Defensive funds to help protect your portfolio

Experienced investors will have survived many bear markets, but for those who are new to it the Coronavirus induced sell-off could be their first serious test. How you plan for and react to extreme events like this will go a long way towards determining the sort of long-term returns you are going to make.

Covid-19 first emerged at the end of last year in the Hubei province of China. As it is a highly contagious, flu-like viral infection, with a long gestation period of up to six weeks, it is almost impossible to contain.

Those most at risk are the elderly and people with certain pre-existing conditions, for whom the virus can be deadly. In order to limit the number of fatalities and keep health services functioning, governments around the world are having to resort to draconian measures that would have been unimaginable a few months ago.

With the number of new cases outside China rising rapidly, the only way to slow the spread of the virus is to limit all unnecessary social contact. The steps taken to put this into practice have resulted in an unprecedented collapse in economic activity as normal day-to- day life is suspended.

It is impossible at this stage to assess the financial impact on different economies and companies or to gauge how effective the policy responses will be. This means that the main factor determining market prices is fear, with volatility hitting unprecedented levels and the correlation across asset classes increasing dramatically.

Try not to panic

The question is whether the market has enough further downside that it makes sense to sell, and whether you would be able to buy back in when it recovers. Adrian Lowcock, head of personal investing at Willis Owen says:

“The answer to these questions for most people is don’t know and no. Predicting short-term swings in markets is notoriously tricky and trying to do so often leads to bad decisions, with investors selling after big falls and only returning once markets have recovered, so effectively you lock in the loss, not the gain.”

In his view, the best course of action is to accept that you missed the chance to protect your wealth this time around and look beyond the ‘noise’ to focus on your long-term goals and invest accordingly. You should also take the opportunity to learn from the sell-off to see whether your investments offered enough protection or whether you need to improve diversification.

Patrick Connolly, a chartered financial planner at Chase de Vere Independent Financial Advisers, says that it’s a common mistake to make investment decisions based on short-term sentiment:

“More people tend to invest when markets are riding high. In contrast, when markets are in the doldrums and investment losses have already been made, many investors are reluctant to take risks for fear of losing more money. The result is that too many people take too much risk and buy at the top of the market and take too little risk and sell at the bottom.”

Make sure that you have the right asset allocation

The best way to avoid this situation is by maintaining an appropriate asset allocation. This means holding the right blend of investments to meet your circumstances, objectives and risk profile:

“The more of your money that you invest in high risk assets, such as shares, the more growth potential you have, but also the more chance of a capital loss. Those who want to take less risk, such as by having more money in cash and fixed interest, should have a greater level of capital protection, but will have very limited growth potential and will be more susceptible to the effects of inflation,” explains Connolly.

It’s vital to have a financial plan and stick with it, while having a clear understanding of your attitude to risk and time horizon. Only when you understand these things are you in a position to determine what might be an appropriate asset allocation for you.

In some portfolios there is clear evidence of ‘false diversification’ where a portfolio is diversified across a number of different funds, but those funds are highly correlated and therefore perform in a very similar manner. Ryan Hughes, head of active portfolios at AJ Bell comments:

“As a result, this diversification in name only serves as little benefit to investors when things get difficult. True diversification means holding assets that behave differently and can sometimes mean investing in assets that you may not particularly like, but do so in the knowledge they will hopefully perform well when your core holdings are not.”

Gold

According to Emma Wall, head of investment analysis at Hargreaves Lansdown, a well-balanced portfolio should have exposure to safe-haven assets like gold and lower-risk assets such as bonds: “Funds focused on capital preservation, strategic bond funds and multi-asset funds with a cautious approach are good additions if you are looking to add diversification to an equity portfolio,” she says.

Gold tends to divide opinion more than any other asset class. It should protect investors’ money during volatile and falling markets, but doesn’t generate an income and doesn’t produce anything, so the growth in the price is often linked to general inflation over the longer term.

Lowcock says that the best way to look at it is to treat it as an insurance policy: “Typically I would suggest holding around five percent of gold in your portfolio to offer a cushion in volatile markets.”

