A Successful Blend: Witan Investment Trust

A multi-manager fund that allocates its money to a number of specialist, external managers has the potential to deliver consistent outperformance while diversifying more of the risk. The trick is to appoint the right combination of people and mandates so that you don’t accidentally end up with an expensive closet tracker.

A good example of how this sort of approach can work in practice is the Witan investment trust, which trades in London under the ticker WTAN. The £1,480m self-managed, closed-ended fund aims to achieve long-term growth in income and capital through an active strategy of multi-manager investment in global equities.

Andrew Bell and James Hart, the chief executive and investment director, have put together an interesting portfolio that consists of 10 specialist external managers that are all noted for their ability to add value via stock selection.

The list includes three UK mandates run by Artemis, Lindsell Train and Heronbridge, as well as five global remits managed by Veritas, MFS, Lansdowne, Pzena, and Tweedy. There is also a portfolio run by Matthews that provides exposure to the Asia Pacific region and a European specialist called Marathon.

The other 9% of the fund is invested in direct holdings chosen by Bell and Hart. These include several listed private equity funds, as well as investment trusts such as BlackRock World Mining and Edinburgh Dragon.

During 2015 eight of the ten external managers outperformed, with the main underperformance coming from those with a value bias in a year when growth continued to dominate. There was also one other manager – Trilogy Global Advisors, an emerging markets specialist – that has since been removed following a period of disappointing returns.

Witan’s performance is measured against a global composite benchmark that consists of 40% FTSE All-Share, 20% FTSE AW North America, 20% FTSE AW Europe ex UK and 20% FTSE AW Asia Pacific. By comparison, the fund is slightly overweight in the US and underweight in Europe and Asia Pacific.

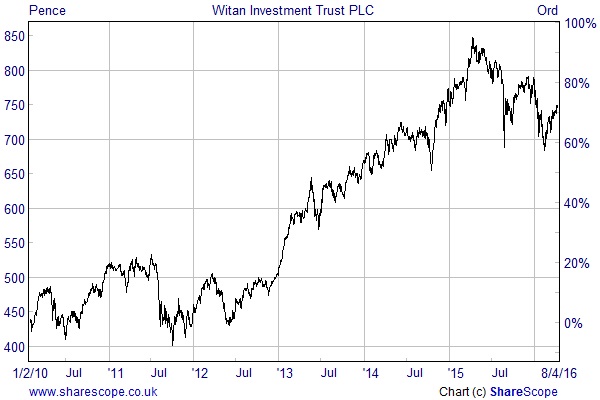

Over the last calendar year Witan’s NAV rose by 6.4% on a total return basis compared to an increase of just 3.5% in its benchmark. The long-term returns have been just as impressive. Since Bell took over in February 2010, the NAV is up 91%, which is well ahead of the 73% improvement in the benchmark.

It has also successfully increased its dividend every year for the last 41 years. In 2015 the payment rose by 10.4% to 17 pence per share. Based on the recent share price of 748.5p this puts the fund on a prospective yield of 2.4% with the roughly equal distributions made on a quarterly basis.

The multi-manager approach can add to the cost because of the double layer of fees, although Witan still offers decent value with ongoing charges (including performance fees) of 0.99%. On a look through basis the portfolio consists of 482 underlying stocks, which is much more than you would normally get with a single manager.

Each of the external managers uses a different investment approach and follows a specific mandate set by the Board. This ensures that the combined portfolio differs to the benchmark and has the potential to add considerable value via stock selection.

The UK segment is a good example as all three managers are benchmarked against the FTSE All-Share index but follow different strategies. Artemis target recovery and special situations, while Heronbridge focus on intrinsic value growth and Lindsell Train on long-term growth from undervalued brands. Their 2015 returns were 5.4%, 4.7% and 7.7% respectively, with each comfortably ahead of the 1% increase in the FTSE All-Share.

Witan shares have traded at an average discount to NAV of less than 1% over the last 12 months, although the discount has recently widened to 5.6%. This could offer a decent buying opportunity for long-term investors looking for a well-diversified core portfolio holding.

Comments (0)