Building on the success of commercial property – MAGAZINE EXCLUSIVEMAGAZINE EXCLUSIVE

MAGAZINE ARTICLE

This article first appeared in Issue 39 of Master Investor Magazine.

Click here to download the article as a printer-friendly PDF

|

Get this article and many more – for free! |

The last few years have been a good time to be invested in UK commercial property, with the sector offering an attractive level of income combined with steady capital growth. For most people the easiest way to benefit is via the Direct Property investment companies that provide a ready-made exposure to a diversified portfolio of commercially-let premises.

In 2017, the commercial property market generated a total return of 11.2% via a combination of capital growth and income. The healthy performance has continued into 2018, with aggregate capital values rising by a further 1% in the first quarter, although some areas have done much better than others.

An analysis of the underlying regional data reveals that most of the gain was driven by the 4% appreciation of industrial buildings in the South East, whereas shopping centres across the country fell by an average of 1.2%. This shows what a huge difference the nature of the properties – be they offices, retail or industrial – and their location can have on the returns.

Forecasts suggest that the sector will continue to generate an attractive level of income, but the short-term prospects for capital growth are a lot more uncertain due to the political and economic impact of Brexit. The Investment Property Forum, which consists of 23 property advisers and investment firms, is expecting modest total returns from the UK All Property index of 4.6% in 2018, falling to 3.9% in 2019, with both years being dominated by the income component of 4.9%.

Investment companies

A Direct Property investment company will aim to generate outperformance by buying the most suitable premises in the best locations and then finding good quality tenants. They may also be able to add value by changing the nature or use of the buildings or acquiring sites with development potential.

These closed-ended funds are the ideal way to gain exposure to this type of illiquid asset class, as their shares can be bought and sold on the London Stock Exchange without having any cash flow implications for the underlying holdings.

The strong historic performance and attractive dividend yields that are in the order of 4% to 7% have helped to push about half of these vehicles onto a small premium to Net Asset Value (NAV). Investor sentiment has been further improved by the fact that portfolios are generally let to good quality tenants and voids are at low levels, with dividends typically well covered by the rental income.

There is also still a healthy level of investor interest in the sector, with the PRS REIT (LON:PRSR) able to close its recent secondary share placing early due to strong levels of support, although the Board of the AEW UK Long Lease REIT (LON:AEWL) decided to not to go ahead with their secondary issuance due to the extreme market volatility at the time of the proposed issue in February.

Nobody knows for sure what sort of impact Brexit will have on the UK economy, but in view of the uncertainty, it is important to think about what type of commercial property exposure you feel comfortable with. It is likely that funds with modest levels of gearing (debt), defensive property strategies and attractive yields well covered by income will have the best chance of withstanding any bouts of investor nervousness.

Attractive yields

The broker Numis recommends the £442 million Custodian REIT (LON:CREI), which invests in smaller properties that are worth less than £10 million. These have typically experienced less competition amongst buyers and still offer an attractive, high level of income. The fund operates a low to moderate risk strategy and has successfully diversified its income stream to the extent that no single tenant makes up more than 2.5% of the overall rent roll.

Richard Shepherd-Cross, the fund manager, has been actively selling properties where the business plan has been achieved and then reinvesting the profits into assets with stronger growth potential. One such area that he has been targeting is retail warehousing and this now accounts for 16% of the portfolio’s income.

Numis believes that the Custodian REIT is well positioned to thrive in a slower growth environment and it likes the fact that the REIT has a conservative balance sheet with long-term, low cost debt. The fund has a well-covered dividend yield of 5.5%, which has pushed the shares onto a substantial 14% premium to NAV, so it suggests using any dips in the share price as a buying opportunity.

Another attractive source of income is the £208 million LXI REIT (LON:LXI), which was launched in February 2017 and invests in a portfolio of long-lease assets. These have an average net initial yield of over 6% and an average unexpired lease term to the first break in the contract of 24 years. The fund benefits from a diversified tenant base with almost all of the income being linked to inflation or having fixed periodic uplifts. It is currently yielding 5.2% with quarterly distributions.

Alternatively, there is the £500 million PRS REIT (LON:PRSR), which was launched in May 2017to invest in newly constructed private rental properties that are to be let on 12-month Assured Shorthold Tenancies to qualifying tenants in the largest English towns and cities outside of London. The fund is targeting a yield of at least 6% per annum and a total annual return of 10% or more once fully invested and geared, although the current yield is a more modest 4.6%.

Take advantage of movements in the discount

Share prices in the Direct Property investment companies are determined by the level of investor demand, and although this is influenced by the performance of the underlying holdings, there are times when they can trade at a substantial premium or discount to NAV. Savvy investors can take advantage of these movements to increase their return.

Earlier in the year, Numis identified the £478 million Picton Property Income (LON:PCTN) as a value opportunity, but since then its shares have rallied strongly and it is now trading close to NAV. The improvement in performance was due to the impressive first quarter results, during which the fund generated a NAV total return of 3.1%.