He recommends Blackrock Gold & General, which is managed by Evy Hambro and gives investors exposure to gold and other precious metals by investing in listed mining companies. It has a bias towards larger producers, as they often give the best exposure to commodity prices for the risks, and have the ability to grow production in a cost-effective way.

Ben Yearsley, a director at Shore Financial Planning, prefers Merian Gold and Silver. He says this is one of the few funds to mix bullion with shares: “Gold does well when real interest rates are falling [as this reduces the opportunity cost of holding it], but it does less well in a rising rate environment. Personally I wouldn’t hold it in most portfolios.”

Gold rose strongly during the early stages of the pandemic, but has since sold off heavily as investors cashed in their positions to raise money to meet margin calls on their loss-making equities. The associated mining stocks have been hit hard by the fall and also presumably because of fears about interruptions to production with both of the recommended funds losing approximately 20% of their value.

Bonds

The main way to diversify equity-based holdings is to use bonds and Connolly says that they should still have a place in the majority of investment portfolios:

“They are particularly suited to more cautious investors including those who want to provide some protection against stock market falls. However, the conventional wisdom of bonds being low risk doesn’t necessarily work today and so investors have to be careful about where they are investing.”

The problem is that the manipulation of financial markets by central banks in the last decade has pushed the yields on bonds to very low levels, while at the same time, the diversifying nature of bonds from equities has seemingly broken down. As a result, many fixed-interest securities now look expensive and could be subject to significant falls in the future.

Hughes says that the solid performance of bonds during the current market volatility indicates that they still have a role to play, although it is important to invest in a fund that behaves like a bond fund rather than a quasi-equity fund:

“I like the Allianz Strategic Bond fund that is managed by Mike Riddell and Kacper Brzezniak. It has a clear focus on government bonds from the likes of the US, Japan and Sweden and is managed to deliberately operate like a bond fund, which should mean it behaves differently to equities, making it a good diversifier.”

The best way to limit the risk is to go for a shorter duration exposure as this is less sensitive to interest-rate movements, hence Connolly’s recommendation of the Royal London Short Duration Credit fund:

“It invests at least 70% in company bonds which mature in five years or less and has provided consistent positive returns, which aren’t affected very much by short-term market noise or interest-rate movements. The fund has a current yield of three percent.”

Government bonds have been the standout performer during the market crash with the wave of interest-rate cuts and the flight to safety pushing prices ever higher. It is hard to believe that this is not the top of the market.

Defensive funds

Lowcock and Connolly both recommend BNY Mellon Real Return, which is an unconstrained multi-asset fund. It invests in a combination of return-seeking assets such as equities, infrastructure, corporate debt and convertibles. These are then offset by stabilising, lower-risk investments to dampen the volatility and provide downside protection:

“Manager Suzanne Hutchins’ priority is to protect investors’ money and then over the longterm look to grow it at around four percent above cash. The fund has a core element which invests in bonds and shares with a long-term view and low turnover. This is complemented by more tactical, short-term, investments in cash, government bonds and derivatives in order to reduce the risk,” explains Lowcock.

He also likes Trojan Income, which invests mainly in UK shares in the FTSE 350 index. Manager Frances Brooke looks to preserve investors’ capital by selecting companies that produce steady, long-term income and capital growth. He has a bias towards larger companies and tends to favour more defensive sectors such as healthcare.

Hughes says that in theory, absolute return funds make great diversifiers as they should be able to deliver uncorrelated returns to traditional equity and bond funds, but unfortunately most fail to deliver:

“One I rate highly is Janus Henderson UK Absolute Return, which is a long/short equity fund that looks to deliver positive returns over rolling 12 month periods. Historically, the managers have proven to be adept at mitigating big falls in the market with the only drawback being the higher than average costs and a performance fee.”

Another option recommended by Connolly is the L&G Global Infrastructure Index fund.

Infrastructure is very ‘bond-like’ in that its assets tend to be long-duration and provide a stable income, usually inflation-linked. This is a passive fund and has an annual charge of just 0.3%.

