An ill wind: could the Ukraine crisis be good for Greencoat UK Wind?

If Russia takes control of gas prices in Europe as part of its battle with the West over the Ukraine then the wind farm operator Greencoat UK Wind could be a huge beneficiary.

There are fears that Russia would restrict Europe’s gas supply if NATO countries impose tough sanctions after its likely invasion of the Ukraine. Moscow controls about 40% of the EU’s gas and any reduction would send the current high prices to even more extreme levels.

Europe’s storage facilities are around a third full and would be enough to meet just six weeks’ demand. Germany would be hit the hardest as it gets more than half of its gas requirements from Russia with the fossil fuel covering a quarter of its energy consumption.

Nobody wants a war, but the increase in energy prices might give investors a means of protecting the value of their portfolios. There are lots of ways that you could do this with one example being the wind farm operator Greencoat UK Wind (LON: UKW). Unlike most of the other renewable trusts it usually sells into the power market on relatively short-forward terms so would profit from an immediate uplift in the wholesale market.

A sustainable way to benefit

Peter Spiller, manager of the Capital Gearing Trust (LON: CGT), believes that Greencoat would be a major beneficiary if gas prices in Europe end up being controlled by Russia. Significantly higher power prices over the next few years would be good news for the wind farm operator, which is an important holding in the defensively-oriented trust, especially as there would be a great reluctance to invest in new gas facilities to reduce Russia’s dominance.

Power prices, together with the rate of generation, are normally the most significant variables for investment trusts like Greencoat that specialise in renewable energy. Persistently higher prices result in larger forecast revenues from the sale of electricity to offtakers.

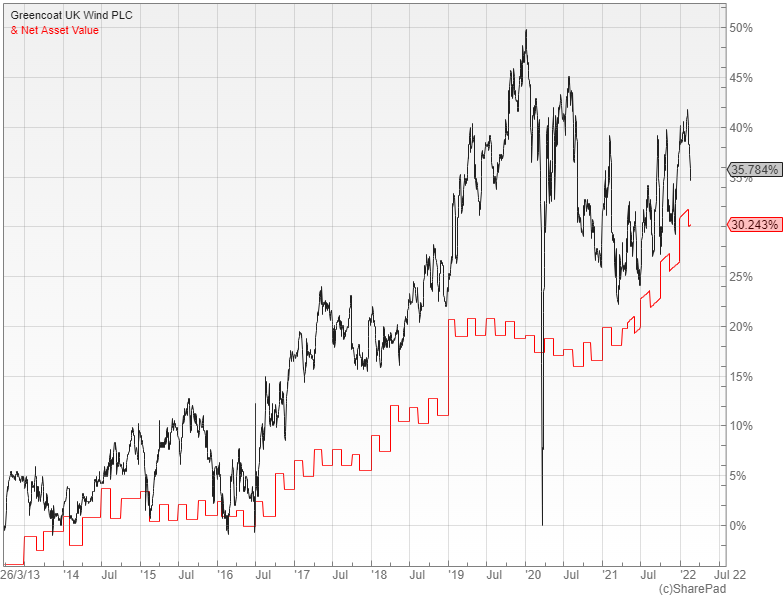

Greencoat aims to generate an attractive, sustainable dividend that increases in line with RPI, while preserving capital in real terms by reinvesting excess cash flows in additional operating assets. It owns a portfolio of onshore UK wind farms dotted around England, Scotland, Wales and Northern Ireland with the shares yielding 5.2% and trading on a four percent premium to NAV.

Further uplifts to come

In its third quarter results to the end of September the trust announced a 4.5% NAV total return, despite the benign weather leading to a 20% reduction in the forecast power generation for the year. The uplift was driven by a material increase in forward energy prices for the period 2021-2024, although there were no changes to the longer term forecasts.

Numis point out that changes to the long end of the power price curve have the potential to be particularly impactful given that the associated cash flows are not covered by subsidies or hedging arrangements. This suggests that if Russia uses its supply of gas to Europe as a weapon then trusts like Greencoat could experience a further material uprating.

Russian aggression against the Ukraine and the economic sanctions that are likely to follow have the potential to unnerve the markets, especially as higher power prices would add further inflationary pressure. It is possible that Greencoat and other similar beneficiaries would be one of the few ways to help protect the value of your portfolio.

Comments (0)