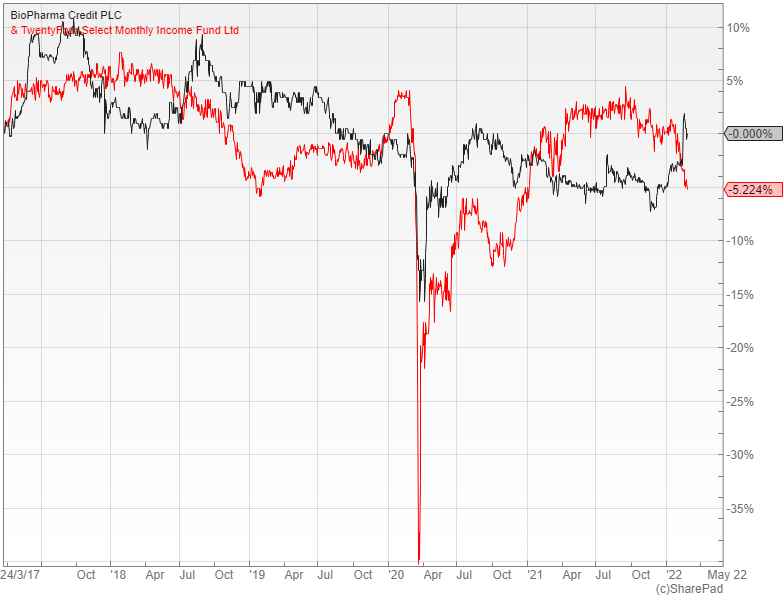

The first of them is the $1.4bn BioPharma Credit (LON: BPCR),which provides exposure to the life sciences industry through a diversified portfolio of loans and other instruments. Its main objective is to generate a predictable income for shareholders over the long-term with a target dividend of seven percent per annum paid quarterly.

BPCR is managed by Pharmakon Advisors, a specialist in this area that was founded in 2009 and which operates three other similar funds, all of which are now fully invested. The firm has a good range of contacts within the industry that enables it to source, analyse and structure attractive opportunities.

BioPharma Credit primarily invests in corporate and royalty debt secured by cash flows derived from sales of approved life sciences products. Its manager has put together a portfolio of these instruments that benefit from high visibility and stability of cash flows, although each individual transaction is large so diversification is an issue.

Buy recommendations

The trust is one of Winterflood’s recommendations for the year with the broker saying that the target yield is attractive given the lack of correlation of underlying revenues with the financial markets. They do however warn that it is exposed to both credit and sector risk, especially as the portfolio is extremely concentrated with the six largest counterparties representing 70% of the assets at the end of January.

There was another significant deal in February that enabled the fund to reach full investment. The transaction increased its exposure to floating rate loans to around half of the portfolio and provides some degree of protection in an environment of rising interest rates. In view of this the broker Investec has reiterated their buy recommendation as they like its attractive and sustainable yield of seven percent.

The other trust paying this same high amount is the £178m TwentyFour Select Monthly Income (LON: SMIF) that holds a diversified portfolio of ‘less liquid’ debt instruments. It has just received a buy rating from Numis who believe that it is a good time to invest with the fund currently issuing new shares at a modest premium to NAV.

Protected against rising interest rates

They say that coming into this year, SMIF was positioned for a potential market sell-off, with the protection including interest rate hedges that have insulated the portfolio from rising rates. The manager sees the current volatility as a mid-cycle sell-off and remains positive on the outlook because of the strong credit fundamentals as indicated by the low default expectations and ratings upgrades.

Its largest exposure at 27% of the portfolio are debt tranches of collateralised loan obligations, with single B rated tranches yielding 10%. Another key weighting is bank debt at 23% of the fund, which is attractive given the strength of the balance sheets, while the 15% allocation to high yield debt is focused on niche opportunities where the lower liquidity makes holdings unsuitable for open-ended funds.

Numis believe that the portfolio is well-suited to weather rising interest rates as it has a relatively low duration of 2.2 years, as well as significant exposure to floating rate assets and a high overall yield in excess of seven percent. They also point out that sectors such as banks are typically beneficiaries of rising rates.

Comments (0)