Janus Henderson UK Absolute Return has held up remarkably well during the current sell-off, while BNY Mellon Real Return and L&G Global Infrastructure Index have lost around 15% to 20% year-to-date.

Investment trusts that protect your wealth

There are a handful of defensively-oriented investment trusts that aim to both preserve and grow your capital. These have built up strong long-term track records and make good core portfolio holdings that help to limit the downside during market sell-offs.

The Capital Gearing Trust (LON:CGT) aims to preserve the real wealth of shareholders and to achieve absolute total returns over the medium to longer term. It currently has around a third of the portfolio in UK and US index-linked bonds, with a similar amount in conventional government bonds and corporate debt. The rest is invested in funds and equities.

It is similar to the Ruffer Investment Company (LON:RICA) that also has capital protection at the heart of its mandate. The fund has about a third of its assets in index-linked government bonds, with cash and short-dated bonds making up a further 12% and gold/gold equities eight percent. It has a slightly higher allocation to equities at around 42%, but what really differentiates it is its exposure to illiquid strategies and options.

The latter are specifically designed to pay out in a market crisis and they have made an enormous difference. According to analysis from the broker Numis, RICA is the best performing equity investment trust with a year-to-date share price total return of 0.4% up to close on 17 March.

Another option is RIT Capital Partners (LON:RCP). Over the years it has managed to capture a significant amount of the market upside, while protecting against the worst of the declines. It is defensively positioned, yet has suffered more than the others during the sell-off with the shares moving from a premium to a discount.

Investors with well-diversified portfolios that include defensive funds like those above will find it a lot easier to withstand market sell-offs than those who go into them with too much risk. The key is to be comfortable in all market conditions so that you can stay invested rather than be panicked into crystallising large losses and then missing the rebound.

FUND OF THE MONTH

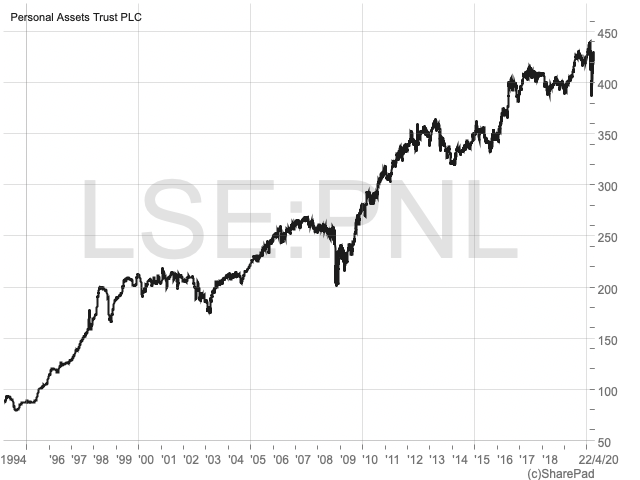

The Personal Assets Trust (LON:PNL) is managed by Troy’s Sebastian Lyon who operates with an absolute return mindset. It is defensively positioned, with 30% invested in US index-linked bonds, 26% in cash and cash equivalents, nine percent in gold and the remaining third of the portfolio in high-quality equities such as Microsoft, Nestlé and Unilever:

“Avoiding loss of capital is a primary consideration and therefore this trust makes a good diversifier for investors with a broad spread of assets. The approach will typically mean that it delivers steady returns in strongly rising markets, but performs better when markets fall sharply,” explains Hughes.

Yearsley is also a fan and says that it is the best of the defensive funds alongside its open-ended counterpart, Troy Trojan: “Its key aim is to maintain the real value of your investment so that your capital at least keeps pace with inflation. The manager will vary the asset allocation depending on his wider economic outlook and the value offered by each asset class.”

Year-to-date (up to close on March 20) it has held up pretty well, with a loss of just over eight percent. The longer-term returns are also impressive. Over the last decade, the share price is up 64%, compared to the 41% increase in the FTSE All-Share benchmark, which is a remarkable achievement given the defensive nature of the mandate.

I have always looked for shares with decent dividend returns (above ISAs % annual rates).