Picton is heavily invested in industrial properties, which make up 41.2% of the portfolio and grew by 2.6% in the first quarter. Its office buildings also did well with a gain of 2%, although retail, which makes up the remaining 22.9% of the fund, fell by 1.6%.

PCTN targets an annual dividend of 3.5 pence per share, which represents a yield of 3.9%, with dividend cover for the first quarter’s distribution being a robust 128%. Recent lettings have been achieved at higher levels of rent, with occupancy rates improving to 96%.

One fund that offers better value is the £316 million Schroder Real Estate Investment Trust (LON:SREI), which is currently trading on a 7% discount to NAV. Its shares have recently suffered a sharp de-rating for no apparent reason, and although the 4% yield is lower than many of its peer group, the dividends are well covered by recurring income.

SREI’s main geographical weightings are in the South East ex Central London, the Midlands and Wales, and the North and Scotland, with each of these regions being home to 25% to 30% of the total value of the properties. Around 40% of its assets are offices, with a further 31% being retail premises and 26% industrials. The biggest tenant accounts for 5.5% of the rent roll, with the 10 largest making up around a third of the income.

Moving in the right direction

The £230 million Ediston Property Investment Company (LON:EPIC) had a successful first quarter, with a NAV total return of 2.6%. It aims to generate an attractive level of income by investing in a diversified portfolio of high quality assets located throughout the various regions of the UK.

Ediston is heavily weighted in favour of retail warehouses, which make up almost three-quarters of the fund, with most of the rest being offices. Its five largest tenants – B&Q, Tesco, B&M Retail, Ernst & Young, and M&S – account for 31% of the exposure, with each of its other occupants contributing less than 4% each.

The fund managers are actively engaged in lease restructurings and other initiatives to protect and improve the income and capital values. They are also permitted to undertake speculative developments of up to 10% of the total assets, which adds to the risk and the potential returns.

A recent example was the purchase of a seven-acre development site in Haddington for £2.75 million plus costs. The site has planning permission for a supermarket and petrol station, but the manager is trying to change the consent to a retail warehouse development that once completed would provide a double-digit yield on cost.

Ediston pays an annualised dividend per share of 5.75p, which is equivalent to a yield of 5.2% with the payments made monthly. It has a vacancy rate of just 3.1% and a lengthy weighted average unexpired lease term of 6.7 years. The shares are trading close to NAV.

FUND OF THE MONTH

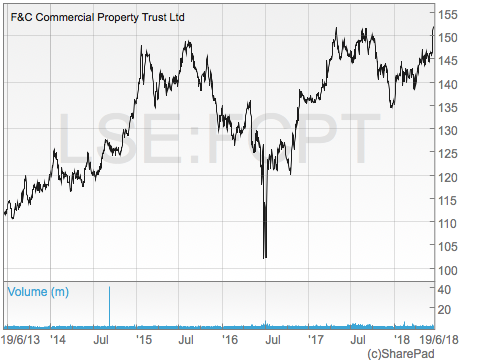

Those looking for a core exposure to UK commercial property would be hard pressed to find a better option than the £1.39 billion F&C Commercial Property Trust (LON:FCPT). This owns the highest quality portfolio in the sector with around 60% of the value concentrated in London and the South East. The fund has a strong long-term performance record and is yielding 4.2% with monthly dividends that it has maintained since it was launched in March 2005.

Richard Kirby, the manager, has been actively reducing his exposure to Retail, which has acted as a drag on performance in recent years. One of the latest examples of this policy was the sale of three retail centres in Shrewsbury town centre to the local council at a small premium to their book value. The disposal helped to reduce the Retail allocation to 30.9% at the end of 2017, with Offices being the largest weighting at 36.3% and the balance being fairly equally divided between Retail Warehouses and Industrials.

FCPT generated a NAV total return of 2.3% during the first quarter, including an increase of 1.1% in the capital values of the properties. The growth was led by its offices, which rose by 2%, followed by industrials with a gain of 0.8% and retail with an increase of 0.6%.

The fund pays a monthly dividend of 0.5 pence per share, which (based on the share price at time of writing) is equivalent to a yield of 4.2%. Unlike some of its peers, it has managed to maintain the dividend ever since it was launched in March 2005, although the level of cover is more stretched than it was in the past. F&C Commercial Property is currently trading on a 1% premium to NAV, which reflects its strong tenant profile, low level of gearing and successful track record. It should be well-placed to ride out any periods of economic uncertainty.

Fund Facts

Name: F&C Commercial Property Trust (LON: FCPT)

Type: Investment Company

Sector: Direct Property

Total Assets: £1.39bn

Launch Date: March 2005

Current Yield: 4.2%

Gearing: 20%

Ongoing Charges: 1.22%

Website: www.fandc.co.uk

Good article.

Is there a similar report for reits specialising in specific sectors eg., student, medical and logistics sector- eg PHP, MediCX, Tritax, Assura, etc.,?

London Metric Property is probably the best positioned for future growth.